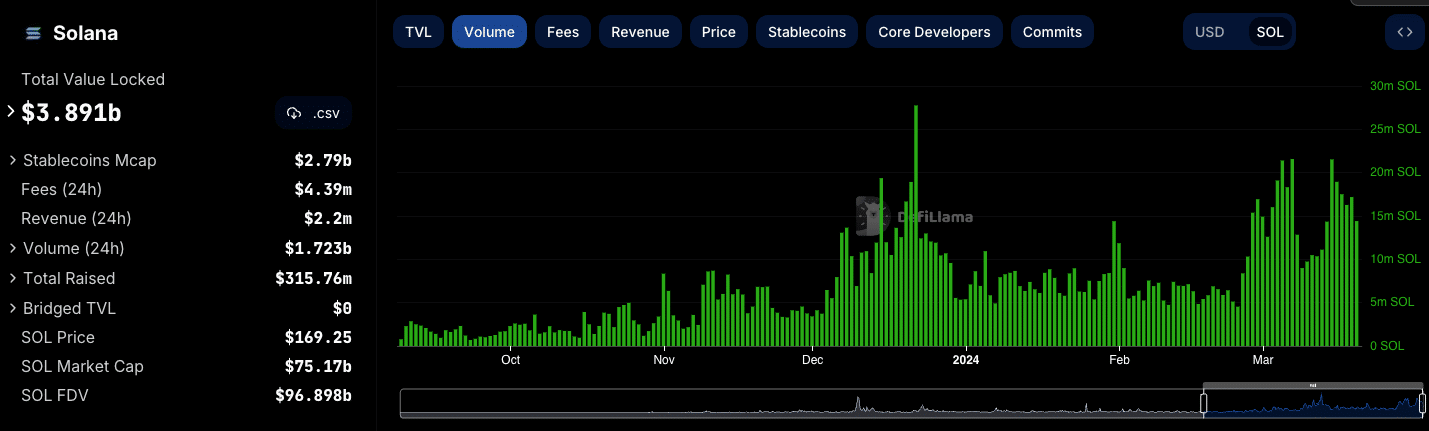

The Solana blockchain has recently experienced a surge in usage, primarily driven by a wave of memecoin activity. This uptick has brought the platform’s high transaction throughput and low fees into the spotlight, attracting significant attention and active users.

The last 30 days have been a period of remarkable growth for Solana, with network fees nearly tripling to around $50 million from last month, according to data from Token Terminal. Moreover, the fees paid by users in March 2024 are higher than the entire year of 2023 combined. This surge reflects the blockchain’s growing appeal and its capacity to facilitate a high volume of transactions efficiently.

Surprisingly, however, despite this heightened activity, Solana is still far from economically sustainable, which becomes apparent when examining the balance between network fees and token incentives.

Economic Sustainability

The memecoin frenzy has tested not only Solana’s technical capabilities but also its economic model. The crux of the issue lies in the expenses associated with maintaining and securing the network, which have ballooned to $371.9 million from just $37.7 million in September 2023, mainly due to the increase in the value of SOL.

These expenses are predominantly comprised of token incentives allocated to validators. Validators play a pivotal role in the blockchain ecosystem, maintaining the integrity and security of the network by validating or rejecting transactions. In return for their services, they are rewarded with token incentives, a practice that is fundamental to the Proof of Stake (PoS) model that Solana employs.

The substantial amount paid in token incentives raises questions about the economic sustainability of the SOL token. While it is crucial to compensate validators for their contributions to network security adequately, the disparity between the revenue generated from transaction fees and the costs incurred through token incentives is stark.

Learn more: What Is Tokenomics? A Beginner’s Guide

The situation is further complicated by the nature of the memecoin phenomenon itself. While memecoins can drive a temporary spike in network usage and fees, they often do not provide a stable or sustainable basis for economic growth.

The situation in Solana stands in contrast to the economic models of Ethereum, which is one of the few profitable blockchains. Its profitability is attributed to the revenue generated from high transaction fees and the relatively lower token incentives paid to validators, especially after its transition to Proof of Stake (PoS). Moreover, Ethereum has become deflationary after The Merge, according to the ultrasound.money dashboard.

For more context, Ethereum users pay $12.5 million a day in fees, while approximately $9 million are paid in token incentives to validators.

Meanwhile, Bitcoin is in a similar position, with token incentives to miners currently standing at over $50 million a day compared to only $2.5 million in revenue from fees.

A Silver Lining

However, data shows that SOL is at least improving. The price-to-fees (P/F) ratio, which assesses the circulating market cap relative to annualized fees, offers a telling glimpse into the economic standing of blockchains. According to Token Terminal, Solana has seen a significant adjustment to this ratio, which dropped from 375x on March 8th to 123x—a marked improvement in the network’s ability to generate fee revenue relative to its market valuation during the memecoin frenzy.

This change signifies a positive shift towards economic sustainability, though Solana’s P/F ratio still trails behind Ethereum’s more robust standing at 52x. Ethereum’s lower P/F ratio indicates a stronger correlation between its market capitalization and the fees it generates, hinting at its more resilient economic model in comparison to Solana’s.

Looking ahead, Solana’s roadmap includes a reduction in token issuance, with its current annual inflation rate of 5.394% slated to decrease by 15% each epoch-year. This would amount to a decrease of $55 million a month, or $667 million a year. This adjustment is designed not only to curb inflation over time but also to enhance the rewards for those staking SOL, ensuring network security remains robust. Moreover, the network employs a transaction fee model where half of every fee is burned, reducing the total supply, while the rest rewards validators.

This approach, coupled with the anticipated increase in transaction volumes, could potentially position Solana to offset the inflationary pressures and achieve economic stability, but as of today, that could be somewhat overly optimistic.

Read more: Ethereum and Solana Supporters Lock Horns on Social Media Over Scalability and Memecoins