August 2, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Ethereum’s London hard fork is set to launch this week (August 4th).

-

Kentucky has ordered BlockFi to stop opening new accounts in the state.

-

Wealthfront clients now have access to GBTC and ETHE.

-

The number of crypto holders has doubled since January, according to a report from Crypto.com (which, disclosure, is a sponsor of my shows).

-

The average CryptoPunk price has risen 53% in the past week, highlighted by a $3.7M purchase from Gary Vaynerchuk.

- The President of Ukraine signed a bill that would allow the issuance of a CBDC.

What Do You Meme?

What’s Poppin’?

The language regarding the bipartisan infrastructure bill that intends to bring in $28B in crypto taxes is still under review, according to Jerry Brito, executive director of Coin Center.

Brito reports that the original wording of the bill has been changed. He says that it is “better than where it started,” although he is still concerned about miners being shoehorned into the deal. The language, he said, is “still not good enough to clearly exclude miners and similarly situated persons” from being designated as a broker.

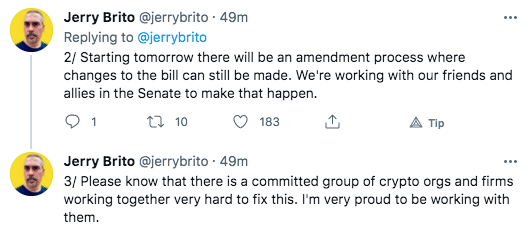

Brito also noted that while the phrasing was changed, it has not been finalized, tweeting:

Relatedly, in a tweet from early Sunday afternoon, Senator Ron Wyden criticized an earlier draft of the crypto provision from the bipartisan infrastructure bill.

Wyden started by acknowledging that crypto taxation in the US is an issue, saying, “Americans avoiding paying the taxes they owe through cryptocurrency is a real problem that deserves a real solution.”

However, he argues that the bill, as written, attempts to squeeze money out of the cryptocurrency industry without understanding the underlying technology they are legislating.

“The Republican provision in the bipartisan infrastructure framework isn’t close to being that solution. It’s an attempt to apply brick and mortar rules to the internet and fails to understand how the technology works,” said Wyden.

Wyden and Brito are far from the only ones concerned about the bill (and the possible KYC ramifications for a wide array of crypto participants).

To recap…

News broke last Thursday that tucked inside the $550B infrastructure bill was a provision looking to raise $28B from the crypto industry by expanding the definition of a broker.

Kristin Smith, executive director of the Blockchain Association, told CoinDesk, “We interpret this to mean software wallet developers, hardware wallet manufacturers, multisig service providers, liquidity providers, DAO token holders and potentially even miners,” would have to begin reporting their transactions.

Jake Chervinsky, general counsel at Compound Labs, agrees with Smith. In his opinion, such a mandate defies logic, citing various reasons, including:

- It would be nearly impossible for miners to collect KYC data from pseudonymous users using DeFi protocols.

- For every dollar gained in tax revenue, multiples will be lost as US crypto participants move offshore or underground.

- The fourth amendment may offer protection from heightened government surveillance without a warrant.

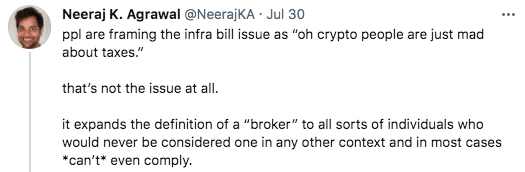

Coin Center’s Neeraj K. Agrawal also chimed in on the bill, mirroring many of Chervinsky’s points:

Once the wording is cemented, multiple Senators professed hope to get the bill passed, with support, by the end of the week, as reported by CNN.

For updates on this developing story, I recommend following Jerry Brito, Jake Chervinsky, and Ali Zaslav. For the non-Twitter savvy, you can read up here, here, and here.

Recommended Reads

- Money’s Millika Mitra on how Gen Z is using crypto as a tool for financial freedom:

- Mario Gabriele, who writes the Generalist newsletter, published a deep-dive on FTX’s Sam Bankman-Fried:

- The Guardian on Bitcoin and Nigeria:

On The Pod…

Axie Infinity’s July Revenue Tops $200 Million. Here’s How Filipinos Drove It

Leah Callon-Butler, director of Emfarsis, discusses her documentary, “Play-to-Earn: NFT Gaming in the Philippines,” and the real-world impact that crypto is having in the Philippines. Show highlights:

-

how the Axie Infinity movement started in the Philippines

-

how much money players can earn through Axie Infinity compared to normal wages in the Philippines

-

how Filipino crypto exchanges are catering to Axie Infinity players to make it easier to cash out their earnings

-

what percentage of Axie Infinity players live in the Philippines

-

why the game is so popular in rural areas

-

what about Axie Infinity is bringing in non-crypto native players

-

why Axie Infinity now has high barriers to entry

-

how players have created their own system for helping bring new users into Axie Infinity

-

how Axie Infinity scholarships work

-

what Leah thinks about Yield Guild Games’s relationship with Axie Infinity

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians