Publicly-traded software firm MicroStrategy (MSTR), the largest corporate holder of bitcoin (BTC), acquired approximately 14,620 bitcoins for about $615.7 million during the month-long period ending Dec. 26, according to a new regulatory filing on Wednesday.

The acquisition, averaging $42,110 per bitcoin, increased MicroStrategy’s total holdings to around 189,150 bitcoins, with an average purchase price of $31,168 each or $5.9 billion overall. Using the current BTC price of $43,116.20, reached after a nearly 15% gain in the past month, MicroStrategy has made a roughly $2.3 billion profit on its purchases.

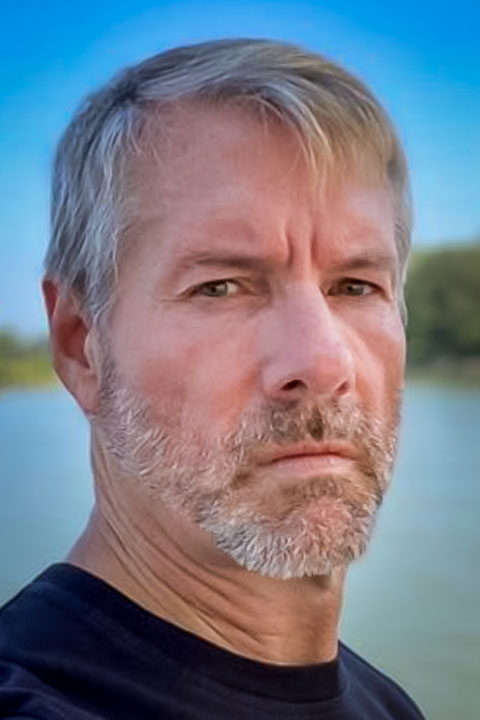

Founded in 1989, Virginia-based MicroStrategy was initially known as a provider of data intelligence software before becoming an aggressive investor in digital assets under the leadership of former CEO Michael Saylor, a bitcoin enthusiast who still heads the company’s board of directors.

Additionally, MicroStrategy used the filing to update its stock sale activities under a previously disclosed Sales Agreement. Since Nov. 30, the company has been authorized to sell up to $750 million in class A common stock. As of Dec. 26, MicroStrategy has sold 1,076,915 shares, resulting in net proceeds of approximately $610.1 million.

MicroStrategy has acquired an additional 14,620 BTC for ~$615.7 million at an average price of $42,110 per #bitcoin. As of 12/26/23, @MicroStrategy now hodls 189,150 $BTC acquired for ~$5.9 billion at an average price of $31,168 per bitcoin. $MSTR https://t.co/PKfYY59sTW

— Michael Saylor⚡️ (@saylor) December 27, 2023

Read more: MicroStrategy Adds 16,130 Bitcoin to Already Massive Holdings