December 16, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

After the Federal Reserve’s meeting yesterday, crypto assets saw a bounce in price.

-

Katie Haun, a general partner at a16z, is leaving the firm to found a crypto fund.

-

Five members of Congress have invested in crypto assets.

-

Anchorage, a crypto bank, raised $350 million at a $3 billion+ valuation, with funding coming from KKR, Goldman Sachs, BlackRock, PayPal Ventures, and a16z (amongst others).

-

Dapper Labs has partnered with Dr. Seuss Enterprises to launch a Dr. Suess-themed NFT platform.

-

Senator Elizabeth Warren views DeFi as “one of the shadiest parts” of the crypto industry.

-

Sotheby’s, a traditional art house that has hosted multiple NFT auctions, has earned $100 million from NFT sales this year.

-

Aave’s community voted to implement a “business license” to prevent forks.

-

Ledn, a crypto lender, announced a $70 million Series B.

-

Tornado Cash, a coin mixer on Ethereum, released a new set of upgrades.

-

NBA superstar Kevin Durant signed a promotional deal with Coinbase.

-

Ramp, a crypto payments startup, closed a $52.7 million funding round.

-

Michael Jordan’s son, Jeffrey, is launching a Solana app for athletes called “HEIR.”

-

Balancer Labs is launching “Boosted Pools” on Aave, in which the unused portion of liquidity pools on Balancer can now earn interest on Aave.

-

Valkyrie plans to launch a new ETF that tracks the prices of stocks that hold BTC on their balance sheets.

What Do You Meme?

What’s Poppin’?

DeFi Takes a Step Back From Open-Source

Token holders of Aave, a lending and borrowing DeFi protocol, voted to implement a “business license” to restrict the usage of Aave’s upcoming V3 codebase in other DeFi projects for one year. “This vote is essentially a signal on whether or not the Aave community wants to protect its Intellectual Property from unauthorized use, or simply allow anyone to use the code in any way they prefer,” explained the proposal.

The vote was contentious, with 55% of token holders voting in favor of a business license and 44% voting in favor of releasing the code under an MIT license, one of the more popular open-source structures that grants, without limitation, the rights to use, copy, modify, merge, publish, distribute, sublicense, and/or sell copies of the code.

While much of DeFi is built on open-source software, it seems that protocols are getting tired of their codebases being forked. Uniswap, a decentralized exchange, was the first DeFi protocol to create a business license for its latest version release. Uniswap, of course, most likely instituted its version of a business license in response to a “vampire attack” from SushiSwap, a DEX competitor that essentially copied Uniswap’s codebase and incentivized users to move liquidity from Uniswap to SushiSwap via token rewards. (Notably, the Aave proposal specifically cites Uniswap in the documentation: “The business license would be implemented in a similar fashion as Uniswap.” Also, ironically, during the recent SushiSwap debacle, more than one community member proposed that Sushi go with a Uniswap Labs-style development model.)

However, while a business license would restrict Aave’s code usage, it wouldn’t completely stifle innovation. “The idea around the Business License is that the Aave Governance would keep the rights to authorize code forks even during the initial period with projects and teams that show great collaboration and participation in the Aave Ecosystem,” said the pseudonymous author behind the proposal.

That being said, not everyone was thrilled to see one of DeFi’s most significant projects decide to restrict access to its code. Cinneamhain Ventures’s Adam Cochran (in response to a tweet from The Defiant covering the Aave story) said that Aave’s decision was “Disappointing to see.” He added, “We’ve seen more restrictive licenses and closed source pop up across defi protocol and other chains over the past year. When we design system to be anti-competitive profit seekers, we’re just going to recreate the broken banking system but on-chain…”

Recommended Reads

- Cozomo Medici (Snoop Dogg) on NFTs versus traditional art:

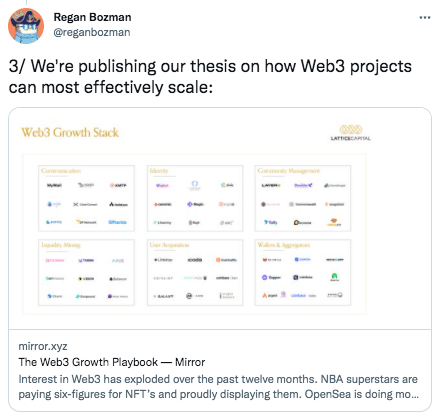

- Lattice on the web3 growth playbook:

- CoinDesk on Bitcoin mining in 2022:

On The Pod…

How Yield Guild Games Is Revolutionizing the Future of Work and InvestmentGabby Dizon, cofounder of Yield Guild Games, discusses his background in gaming, why he started Yield Guild Games, the performance of Axie Infinity, and more. Show topics:

- how Gabby fell down the crypto rabbit hole

- what inspired Gabby to co-found Yield Guild Games

- what Yield Guild Games does

- how blockchain games improve upon games in the traditional world

- a real-life story of Yield Guild Games improving a player’s life

- why it’s difficult for Yield Guild Games players to cash out earnings and how Yield Guild Games is trying to solve this issue via a partnership with XLD

- why Gabby thinks the value of $SLP in Axie Infinity is dropping

- what sort of game and tokenization mechanisms work best for blockchain games

- why Gabby wants a new Ethereum token standard

- what Gabby thinks makes an in-game NFT valuable

- why Axie Infinity is popular in the Philippines and Venezuela

- where Yield Guild Games is attempting to expand next

- how Yield Guild Games built out the tokenomics for YGG, the guild’s native token

- what Gabby thinks about P2E games on chains outside of Ethereum

- how Yield Guild Games is decentralizing

- how blockchain games are changing the nature of work

- what sort of jobs exist in the metaverse

- why Gabby buys NFTs

- Gabby’s crypto prediction for 2022

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians

RTFKT is now a part of the NIKE, Inc. family. 🌐👁🗨 pic.twitter.com/5egNk9d8wA

— RTFKT (@RTFKT) December 13, 2021