August 23, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- FTX could end up buying BlockFi for only $15 million, according to CoinDesk.

- CryptoPunks Ethereum NFTs flipped Bored Apes floor price again.

- NFT lender BendDAO is voting to make changes to the platform in order to navigate its liquidity crisis.

- TON, the native token of The Open Network, increased 15% after the founder of Telegram said that the company might offer a marketplace to auction addresses.

- Sepolia, an Ethereum testnet, went through a post-merge update.

- South Korean authorities plan to tax airdrops, as they are considered gifts.

- Australia is planning to develop a crypto regulation framework unlike “anywhere else in the world.”

- Hodlonaut, a BTC community member and editor of Citadel21, received almost $1 million worth of BTC in donations ahead of the defamation court hearings involving Craig Wright.

Today in Crypto Adoption…

- DTCC, a financial services company, launched a private blockchain platform to settle trades more quickly.

The $$$ Corner…

- Global asset management firm Invesco launched a $30 million fund to invest in the metaverse.

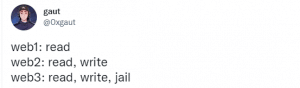

What Do You Meme?

What’s Poppin’?

Former OpenSea Executive Wants His Insider Trading Case Dismissed

The lawyers of Nathaniel Chastain, former head of product at OpenSea, filed a motion with the Department of Justice to dismiss the insider trading case against him.

Chastain had been indicted on wire fraud and money laundering charges after an insider trading scandal and was arrested in June this year.

The former OpenSea executive allegedly defrauded the NFT marketplace by using inside knowledge of the NFTs that were soon to be featured on the platform’s homepage. He is accused of buying those NFTs before they were displayed so prominently, and selling them later at a profit. Chastain was also accused of using different digital wallets to purchase assets.

The motion issued by Chastain’s lawyers argues that NFTs are neither securities nor commodities, and therefore, the case shall be dismissed. “Can the government proceed on a Carpenter wire fraud theory of insider trading in the absence of any allegation involving securities or commodities trading?” they wrote, referring to the Carpenter v. Unites States insider trading case.

In addition, his attorneys argued that by moving forms from one personal wallet to another, Chastain could not be “intending to conceal,” because the transactions were always visible, as they were conducted on the Ethereum blockchain. “The defendant did nothing more than move money in an obvious and perceptible manner.”

The news arises as NFTs, along with cryptocurrencies, are coming increasingly under the sight of regulators. The question of whether NFTs and crypto tokens are considered securities, commodities, or something else, remains to be answered.

In an op-ed published in the Wall Street Journal on Friday, SEC Commissioner Gary Gensler said: “There’s no reason to treat the crypto market differently from the rest of the capital markets just because it uses a different technology.”

Recommended Reads

- Katie Talati’s interview to Daniel Kuhn on whether Ethereum’s Merge is priced in

- Eric Wall on social slashing

- Mark Murdock (former editorial assistant at Unchained) on Fractal Protocol

On The Pod…

Stephane Gosselin, cofounder and chief architect of Flashbots, and Uri Klarman, CEO of bloXroute Labs, joined Unchained to discuss everything about MEV, an especially important topic now with the Merge coming. Show highlights:

- what MEV is, how it works under Proof of Work

- some examples of MEV, like frontrunning and arbitrage

- how MEV is a rabbit hole full of monsters

- the role of Flashbots in the MEV industry and how Flashbots enabled a reduction of gas fees for users

- how MEV-geth functions and how it relates to auctions systems

- how bloXroute, Uri’s company, is working with MEV

- where Stephane and Uri disagree on MEV, despite agreeing on many fundamental things

- how MEV changes with the implementation of Proof of Stake

- what MEV-Boost is and the problems it solves

- what proposer-builder separation is and the motivation behind this idea

- whether DeFi would flourish more if there wasn’t frontrunning and why MEV-Boost doesn’t prevent it

- what externalities MEV-Boost or proposer-builder separation (PBS) would solve for users

- how MEV exists in other industries and in traditional finance

- why Flashbots’ own investors would rather trade on a fair-sequenced rollup than on Flashbots

- how the number of MEV extractors has been decreasing and whether this would end up centralizing MEV

- whether exploiting certain types of MEV is illegal

- how other chains are trying to solve frontrunning, like Osmosis with threshold encryption

- what are the levers that can be pulled to solve MEV, according to Uri

- how eradicating MEV can positively affect the price of ETH, and by how much

- whether validators can potentially share MEV profits with users

- how to determine if a network has a good MEV supply chain

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians