November 24, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

ConstitutionDAO announced its decision to disband following an unsuccessful attempt at buying a copy of the US Constitution.

-

India is expected, during the winter session of Parliament, to introduce a crypto bill that could ban most cryptocurrencies.

-

Wolf Game, a new play-to-earn game, is ranked first in volume on OpenSea over the past seven days.

-

Fei Protocol and Rari Capital, two protocols that combine for roughly $2.4 billion in TVL, have proposed a merge.

-

Bank of America released a report that views stablecoin regulation as a catalyst for major adoption of crypto technology.

-

ORIGYN Foundation, an NFT authentication company, raised $20 million at a $300 million valuation.

-

ADA and TRX will be delisted from eToro due to regulatory concerns.

-

Martha Stewart is cooking up a batch of NFTs in a Thanksgiving-themed drop; Macy’s is jumping into NFTs with a collection based on its Thanksgiving Day Parade.

-

Pantera Capital raised $600 million for a new crypto fund.

-

The company behind Pokemon GO is enabling Fold app users to catch Bitcoin rewards.

-

Rarible launched a messenger feature that allows users to directly discuss NFT purchases.

-

An OlympusDAO bug resulted in a user taking home $1.43 million in OHM after paying roughly $50,000.

-

Fidelity, UBS, and State Street Global Advisors confirmedthat they are looking at potentially offering clients exposure to cryptocurrencies through crypto funds.

-

According to the IMF, “Bitcoin should not be used as a legal tender” in El Salvador.

What Do You Meme?

What’s Poppin’?

US Regulators Eye 2022 for Crypto Clarity

In a joint statement yesterday, The Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency outlined plans to “provide greater clarity” on certain crypto-banking activities.

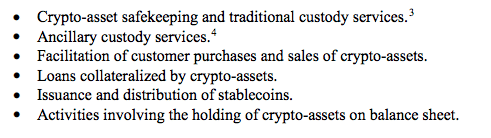

According to the statement, the agencies plan to publish guidance on the legality of the following six different crypto-banking activities throughout the next year.

Source: Joint Statement on Crypto-Asset Policy Sprint Initiative and Next Steps

Each of these activities was identified earlier this year in “policy sprints” as areas “where additional public clarity is warranted,” as the joint statement describes them. At that time, agency staff developed common frameworks for banks getting involved in handling crypto assets. Topics addressed by the sprints included developing a common and consistent vocabulary for crypto-banking activities, the assessment of potential risks for banks handling crypto assets, and the acceptability of current laws being used to regulate crypto assets.

Yesterday, in addition to the joint statement, the OCC also published an interpretive letter confirming that national banks could engage in “certain cryptocurrency, distributed ledger, and stablecoin activities.” For banks to do so, the OCC says banks should demonstrate “adequate controls in place.” Additionally, the OCC says banks should not engage in crypto activities until they have received a non-objection from its supervisory office.

“This letter clarifies that the activities addressed in those interpretive letters are legally permissible for a bank to engage in, provided the bank can demonstrate, to the satisfaction of its supervisory office, that it has controls in place to conduct the activity in a safe and sound manner,” said Tuesday’s letter.

Yesterday’s letter was issued after a review of the interpretive letters by former acting comptroller of the OCC, Brian Brooks (who, after a pit stop as Binance US CEO, is now Bitfury CEO), who initially made waves by permitting banks to provide crypto custody services to customers.

Recommended Reads

- Not Boring on composability:

- @fintechjunkie on getting red-pilled:

- @magdalenakala on web3 + the music industry:

On The Pod…

The Tokenomics Episode: Why ‘EIP 1559 Is Like Catnip for Investors’

Two tokenomics experts, Yan Liberman, co-founder of Delphi Digital, and Viktor Bunin, protocol specialist at Coinbase Cloud, discuss their experiences building tokens, their thoughts on the recent ENS/PSP airdrops, and what “fair” token distribution looks like. Show highlights:

- the definition of tokenomics

- what factors (such as utility, fairness, liquidity, security, etc.) token designers are incentivizing for

- what Yan learned from helping design Astroport tokenomics

- what Vikor learned from helping design Threshold, the token that was built to facilitate the merge of NuCypher and Keep

- how the EIP 1559 burn has changed Ethereum’s tokenomics

- how EIP 1559 has improved investor outlook for Ethereum

- why Viktor is worried about people actually using Ethereum going forward

- what Viktor and Yan think about how the ENS airdrop farming issue was handled

- what Viktor and Yan think about ParaSwap’s PSP airdrop and why Viktor thinks ParaSwap made a “mistake”

- how Viktor and Yan would go about airdropping a token to good actors instead of bad actors

- how improvements in on-chain identity could help future airdrops

- fair launch tokens versus VC-backed tokens

- what the definition of fair is in terms of tokenomics

- why Viktor thinks a token’s distribution is more important than a token’s launch

- what could be the optimal way to distribute liquidity mining rewards

- how community affects tokenomics

- how to incentivize NFT-based tokens, like the forthcoming Bored Ape Yacht Club token, for the right goals

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians