November 16, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

President Joe Biden signed the Infrastructure Investment and Jobs Act into law; Senators Ron Wyden and Cynthia Lummis plan to introduce a new bill that would reverse some of the crypto provisions in the infrastructure package.

-

Galaxy Digital reported a Q3 income increase of 1,146% YOY.

-

Paradigm announced a $2.5 billion fund to invest in crypto companies and protocols.

-

Digital asset funds saw inflows totaling $151 million for the week ending November 12.

-

Marathon Digital, a bitcoin mining company, raised $500 million via convertible notes to buy BTC and mining equipment; the company also revealed that its executives received a subpoena from the SEC in a recent filing.

-

Coinbase has plans to support third-party DeFi apps on its platform.

-

The Dallas Mavericks have begun issuing NFTs for fans attending games in person.

-

Bloomberg and Galaxy Digital have partnered to launch the Bloomberg Galaxy Solana Index, which tracks the price of Solana.

- VanEck’s bitcoin futures ETF should begin trading today.

What Do You Meme?

What’s Poppin’?

ParaSwap, a DEX-aggregator, announced the launch of its PSP governance token on Ethereum via a retroactive airdrop.

The decision to launch a token comes less than two months after the protocol said it was not planning an airdrop:

The airdrop will see 150,000,000 PSP tokens, or 7.5% of the supply, distributed across roughly 20,000 wallets. Interestingly, the airdrop included a “heavy filtering process” to make sure the PSP was “allocated to users most relevant to ParaSwap’s vision,” as the team explained in an announcement.

According to Shresth Agrawal, an algorithm designer for ParaSwap, eligibility for the airdrop necessitated users completing at least six ParaSwap transactions in the six months before the snapshot date of October 8th. In addition, eligible users need to hold a minimum native token balance.In a conversation with CoinDesk, ParaSwap’s founder Mounir Benchemled suggested ParaSwap’s decision to have high standards for its airdrop had to do with the amount of farming taking place on its token. When asked about the over 1.3 million addresses that had interacted with the protocol, in an apparent attempt to game the airdrop, Benchemled told CoinDesk:

“The vast majority are farmers, and some of them are quite sophisticated. They use bots, sending tokens to thousands of wallets – sometimes tens of thousands of wallets – and they’re not real, active users.”

On top of eligibility requirements, ParaSwap users based in the US and China were also excluded from the drop. At the time of writing (6:28 pm EST), PSP is trading at $1.49, which makes the value of tokens airdropped worth over $200 million.

Recommended Reads

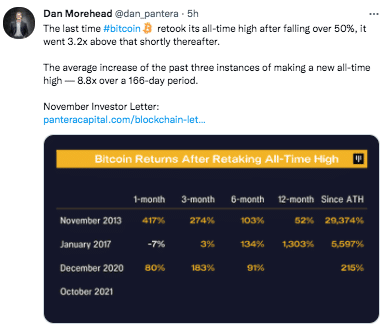

- Pantera Capital on sound money:

- Not Boring on the DAO working to buy a copy of the US Constitution:

- T., an Ethereum on-chain analyst, on the long-term price of ETH:

On The Pod…

PayPal Would Need These Two Things In Order to Issue a Stablecoin

Jose Fernandez da Ponte, PayPal’s senior vice president and general manager of blockchain, crypto, and digital currencies, discusses PayPal’s crypto game plan, how CBDCs might be implemented, crypto regulations, and more. Show highlights:

- Jose’s path to becoming the GM of blockchain, crypto, and digital currencies at PayPal

- what factors led to PayPal’s decision to launch its crypto offering

- what sort of customer makes up PayPal’s crypto demographic

- how users are engaging with the various PayPal crypto services, like crypto-rewards cards

- whether the introduction of crypto had anything to do with Venmo’s 36% jump in volume during Q3 2021

- how PayPal interacts with Paxos on the backend to settle crypto transactions

- why Jose thinks PayPal has decided to not add cryptocurrency to its balance sheet

- how crypto transactions work within PayPal’s internal ledger and how that might change once PayPal launches support for withdrawals off-platform

- the three types of directions that Jose believes stablecoins and CBDCs could be built

- what solutions would need to be built before PayPal would consider issuing its own stablecoin

- what scaling technologies, be it L1 or L2, PayPal is interested in

- whether stablecoins and CBDCs can/will co-exist

- Jose’s thoughts on how long it will be before CBDCs are being issued

- why Jose thinks that new regulation might be necessary for cryptocurrencies

- whether PayPal will be participating in decentralized activities, such as on-chain governance

- why Jose thinks that PayPal’s crypto offering could help improve financial inclusion — especially for smaller companies

- why Jose and PayPal are excited about NFTs

- how PayPal will decide to support new cryptocurrencies on its platform

- what Jose thinks PayPal’s crypto offering could look like in the future

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians