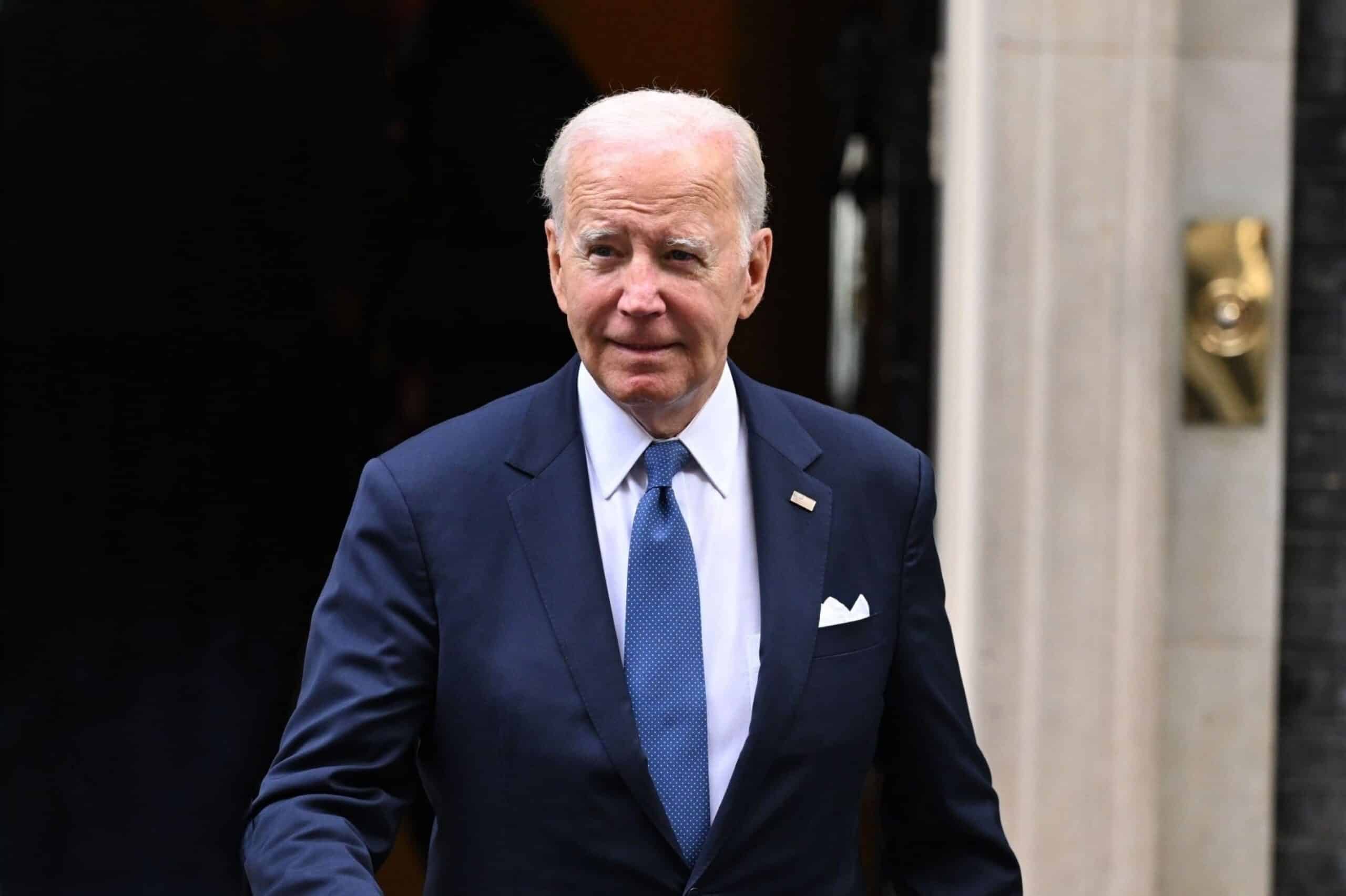

U.S. President Joe Biden signed a veto of the resolution that would have overturned the U.S. Securities and Exchange Commission’s (SEC) Staff Accounting Bulletin (SAB) 121 – a move that many labeled disappointing, but not surprising.

SAB 121 would impose tough requirements on banks and financial institutions looking to custody crypto, requiring them to hold customer’s digital assets on their balance sheet. Earlier this month, the Senate voted 60-38 to repeal the controversial accounting bulletin.

In a letter to the House of Representatives on Friday, Biden said that the reversal of the SEC’s judgment risks undercutting the securities regulator’s broader authorities regarding accounting practices.

“My Administration will not support measures that jeopardize the well-being of consumers and investors,” wrote Biden.

“Appropriate guardrails that protect consumers and investors are necessary to harness the potential benefits and opportunities of crypto-asset innovation.”

Although Biden had previously stated his intent to veto the resolution, the move still drew widespread criticism from those in the crypto community, Congress, and even Wall Street.

Sheila Warren, CEO of the Crypto Council for Innovation, said she was disappointed but not surprised, calling the move a mistake that would undermine the safety that the administration seeks.

Blockchain Association CEO Kristin Smith said Biden administration is “swimming against the tide of public opinion and growing consensus in Congress that digital asset innovation should be supported – not punished.”

Four lobbying groups for major Wall Street banks shared that opinion, asking Biden to reconsider his decision to veto the resolution before The White House’s official stance was released.

“SAB 121 represents a significant departure from longstanding accounting treatment for custodial assets and threatens the industry’s ability to provide its customers with safe and sound custody of digital assets,” they said in a letter addressed to the president earlier in the day.

“Limiting banks’ ability to offer these services leaves customers with few well-regulated, trusted options for safeguarding their digital asset portfolios and ultimately exposes them to increased risk.”

Nine members of Congress, including Sen. Cynthia Lummis and Rep. Patrick McHenry, also penned a letter to Biden on May 30 urging him to sign the resolution into law. They noted that the bipartisan support the resolution received sent a clear message to the SEC as to why the “misguided policy” would be harmful to customers.