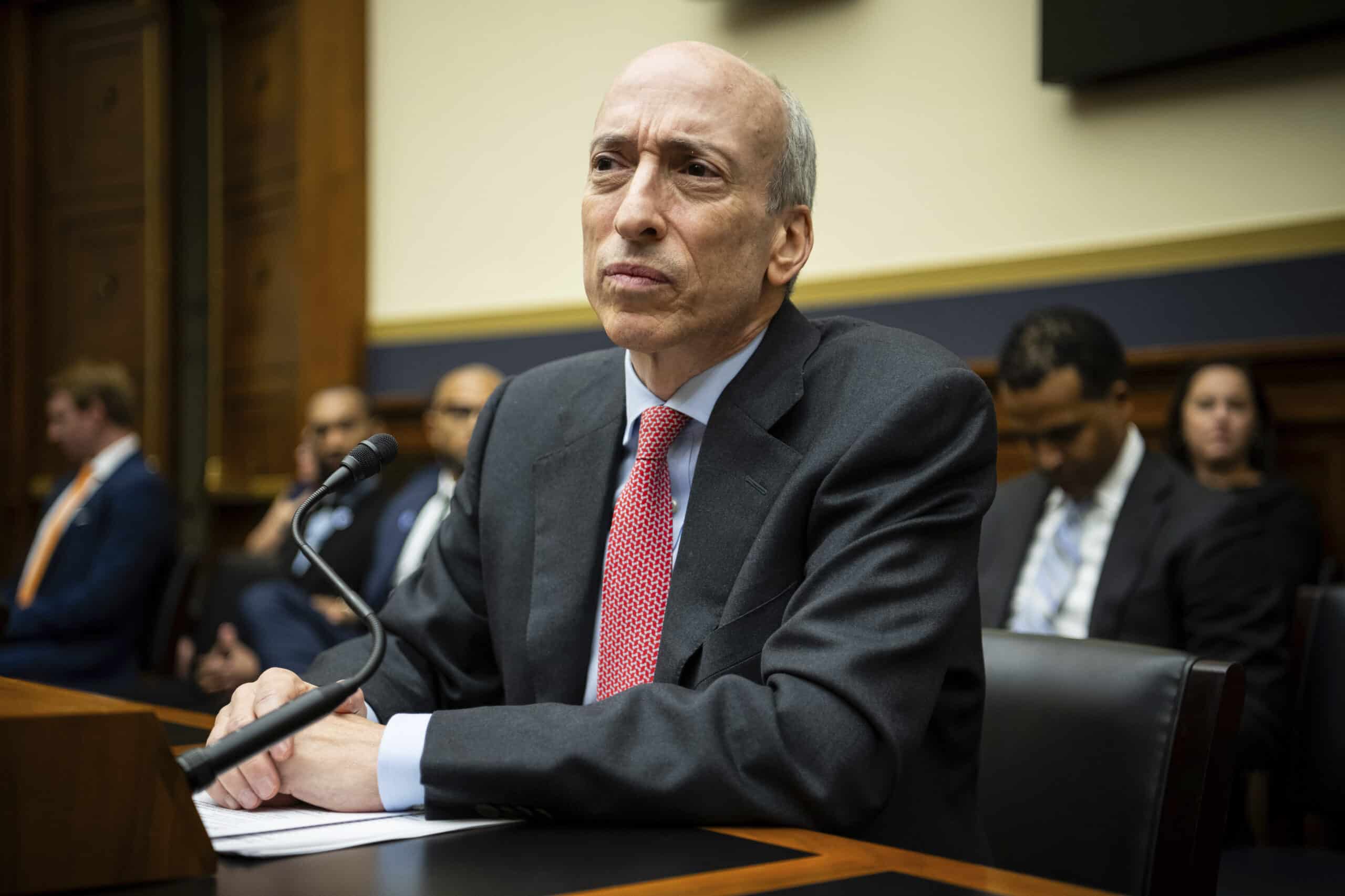

Gary Gensler will resign from his role as Chair of the Securities and Exchange Commission (SEC) on January 20th, the day of president-elect Donald Trump’s inauguration. Trump has repeatedly promised to “fire” Gensler on his first day in office, but it appears Gensler plans to remove himself first.

According to two people familiar with the deliberations, the Trump administration plans to announce a nominee to replace Gensler as SEC Chair tomorrow or Monday.

Read More: The Trump-Connected Brad Bondi Is a New SEC Chair Contender and Pro-Crypto

A source close to the contenders said Trump will likely pick Brad Bondi, global co-chair of investigations and white collar defense at the law firm Paul Hastings, or Brian Brooks, former acting comptroller of the currency and former CEO of Binance.US. They along with two additional sources said that Theresa Goody Guillén, co-leader of the blockchain team at law firm BakerHostetler, and Paul Atkins, a former SEC Commissioner and a favorite in conservative legal circles, are finalists.

Crypto executives close to the administration as well as leaders active in the policy space have been asked for their final input this week, ahead of the announcement. Brooks and Bondi have become industry favorites, followed by Guillén, due to their work in the crypto industry.

Bondi, Brooks, Atkins and Guillen did not respond to requests for comment.

Read More: Trump’s Plans for a ‘Crypto Czar’ and a Crypto Advisory Council: Here’s What We Know

The industry often calls the SEC’s tactics under Gensler’s leadership “regulation by enforcement,” referring to how the agency has repeatedly sued crypto firms without first elaborating on legal interpretation or making rules which clarify when cryptocurrencies are to be treated as securities under federal law. Though the SEC began its enforcement of the crypto industry under the Trump administration, with its lawsuit against digital payment network Ripple, under Gensler’s leadership, it has subsequently sued a variety of entities from crypto exchanges to NFT creators frequently for registration/disclosure type infractions. Major firms targeted by the SEC with Wells Notices or direct enforcement actions include Coinbase, Kraken, OpenSea, amongst others.

The animus Gensler has prompted from the crypto industry gave fuel to Trump’s campaign after he promised to remove Gensler and prioritize the cryptocurrency industry’s demands in order to make America the “world capital for crypto and bitcoin.” Though Trump would have likely not been able to fire Gensler entirely from the commission under federal law, he could have demoted Gensler to a commissioner position.

Read More: What Gary Gensler Could Still Do Against Crypto in His Remaining Days as SEC Chair

In response, several crypto entrepreneurs and companies donated to Trump’s campaign, including Coinbase, Ripple, and venture capital firm Andreessen Horowitz, which invests heavily in crypto. The campaign raised over $7.5 million in cryptocurrency donations in the form of bitcoin, ether, XRP and USDC.

UPDATED: (Nov. 21 at 4:00 p.m. ET): This story was updated to indicate that the four finalists for SEC Chair did not respond to requests for comment.