Despite being slapped with a lawsuit from the U.S. Commodities and Futures Trading Commission (CFTC), Binance has firmly held its status as the world’s largest centralized crypto exchange.

In an April 4 newsletter, Glassnode examined how crypto market participants responded to the CFTC’s lawsuit against Binance.

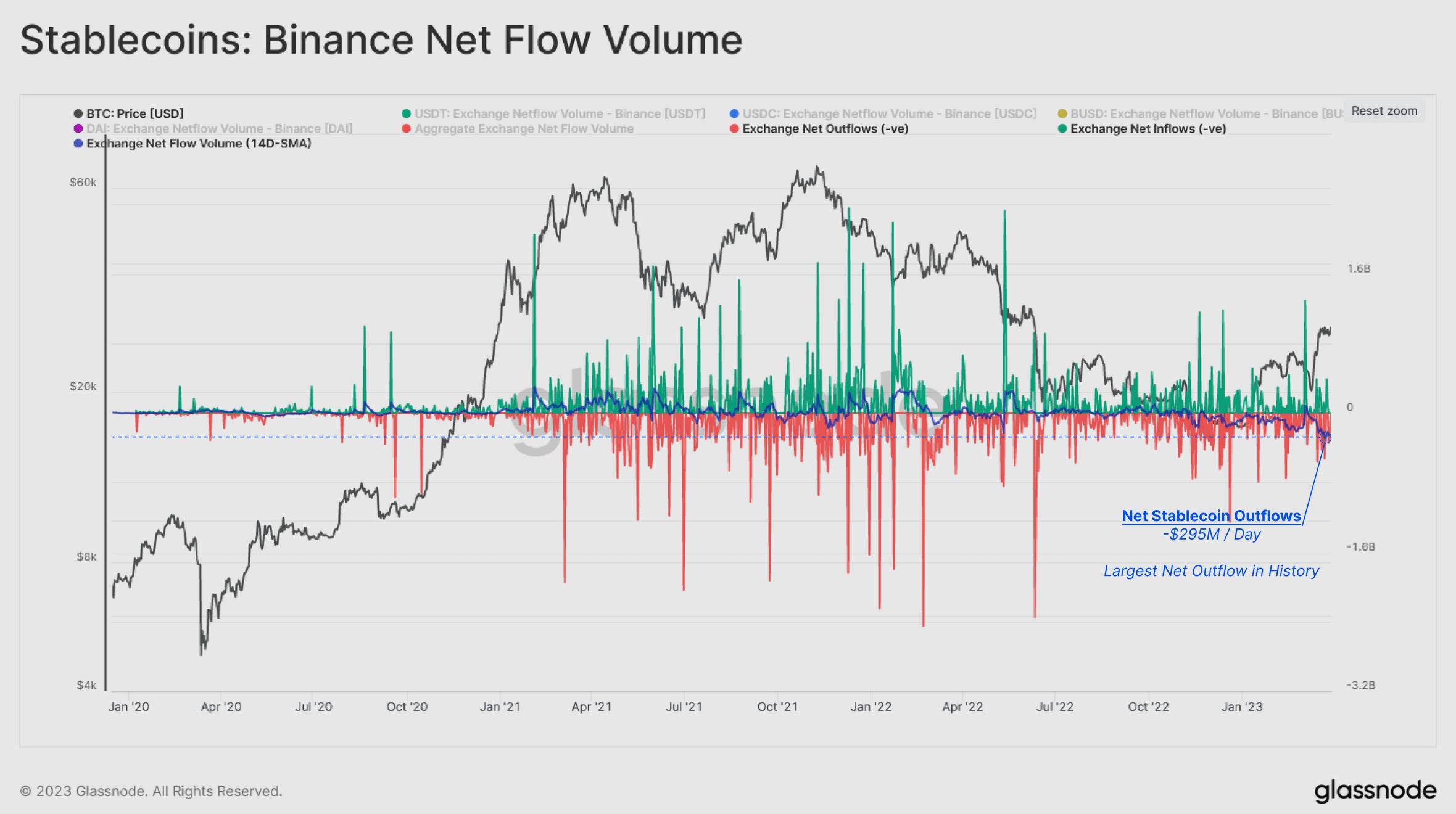

As was widely reported last week, Binance recorded a significant amount in outflows, particularly in stablecoins, when news of the lawsuit spread.

After isolating the net daily outflow using a 14-day Exponential Moving Average (EMA), Glassnode found that Binance recorded negative $295 million in stablecoin outflows per day – the largest net outflow in history.

Sizeable redemptions of BUSD have also contributed to Binance’s declining stablecoin reserves.

“Of note is the historically low balances of USDC ($1.16B) and USDT ($2.17B), in part a function of Binance’s attempt to shift trade volume to BUSD pairs in recent months,” noted Glassnode.

However, the coin-denominated balance of Bitcoin and Ethereum held on Binance has remained intact. The exchange’s Bitcoin reserves increased by nearly 68,000 BTC, while ETH reserves remained flat year-to-date.

“Despite net outflows of stablecoins, the market does not yet appear to be expressing widespread concern about Binance’s standing,” said the Glassnode analysts.

The report concluded that there was little evidence that investors were fleeing the exchange despite Binance now being in the CFTC’s crosshairs.

“The primary observation is a structural shift in stablecoins hosted on Binance as BUSD enters redeem-only mode and USDC sees global dominance declining,” they added.