Driven by speculation surrounding the U.S. 2024 presidential election, predictions platform Polymarket has seen record monthly levels in both volume and active traders.

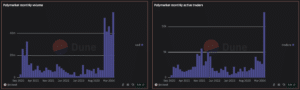

According to data from a Dune analytics dashboard created by Richard Chen, the general partner at crypto investment firm 1confirmation, Polymarket saw $59.2 million in volume from more than 12,800 traders in May.

The monthly trading volume in 2024 ranged as low as $38.9 million in April and as high as $59.2 million in May, a substantial deviation from Polymarket’s volumes for each month of 2023, which never exceeded $12 million in a month.

The new records for Polymarket come as the five most liquid markets on the platform built on the Polygon blockchain network are directly tied to outcomes grounded in the U.S. political system.

Speculators have wagered a total of $234.1 million on Polymarket in those five markets. This includes bets on who will be the 2024 presidential election winner, who will be the 2024 popular vote winner, who will be the nominee for the Democratic party, who will be the Republican vice-president nominee, and what the electoral college margin of victory will be. The majority of the wagers, $143.8 million, are focused on who will win the presidency.

“Polymarket has hit on a fundamental consumer application for aggregating belief in a very retail-friendly way,” wrote Carlos Mercado, a data scientist at blockchain analytics firm Flipside Crypto, to Unchained via Telegram.

Read More: Ethereum ETFs Likely Protect Ether From the SEC. But What About Staked ETH?

Convergence Between Polls and Betting Markets

The 2024 presidential election takes place on Nov. 5 and will remain “huge for Polymarket in terms of getting attention from media and users,” Suki Yang, data scientist at Electric Capital, told Unchained in a Telegram message.

“We’re already seeing convergence in how polls and betting markets are both discussed in election forecasts even among big players like FiveThirtyEight,” wrote Flipside’s Mercado.

Speculators on Polymarket have placed a 54% probability that Donald Trump will be the next president of the U.S., in light of a New York jury convicting the former president of 34 felony counts Thursday. Similarly, data elections firm FiveThirtyEight shows Trump having a two percentage point lead ahead of incumbent commander-in-chief Joe Biden in national polls.

Zooming out, of the ten most liquid markets on the Polygon-native application, eight are connected to the U.S. political arena. The other two, while also political, are based on the United Kingdom election.

Uniqueness of the U.S.

2024 is the largest election year in history for the entire world. Forbes reported in January that “more than 50 countries around the world with a combined population of around 4.2 billion will hold national and regional elections in 2024, in what is set to be the biggest election year in history featuring seven of the ten most populous nations in the world.”

What makes the election in the United States unique for Electric Capital’s Yang stems from the far-reaching impact of the U.S. elections internationally as well as the dynamic relationship between the two dominant political parties in the U.S.

The November election “is very impactful globally, economically, politically, [in] every single aspect,” wrote Yang, who went to schools in the U.S. but is not a citizen. While it appears bipartisan support for crypto is growing, the Democratic and Republican parties have “diverged a lot over the past few years, [so] their polarizing takes on all different policies makes it crucial for people to care about the result,” Yang added.