A number of wallet addresses borrowing RPL were liquidated on Friday as the governance token for decentralized liquid staking provider Rocket Pool skyrocketed on Friday in light of various tokenomics proposals and ahead of Sunday’s Houston upgrade.

Data from TradingView shows that the price of RPL opened the day around $19 and almost doubled to $35.78 before dropping to hover near $24.

According to a Rocket Pool community advocate, who goes by @Jasperthefriendlyghost.ETH, a wallet address swapped 199.11 WETH for 20,862 RPL, worth over $700,500. “This large buy triggered liquidations to start happening,” Jasper wrote to Unchained over X, meaning that the large purchase pushed the price up, making the collateral insufficient to cover the increased value of the borrowed RPL.

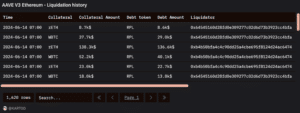

Friday saw 149 liquidations on Aave v3’s Ethereum markets, the second most in a day over the past year, and a large chunk of liquidations came from wallet addresses borrowing RPL tokens with collateral in the form of WBTC, WETH, wstETH, USDC, rETH, per a Dune Analytics dashboard created by data analyst Roman Zinovyev.

Houston Upgrade Expected Sunday

The liquidations come as community members are currently focused on educating the wider ecosystem about the upcoming Houston upgrade, expected to go live on Sunday, as well as various tokenomics proposals in the works. As stated in the liquid staking provider’s documents, the Houston upgrade aims to introduce “a fully onchain DAO to govern the [Rocket Pool] protocol.”

“You can never predict what the market will do but it was reasonable to expect the market to positively price in the upgrade, especially after a number of delays,” Jasper said.

Dissenting, Charlie Mercado, a data scientist at blockchain analytics firm Flipside Crypto said, “People think the Houston upgrade is a big deal, but I’m not sure it actually is…It’s cool, but it’s probably not the primary driver of RPL volatility.”

The price movement “could have been a partner buying RPL for Houston [and] it could have also been a short hunter who wanted to trigger liquidations,” wrote Jasper.

RPL Token to Get a Revamp?

Also underway are a number of tokenomic proposals, which Jasper says, “should help RPL find a more sustainable long-term valuation.”

The tokenomics proposals, first created in March and currently still in their draft stage, aim to revamp the RPL token which has declined over 40% in the past year, according to CoinGecko.

Elements of this makeover include reducing emissions, making it possible to run a Rocket Pool node without RPL, and potentially establishing a smart contract that “holds ETH from protocol revenue and allows for RPL to be burned in exchange for that protocol ETH.”

Rocket Pool has a total locked value of nearly $4.2 billion, making it the ninth-largest DeFi protocol, ahead of restaking protocol Renzo and synthetic dollar provider Ethena, data from DefiLlama shows.