Former FTX CEO Sam Bankman-Fried has resurfaced on Substack, making a series of claims about the state of FTX and Alameda’s balance sheet before it filed for bankruptcy.

In a blog post on Thursday, Bankman-Fried said that FTX had roughly $8 billion worth of assets of “varying liquidity” when he handed over the reins to John Ray III after the crypto exchange filed for bankruptcy.

He also claimed that, at the time, FTX US had over $350 million in cash beyond customer balances.

“It’s ridiculous that FTX US users haven’t been made whole and gotten their funds back yet,” said Bankman-Fried.

According to him, FTX’s bankruptcy was a result of the contagion that spread from Alameda’s insolvency, which in itself was the result of an attack from Binance CEO Changpeng Zhao.

In 2021, both Alameda and FTX were legitimately profitable businesses “making billions,” he said. At the time, he estimated that Alameda was managing around $100 billion with around $8 billion worth of net borrowing. He believes that of these borrowed funds, $1 billion was paid as interest to lenders, $3 billion was used to buy out Binance’s stake in FTX and $4 billion was used to fund venture investments.

“In that context, the ~$8b illiquid position (with tens of billions of dollars of available credit/margin from third party lenders) seemed reasonable and not very risky,” he said.

He attributed a series of market events in 2022, including LUNA’s implosion, Three Arrows Capital and a number of crypto lenders declaring bankruptcy as the reason behind Alameda’s liquidity declining from $20 billion to $2 billion.

The FTX founder alleged that a tweet from Binance’s Zhao in November, saying the crypto exchange was liquidating the entirety of its FTT position, was what ultimately led to Alameda’s crash. Zhao’s tweet followed a Nov.2 report from CoinDesk, revealing that Alameda’s balance sheet largely comprised of illiquid FTT – FTX’s native exchange token.

In Bankman-Fried’s view, Zhao’s tweet was not in fact a response to these revelations, but rather a “targeted attack on assets held by Alameda.”

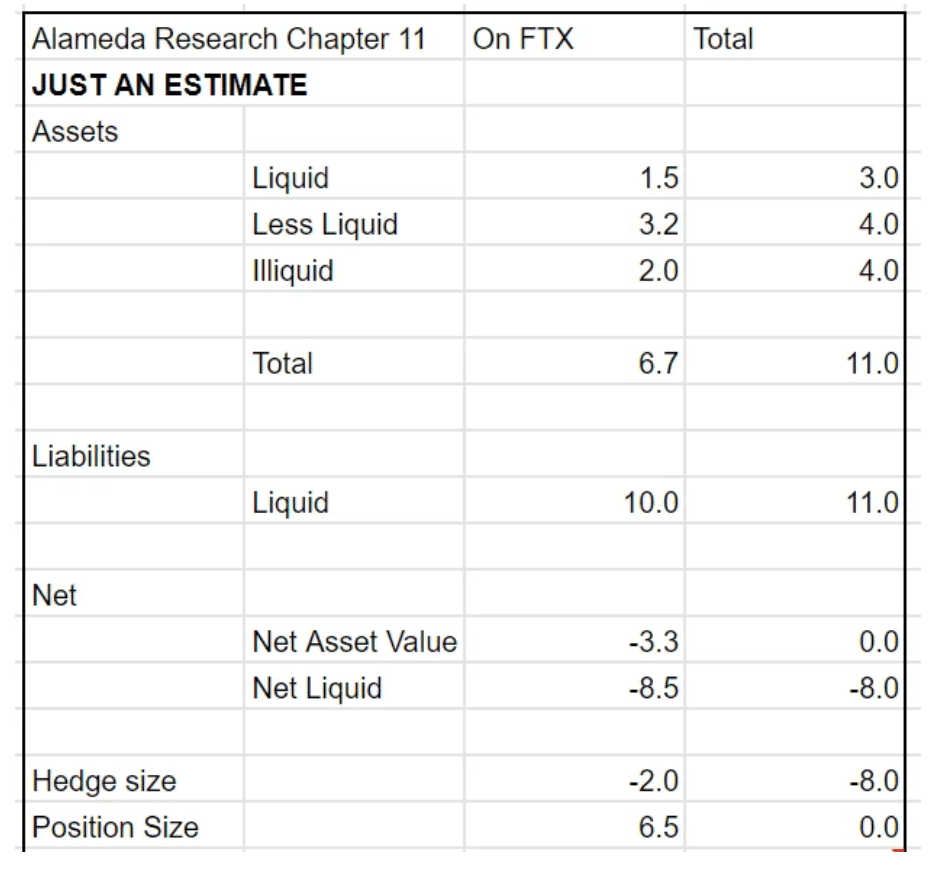

“By November 10th, 2022, Alameda’s balance sheet had only ~$8b of (only semi-liquid) assets left, versus roughly the same ~$8b of liquid liabilities,” said Bankman-Fried, sharing his breakdown of the firm’s balance sheet.

“And a run on the bank required immediate liquidity—liquidity that Alameda no longer had.”

As Alameda became illiquid, so too did FTX, because of Alameda’s open margin position on the exchange, he claimed.

Bankman-Fried’s version of events is a stark contrast to what Alameda CEO Caroline Ellison had to say in her guilty plea last month. In a Dec. 19 hearing, Ellison said Alameda was granted an unlimited line of credit on FTX, without being required to post collateral or pay margin calls.

She said that FTX’s loans to Alameda were financed with the exchange’s user funds, and that herself and Bankman-Fried had misled investors with financial statements that concealed the extent of Alameda’s borrowings on FTX.