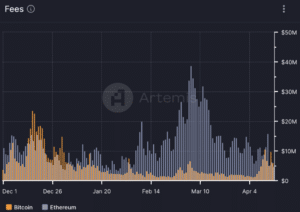

Since 2021, Ethereum has typically led layer 1 blockchain networks in terms of daily fees generated, but Bitcoin has recently been giving Ethereum a run for its money.

On Monday, crypto users paid $9.8 million in total fees on Bitcoin and $6.4 million on Ethereum, while on Tuesday, Bitcoin generated $6 million in fees, compared to $4.8 million for Ethereum, according to blockchain analytics firm Artemis.

Bitcoin has led Ethereum in daily fees generated for 27 days since 2021, and of those 27 days, 23 of them occurred between December and now, highlighting rising fees and heightened demand to transact on the oldest blockchain network, data from onchain statistics firm Token Terminal shows.

According to an April 16 note from blockchain analytics firm Nansen, the higher amount of fees users have been paying to transact on Bitcoin is a positive sign that fees will serve as an ongoing and effective motivation for miners to uphold the security of the Bitcoin blockchain network.

“With Bitcoin experiencing its fourth halving, which will reduce block rewards to just 3.125 BTC per block, I’m optimistic about the potential for onchain activities that generate transaction fees which will continue to incentivize miners to secure and decentralize the network,” wrote Journey Li, Nansen’s product marketing manager.

Read more: Bitcoin Miners Diversify Their Revenue Streams as Halving Nears

The Driving Forces Behind Bitcoin’s Fees

The amount of fees Bitcoin generates does not solely come from simple BTC transfers. Li noted that Bitcoin’s recently higher fee income also arises from onchain activities such as minting Ordinals non-fungible tokens (NFTs) and trading BRC-20 tokens.

Not only has NFT trading volume on Bitcoin exceeded that of Ethereum over the past 24-hour, 7-day, and 30-day periods, according to NFT industry data aggregator CryptoSlam, but Bitcoin is in fourth place for all-time NFT sales volume, behind Ethereum, Solana, and Ronin.

“This is noteworthy considering that Ordinals, the popular NFT standard on Bitcoin, was only launched at the start of 2023,” wrote Li, as Ethereum, Solana, and Ronin have had a multi-year head start with NFTs.

Additionally, of the top 10 NFT collections ranked by market cap, three belong to the Bitcoin ecosystem—namely, Bitcoin Puppets, Bitcoin Wizards, and Rune Pups, according to CoinGecko.

Bitcoin also generates fee income from crypto users trading BRC-20 tokens. For example, Unisat, a decentralized exchange popular for trading BRC-20 memecoins, had 24-hour trading volume of $10 million.

Looking ahead, Runes, a protocol that hasn’t rolled out its mainnet yet, aims to be “an improvement over the BRC-20 tokens because it doesn’t produce unnecessary data that clogs the blockchain, it’s independent of external data, doesn’t need its own new token, works with the Lightning network, and offers better privacy,” wrote Li.

Read More: What Are Runes?

“Bitcoin’s market for fungible tokens is small compared to Ethereum and Solana (see screenshot below), but with Runes, Bitcoin could close this gap,” Li added.

At the time of publication, the price of BTC has decreased 3.7% in the past 24 hours to around $60,1000.