Crypto investors are eagerly risking their assets for potential rewards through Blast, an unfinished Ethereum layer-2 blockchain that does not yet have an operational testnet.

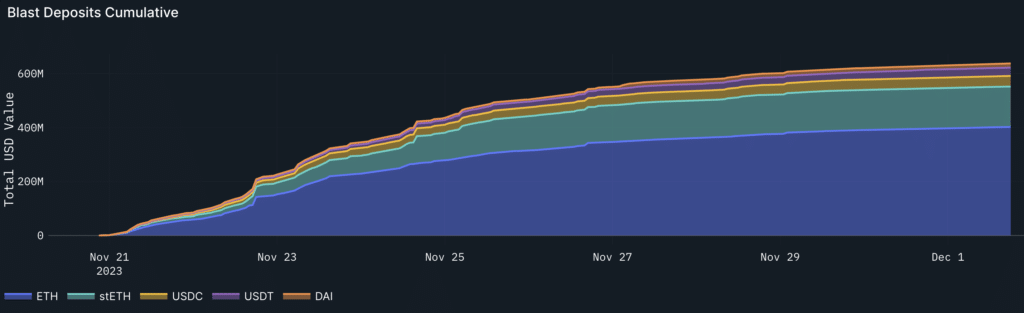

Blast, which aims to provide yield to its depositors and promises an airdrop, crossed $650 million in total value locked in its second week as the Crypto Fear and Greed Index, a statistical number used to gauge current market sentiment, has been at a level not seen since Nov. 2021 when BTC was near its all-time high.

Both are signs that the crypto ecosystem is getting hungrier for risk.

In the two weeks since Blast’s smart contract began accepting deposits, total value locked (TVL) on Blast not only rivals layer-1 blockchains like Avalanche and Solana, each having more than $650 million in locked value, per DefiLlama, but has also surpassed older layer-2 rollups like zkSync Era, Mantle, and Coinbase’s Base.

Read more: The Chopping Block Discusses Blast and Also Talks to a DeFi Hack Negotiator

Layer-2 rollups are separate blockchains built on top of Ethereum that aim to speed up transactions times and reduce costs by bundling up transactions and settling them on the second-largest blockchain by market capitalization.

The aforementioned protocols have all launched their mainnet, while Blast has yet to unveil its testnet. Virotechnics, an anon Milady NFT holder and Blast depositor, said to Unchained via Telegram, “The speed with which it achieved an excess of $600M TVL is impressive. It’s catching up with Solana at a violent rate, almost toe-to-toe & there isn’t even an L2 blockchain to use yet.”

“An interpretation of the assets deposited so far could be that many people anticipate a bull run mid-term,” wrote Nansen research analyst Niklas Polk in a report. “Given the anticipated bull run, many would be comfortable locking ETH for a few months and getting additional yield on top of the 4% for staking.”

Heavy Concentration

According to Unchained analysis of Nansen data, the top six depositors account for about $101.5 million in deposits, representing 15.6% of Blast’s TVL, while the top 50 depositors make up roughly 26.7% of total deposits, $173.2 million, highlighting how quickly large whales – in crypto parlance – are able to shore up liquidity in search for additional yield.

Even though the top 50 depositors are responsible for a significant portion of Blast, the majority of the more than 68,000 unique depositors are not whales as roughly 70% of Blast depositors have committed less than $1,000.

“If you are given the choice between 5% APY on ETH or maybe a lot more via an airdrop I think some people are willing to take the security/rug risk to get a higher return,” Paul Vaden, a core contributor for perpetuals protocol Lyra, told Unchained over Telegram.

Virotechnics also said to Unchained of Blast’s rise, “If traders/investors are willing to lock their ETH until February & participate in speculative game-theory systems like BLAST is offering — it signals that they are increasingly willing to take on risk. Many are interested to see what the BLAST ecosystem will amount to, how much TVL it will retain after the airdrop, and whether any unique DeFi opportunities will emerge on the chain early on. I think many are with me in this speculation.”

Fear and Greed Index

Blast uses its deposits to generate yield, which “is passed back to Blast users automatically,” from Lido’s ETH staking and real-world asset protocols like Maker, its website says. To incentivize more deposits, Blast said it will airdrop tokens to developers in January and depositors in May. Per Nansen, Blast is the fourth-largest holder of stETH, Lido’s token that represents the combined value of a user’s initial amount of staked ether plus accrued interest.

The Crypto Fear and Greed Index sits at 71 as of Friday, jumping from 27 in the beginning of January, which means market sentiment is currently in the “greed” stage, suggesting a bullish attitude among crypto investors, per data from alternative.me.

Paradigm, the crypto investment firm that invested into the layer-2 rollup, and Blast founder Tieshun “Pacman” Roquerre did not return a request for comment by presstime. According to its website, Blast raised funds from Standard Crypto, eGirl Capital and Larry Cermak, the CEO of crypto publication The Block.

CORRECTION (Dec. 1 8:45 UTC): A previous version of this story inaccurately stated that Blast will airdrop tokens to its depositors in January. It plans to airdrop tokens to developers in January and depositors in May.