July 27, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- Audius released a post-mortem on its $6 million hack that revealed a bug in an old OpenZeppellin contract.

- The CFTC is setting up the “Office of Technology Innovation,” an office that will specialize in crypto regulation.

- The IMF says BTC’s recent sell-off has not impacted the financial stability of the global economy.

Today in Crypto Adoption…

- A new bill in the US Senate would exempt small crypto transactions from capital gains taxes.

- The Central African Republic began the sale of its national cryptocurrency Sango Coin on Monday.

- Kia, the automobile manufacturer, launched an NFT collection.

- The University of Pennsylvania announced a six-week online course on the metaverse via the Wharton School.

- South Korean regulators are looking into the “Kimchi Premium.”

The $$$ Corner…

- Mining pool AntPool has invested $10 million into the Ethereum Classic ecosystem.

- Topl, an eco-friendly blockchain project, closed a $15 million Series A.

- Root Protocol, a DeFi prediction market, announced a $9 million equity round yesterday.

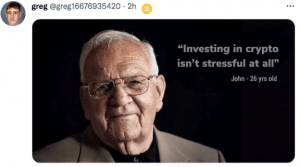

What Do You Meme?

What’s Poppin’?

Crypto Exchanges Under Fire

The US regulators are reportedly investigating two of the most prominent cryptocurrency exchanges in the US: Coinbase and Kraken (disclosure: the latter of which is a former sponsor).

A Monday night report from Bloomberg revealed the US Securities and Exchange Commission is investigating some of the coins listed on Coinbase and whether the company allowed US persons to trade unregistered securities. The report cites unnamed sources and says that the SEC investigation predates its decision to name nine tokens as securities in its charge against a former Coinbase employee who allegedly ran an insider trading scheme.

Paul Grewal, Coinbase’s chief legal officer, did not appear too worried about the charges on Twitter. “I’m happy to say it again and again: we are confident that our rigorous diligence process—a process the SEC has already reviewed—keeps securities off our platform, and we look forward to engaging with the SEC on the matter,” he wrote, linking to a blog post from July 21st explaining that Coinbase does not list securities.

The news led to a brutal day for COIN, which finished the trading day down 21% – marking an overall decline of 78.92% year to date.

As for Kraken, a Tuesday morning report from the New York Times exposed a three-year-old investigation into the exchange that the NYT expects will end in a fine. According to the report, the US Treasury Department Office of Foreign Assets Control began investigating the exchange in 2019 regarding an alleged violation of US sanctions where Kraken allowed users in Iran, Cuba, and Syria to trade cryptocurrencies. Notably, a subsequent article by The Block showed that Kraken had more than 1,500 users with residences in Iran.

Recommended Reads

- Messari’s Ryan Selkis on 15 charts summarizing Q2

- Alex Gladstein on Fedimints

- Connext on Optimistic bridge design

On The Pod…

Two crypto law experts, Wassielawyer and Adam Levitin, analyze the bankruptcies of 3AC, Celsius, and Voyager. Show highlights:

- the difference between Voyager and Celsius “custody” and “earn” deposits

- why Celsius commingling customer custody and earn deposits could make it harder for creditors to get their money back

- what similarities and differences the Voyager and Celsius bankruptcies have

- how Chapter 11 bankruptcy works

- why Wassie and Adam believe Celsius might have engaged in shady business practices, whereas they believe Voyager was just an irresponsible lender

- what the latest is on the 3AC bankruptcy and the location of Kyle Davies and Zhu Su

- what Celsius and Voyager can clawback from 3AC

- how Alameda fits into the Voyager bankruptcy case

- whether creditors will receive funds back in crypto or dollars

- the three types of ways creditors can “claw back” funds in a bankruptcy case

- why Wassielawyer and Adam believe Celsius’ Chapter 11 plan to restructure around mining is so weird

- whether the founders from 3AC, Celsius, or Voyager will see jail time

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians