November 4, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

The interagency “crypto sprint” has concluded, says the acting US comptroller.

-

10% of China’s population has opened a digital yuan wallet.

-

A report from JPMorgan shows that firms could save $100 billion in cross-border costs if they were to use a CBDC.

-

Binance is considering blacklisting addresses associated with the Squid Game token.

-

Coinbase users can now borrow $1 million using bitcoin as collateral; Coinbase is also testing a subscription service, Coinbase One, that would give users access to features like zero-fee trading.

-

Bitcoin mining revenue for October was the second-highestever.

-

Crypto lender Celsius acquired GK8, a cybersecurity company, for $115 million.

-

The Commonwealth Bank of Australia will soon offer retail customers crypto trading capabilities.

-

Data shows that people from lower-income jobs are quitting due to the performance of their crypto investments.

-

BitMEX claims it is now carbon neutral.

-

Lower trading volatility could mean the crypto market is maturing, according to CoinDesk.

-

The EOS Foundation CEO said that “EOS, as it stands, is a failure” in a speech on Wednesday.

-

Bitcoin mining firms are experiencing delays in receiving equipment due to a global supply chain crisis.

-

A single SHIB holder moved $2.9 billion worth of tokens from their wallet yesterday.

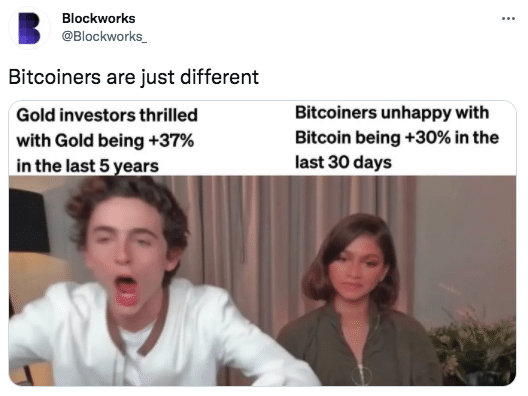

What Do You Meme?

What’s Poppin’?

The Bull Run Round-up

The total cryptocurrency market is less than a 5% increase from hitting $3 trillion, according to data from Coin Gecko. For context, as an asset class, crypto was less than $1 trillion on January 1, 2021. Bitcoin, Ethereum, Solana, Polkadot, Shiba Inu, and Terra, or 60% of the top 10 tokens by market cap (non-stablecoins), have reached a new all-time high in the last 30 days.

With such an exuberant market, it seems like today would be an excellent time to take a look back and try to digest the stream of events that have led to the latest crypto bull run.

Bitcoin Futures ETF

The bull market got a fresh wind when the ProShares’ Bitcoin Strategy (BITO), the first SEC-approved US bitcoin (futures) ETF, began trading on Tuesday, October 19th. Bloomberg’s Eric Balchunas reported that the ETF held over $1 billion after just two days of trading, becoming the second-fastest ETF to hit such a landmark — outpacing $GLD. Notably, Bitcoin hit its all-time high, $67,276.79, on BITO’s second day of trading,

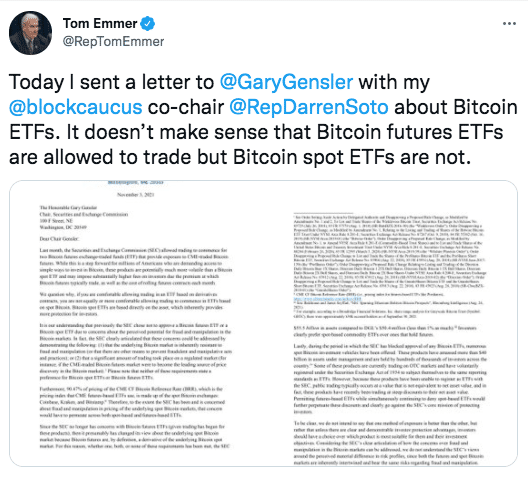

While not a spot bitcoin ETF, the ProShares’ managed futures ETF was the first such product to be approved by the SEC. Subsequently, Valkyrie and VanEck also launched futures-based ETFs.

Meta Is Good for the Metaverse

Facebook rebranded to Meta last Friday in an effort to rebrand the social media giant as a metaverse company. While much of Meta’s focus appears to be on augmented and virtual reality products, CEO Mark Zuckerberg did hint at NFTs, or virtual goods, playing a hefty role in Meta’s vision.

Since Meta’s decision, metaverse-based tokens have exploded in popularity. The Metaverse Index from Index Coop, a DeFi protocol offering tokenized indices, rose 76% over the past seven days on the backs of tokens like $SAND, $ILV, $MANA, $AXS, and $ENJ.

Solana — An NFT Pump?

Solana’s native token, $SOL, reached a new all-time high yesterday, breaking across $240 for the first time. In the past week, $SOL climbed into the top five of tokens by market capitalization, flipping Cardano’s $ADA. Solana now has a market cap over $70 billion.

While the reason for Solana’s jump in price is harder to pinpoint, Messari’s Mason Nystrom noted that Solana’s NFT ecosystem has seen “formidable growth,” with total secondary sales reaching $500 million in the past three months.

The Ethereum Supply Shift

Ethereum hit a new all-time high yesterday above $4,600.

Why? Well, as covered on Facebook Bulletin, Ethereum changed its supply schedule in August by implementing Ethereum Improvement Proposal 1559 (EIP-1559), which resulted in a mechanism that burned ETH when network demand increases over a certain level.

According to data from The Block, Ethereum has actually begun burning more ETH than it issues. Since October 26th, Ethereum’s net issuance is approximately negative 8,900 ETH, or -$3.96 billion. Essentially, Ethereum is becoming a deflationary asset, making ETH more and more scarce with each day of negative issuance.

Recommended Reads

- @CroissantEth on NFT use cases:

- Representative Tom Emmer and Representative Darren Soto on why it doesn’t make sense for bitcoin futures ETFs to be traded while bitcoin spot ETFs are not:

- Spartan Group’s Jason Choi on getting rich in crypto:

On The Pod…

Tor Bair of Secret on Why Private Smart Contracts Are Important

Secret Network is a privacy-first, permissionless layer 1 blockchain built for computational privacy. Tor Bair, founder of Secret Foundation, a developer of Secret Network, discusses what makes Secret Network unique, including smart contract privacy, private metadata for NFTs, and how regulators should treat privacy tech in blockchain. Show highlights:

- how Tor fell down the crypto rabbit hole

- what the Secret Network is and how it is bringing privacy to blockchain

- why public blockchains are problematic

- what makes Secret Network different from Monero or Zcash

- how Secret Network works from a technical perspective

- what type of applications Secret Network can support that public blockchains cannot

- why blockchain voting is probably a bad idea (for now)

- what attack vectors exist regarding Secret Network

- how Secret Network nodes work and why there are only 50 of them

- how Secret Network fixes miner extractable value (MEV)

- what DeFi applications are possible on Secret Network

- how NFTs on Secret Network are different from public blockchain NFTs

- how regulators should treat Secret Network

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians