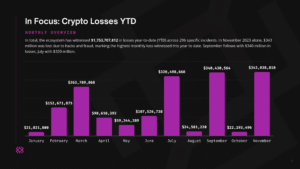

November has been the worst month for crypto hacks and fraud so far this year.

A new report from Immunefi, a blockchain cybersecurity platform, finds that losses from hacks and frauds in the crypto industry surged 1,500% from $22 million in October to $343 million in November.

Hacks are the predominant cause of losses representing 98% of cases this month. Some of the high-profile attacks have included attacks on exchanges Poloniex and HTX (formerly known as Huobi), which lost $126 million and $115 million, respectively.

Centralized finance (CeFi) became the main target for large exploits with around 54% of total losses coming from four CeFi incidents. No major CeFi attacks were recorded in October .

Meanwhile decentralized finance (DeFi) was hit by 37 incidents, which represented 46% of the total losses. The KyberSwap hack, which resulted in a loss of over $48 million, is one of the most prominent DeFi cases from this month.

The uptick in attacks coincide with a rally in crypto asset prices this month. Bitcoin (BTC) and ether (ETH) are up 10% and 12%, respectively, while altcoins such as Solana (SOL) and Avalanche (AVAX) have surged 66% and 80%, respectively, according to data from Coingecko.

September had previously been the worst month for losses at $340 million. Year-to-date, there has been a loss of $1.8 billion to hacks and fraud, according to the report.

So far this year’s losses are just under half of the amount that was lost in crypto in 2022, a year which played host to some of the industry’s biggest hacks, including those of crypto exchange FTX and Axie Infinity’s Ronin Network — each resulted in losses of over $600 million, according to ImmuneFi.

Binance’s BNB Chain and Ethereum remain the most targeted chains in November, representing 83% of the losses, the same percentage as in October.