September 10, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

A collection of 101 Bored Ape Yacht Club NFTs sold for $24.39M on Thursday in an auction at Sotheby’s.

-

Mastercard announced its acquisition of CipherTrace, a blockchain analytics firm specializing in finding illicit transactions (and, disclosure: a previous sponsor of the show) for an undisclosed sum.

-

Brian Shroder, a former Ant and Uber exec, will be taking on the role of President at BinanceUS.

-

US-Canadian citizen, Ghaleb Alaumary, was sentenced to 11 years in prison and ordered to pay $30M in restitution for his part in a North Korean crypto hacking scheme.

-

El Salvador’s new bitcoin wallets could cost Western Union $400M per year by cutting down remittance expenses.

-

The SEC is suing Rivetz, a defunct crypto payments startup, for $18M over its 2017 ICO.

-

VanEck’s Bitcoin ETF deadline was pushed back to November by the SEC.

-

Solana-based DeFi Land raised $4.1M to help gamify the concept of DeFi.

-

North American Bitcoin miners have added 10,000 BTC so far this year.

- Cardano’s Alonzo hard fork, which will implement smart contract functionality, is set to launch on Sunday.

What Do You Meme?

What’s Poppin’?

The crypto venture firm Andreessen Horowitz (a16z) is building out quite a crypto team.

Yesterday, a16z announced the hiring of Brian Quintenz, the former commissioner of the Commodity Futures Trading Commission (and recent Unchained guest), as an advisory partner.

Brian is joining a16z after four years as a crypto-friendly Commissioner, spanning from August 2017 to August 2021. During his tenure, CFTC approved the first regulated bitcoin and ether futures contracts on derivatives exchanges. Additionally, Brian led the Technology Advisory Committee, which hosted many crypto policy discussions over the years.

a16z has amassed a ton of regulatory talent to its organization. Along with the former CFTC commissioner, the venture firm employs…

-

Anthony Albanese, former COO at the New York Stock Exchange

-

Tomicah Tillemann, served as senior advisor to now-President Joe Biden

-

Bill Hinman, former SEC Director of the Division of Corporation Finance, who was the first SEC director to say in a speech that ETH in its then-form was, in his estimation, not a security

-

Brent McIntosh, former Under Secretary of the Treasury for International Affairs

In an explanation of the move, Katie Haun, general partner at a16z, wrote:

“Crypto is at a crossroads. With innovation in the space accelerating so quickly and incredible new projects being launched every day, more and more leaders across business, finance, and government are starting to acknowledge our view that the future of the internet will be driven by crypto technology. It’s no wonder, then, that crypto regulation has come to the forefront of the national debate. As we witnessed with the Infrastructure Bill, it has never been more important for the crypto community to engage in productive dialogue with regulators and policymakers.”

Given the current regulatory headwinds the crypto community — from Coinbase to DeFi, all of which a16z is heavily invested in — it looks like these regulatory hires will be useful going forward.

Recommended Reads

- DappRadar on how The Sevens NFT mint went awry:

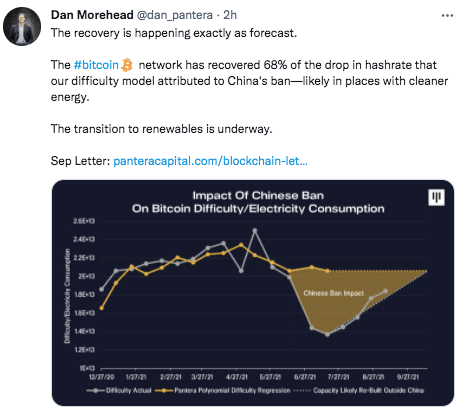

- Pantera Capital dropped its September letter:

- Centre’s Amy Madison on NFT taxes:

On The Pod…

Was Coinbase CEO Brian Armstrong Entitled to a Meeting With the SEC?

-

why Coinbase is unhappy with what it calls the SEC’s “sketchy” behavior

-

how Coinbase’s Lend product is structured and why it might be a security

-

why Ephrat considers Coinbase’s reaction to the SEC’s decision on Lend to be “trolling”

-

what we can learn from SEC chair Gary Gensler’s letters with Senator Elizabeth Warren

-

what legal precedence the SEC is leaning on in its decision about Lend

-

how to explain the SEC’s choice to not meet with Coinbase in Washington

-

why Ephrat thinks Brian Armstrong sounds entitled

-

Why even pro-Bitcoin groups in the US take issue with El Salvador’s adoption of Bitcoin as legal tender

-

why Ephrat thinks Bitcoin is not a practical payment mechanism for El Salvadorans

-

how El Salvadorans have reacted to the law

-

why Ephrat believes El Salvador’s mandate to accept BTC is philosophically problematic for Bitcoiners

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians