June 29, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- CoinFLEX plans to release a $47 million recovery token to raise funds after pausing withdrawals from its platform.

- CoinFLEX CEO Mark Lamb accused Roger Ver, aka “Bitcoin Jesus,” for defaulting on a $47 million loan; Ver responded, “These rumors are false.”

- The CFO and CEO of Compass Mining announced their resignation due to “setbacks and disappointments.”

- Babel Finance is losing top employees after its decision to pause withdrawals.

- Cosmos, a proof-of-stake blockchain, will be releasing a new feature to enable interchain security.

- Hackers responsible for the $100 million exploit in Harmony started laundering the funds.

- Chainlink token LINK soared after being listed on Robinhood.

- White Rock Management, a Swiss bitcoin miner, launched its first operations in the US.

- $21 million worth of mining equipment was seized by Argentina’s customs office.

Today in Crypto Adoption…

- Russian parliament approves tax breaks for cryptocurrency issuers.

- New York Community Bank will act as a custodian for some of the reserve assets behind.

The $$$ Corner…

- Kaiko, a blockchain analytics company, raised $53 million in a Series B funding round.

- Dynamic, a web3 startup, raised $7.5 million in seed funding led by a16z.

- PolySign, a crypto infrastructure firm, raised $53 million in Series C funding.

- Web3 network Peaq raised $6 million in a funding round.

What Do You Meme?

What’s Poppin’?

Maker DAO Is Voting On an Important Proposal

By Juan Aranovich

MakerDAO, the DAO behind the DAI stablecoin, announced a governance proposal to decide how to allocate 500 million DAI ($500 million).

The community is currently deciding whether to allocate these assets 100% in US short Treasuries or to allocate them in a 80%-20% split between short Treasuries and investment-grade (IG) corporate bonds.

“This allocation poll is a result of the passage of MIP65, which introduces a new real-world asset vault with the purpose of acquiring USDC and investing them in high-quality liquid bond strategies held by a trust arranged by Monetalis [an environmentally-friendly wholesale lending company],” said Maker DAO.

The intention behind this proposal is to generate more yield for the treasury. MakerDAO’s treasury is composed of many crypto assets, but the main one is USDC. At the moment, 51% of the DAI in circulation is collateralized by USDC.

So far, the option of the 80%-20% split between short Treasuries and IG corporate bonds has achieved outstanding support, with 98% of the votes in favor.

However, 97% of these votes come from just two wallets, calling into question how decentralized the vote actually is. Last week, Solend DAO had the same issue, as it passed a governance proposal with 90% of the votes coming from only one wallet. (This was covered on last Friday’s Unchained show; don’t miss it!)

DAI is the largest decentralized stablecoin in existence, with a market capitalization of $6 billion and a peak of $10 billion in February this year. Compared to the other top stablecoins, which are backed by fiat, DAI is in fourth place. USDT is the largest one, with $66 billion of market cap, followed by USDC ($55 billion), and BUSD ($17 billion).

The vote will end on Friday, and it will probably be very important for the future of DAI as a decentralized stablecoin. “With yields higher than zero, it makes sense to hold T-bills directly, and get the yield rather than only hold USDC. But then it increasingly looks like the other two fiat-collateralized stablecoins (…) the US Treasury Department has a simple on/off switch for the whole ecosystem,” said Lyn Alden, macroeconomic researcher.

Recommended Reads

1) Jaran Mellerud on Bitcoin miners:

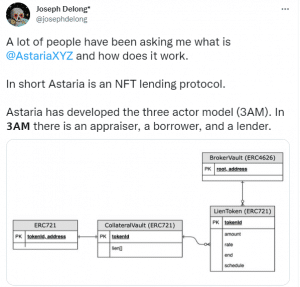

2) Joseph Delong on Astaria protocol and its three actor model (3AM):

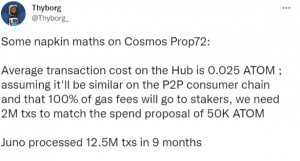

3) Thyborg on Cosmos Prop72:

On The Pod…

Shaun Maguire and Michelle Bailhe, partners at Sequoia, discuss their long term view and thesis about crypto, what do they look for to invest in a crypto project, the takeaways from the blowup of Terra, the insolvency of crypto companies, and much more. Show highlights:

- what is Sequoia’s long term view and thesis about the crypto industry

- how different our lives will look 20 years from now due to blockchain technology

- how Sequoia had to adapt to invest in this new asset class and what are the similarities and differences with investing in traditional startups

- when a product or service on the internet should be offered in a decentralized or centralized way

- how Sequoia decides whether to invest in the entity behind a project or in the tokens

- whether having venture capitalists involved at all goes against the ethos of decentralization

- why Shaun believes that Ethereum proved that decentralization can be achieved even when you start being centralized

- whether people underestimate the value that VCs can add to a project

- why Shaun believes that Solana is moving towards decentralization

- Sequoia’s thesis about privacy in crypto and the potential of zero-knowledge proofs

- how Michelle sees the macroeconomic environment impacting crypto and whether this cycle is different from the previous ones

- the importance of product market fit in crypto projects

- what crypto projects should be focusing on and the business model they should be pursuing

- the main takeaways of the Terra collapse and how it was a major setback for algo stablecoins

- how crypto founders should always do the right thing even though there is no clear regulation

- whether SBF is the Berkshire Hathaway of crypto today

- the lessons to be learned from the potential insolvency of some crypto lenders and investment firms

- how demand for blockspace will keep increasing and whether a single blockchain could supply all that space

- the future of the metaverse and how it can be defined

- Michelle’s mental model for crypto and the phases for achieving worldwide adoption

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians