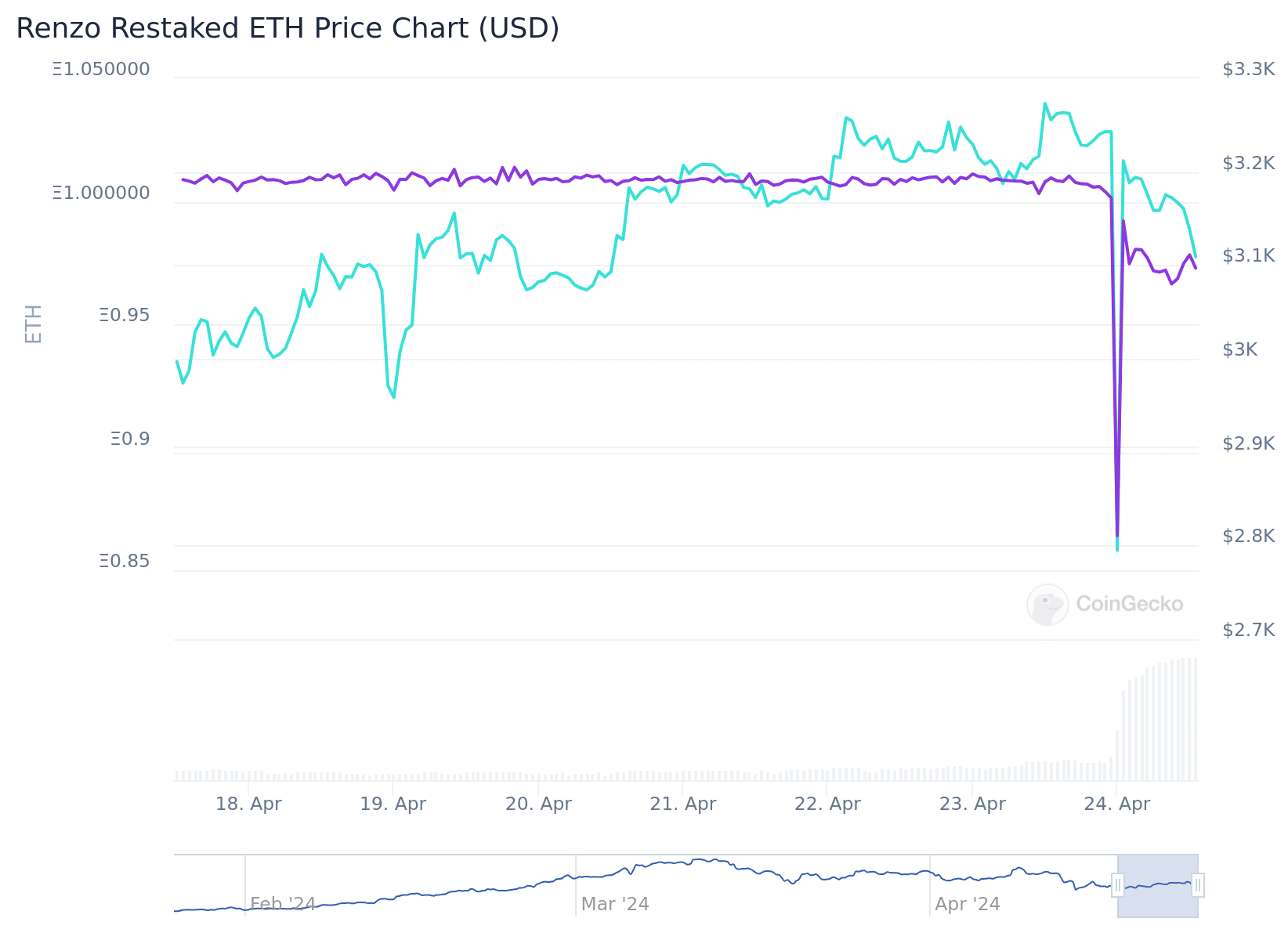

Following its airdrop announcement, Renzo Protocol’s liquid restaking token, ezETH, deviated from its one-to-one peg to ether (ETH), sparking community criticism regarding poor execution of the planned event.

The price of the liquid restaking token (LRT) plummeted as it de-pegged, reaching a low of $688 on decentralized exchange Uniswap. ezETH had traded above $3,000.

Depeggings occur when a cryptocurrency that is meant to maintain stability relative to a paired asset no longer maintains that correlation. That event happened following the announcement of the end of Renzo’s season 1 points program, which rewarded users with points for restaking ETH on the platform. The process is set to lead to an ensuing airdrop of $REZ on May 2.

Airdrops involve distributing free tokens to promote usage or drive ownership. However, in Renzo’s case, the planned move triggered a mass sell-off by holders looking to convert their ezETH tokens into ETH. The sell-off stemmed from the first part of the points program ending, meaning ezETH holders had fewer benefits, even though they probably will keep earning points for the second season of the airdrop. There was also dissatisfaction over the eligibility criteria and how the $REZ governance token will be distributed.

Learn more: What Is a Crypto Airdrop? A Beginner’s Guide

The incident resulted in considerable losses for users engaged in leveraged trading on platforms like Gearbox and Morpho Blue, where ezETH was used as collateral.

1/🧵

• 50% of Gearbox ezETH TVL wiped out + debt

• 150 liquidations on Morpho

• Millions were lost during 78% ezEth depegYesterday was just a rehearsal before a major depeg event once EL points are over

At @0xfluid we protect lenders and borrowers and had 0 liquidations pic.twitter.com/Chrajmbt36

— DMH (@DeFi_Made_Here) April 24, 2024

Though ezETH recovered most of its losses, it’s still trading at a discount to ETH, which highlights that users are not 100% confident in Renzo’s LRT.

Airdrop Criticism

Renzo, the second-largest LRT platform with over $3.3 billion locked, faced criticism concerning its token distribution — and the way information was presented to the public.

Confusion and dissatisfaction with Renzo arose due to a pie chart that misrepresented the distribution of their new $REZ tokens, inaccurately portraying the sizes of different allocations. This led to misunderstandings about the token’s actual distribution. As a result, many criticized and even mocked the misleading presentation, viewing it as an attempt to obscure the true control and influence within the project.

Oh wow, this is pretty bad from @RenzoProtocol

1st, a large portion of the tokens are going to investors and team

2nd, looks like they’re trying to skew how bad it looks with the design of the pie chart

Notice the bottom “half” is 62%, whereas the two 2.5%’s appear to be ~20% pic.twitter.com/1TWIaC9fNI

— Blur (@BlurCrypto) April 23, 2024

The protocol allocated just 5% of $REZ for the airdrop, half of which was earmarked for the Binance launchpool lasting just one week — effectively reducing the direct benefit to the broader community to about 2.5%.

Piling on, the Token Generation Event (TGE) was scheduled before airdrop recipients could claim their tokens, allowing trading to commence on Binance before tokens were accessible to airdrop participants.

“Instead of properly rewarding your loyal community, you screw them in every possible way, buried deep in words to hope that no one will find it,” wrote Levi on X.

Travis Sher of North Island VC highlighted concerns about Renzo’s operational decisions, such as not allowing withdrawals — a feature that competitor platforms like Ether.Fi offered from the start. This restriction was seen as a “bad faith move” that unnecessarily increased the risk for Renzo’s users to facilitate faster growth, further eroding trust and contributing to existing negative sentiment.

Broader Implications for LRTs

The incident has broader implications for the nascent LRT market.

With other protocols such as Puffer, and Kelp yet to launch their tokens, many are wondering how the market will react to similar announcements by these projects. As the dust settles, this episode may lead other LRT projects to reconsider their strategies around airdrops and token economics to prevent similar occurrences.

Moreover, people are starting to reassess their confidence in the restaking ecosystem.

Learn more: What Is EigenLayer? A Guide to the Decentralized ETH Restaking ProtocolThe bigger question: If this happened with a smaller project, what would happen with EigenLayer’s potential airdrop?

You think ezETH depeg is bad?

We got the first lesson that holding LRTs is not risk-free but it'll probably get worse for LRTs.

Eigenlayer just launched on mainnet with a few AVSes but two key upgrades will bring much more risk to restaking/LRTs:

• Slashing

• Permissionless…— Ignas | DeFi (@DefiIgnas) April 24, 2024