December 1, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Bullish, the Peter Thiel-backed EOS exchange, officially began operating on Tuesday.

-

$31 million was stolen from MonoX in a DeFi hack covering Polygon and Ethereum.

-

Digital asset manager Grayscale launched a Solana trust product for accredited investors; Grayscale also sent a letter to the SEC arguing that the SEC’s repeated rejections of a spot bitcoin ETF could violate the Administrative Procedure Act (APA).

-

Layer 2 developer StarkWare launched the mainnet alpha of StarkNet, the team’s zk-based Layer 2 rollup network.

-

A hacker was able to add her Ethereum wallet to Twitter’s tip jar.

-

Crypto.com’s token, CRO, more than tripled in November on the heels of heavy advertising investments. (Disclosure: Crypto.com is a sponsor of my shows.)

-

David Marcus, the current leader of Novi, will be leavingMeta (formerly Facebook) at year’s end.

-

The state of Wyoming is attempting to house 5% of the US BTC mining hashrate by 2024.

-

Coinbase is set to acquire Unbound Security, an Israeli crypto custody firm.

-

Borderless Capital is setting up a $500 million Algorand fund to help develop projects on the network.

What Do You Meme?

What’s Poppin’?

A New ATH for LUNA

Terra’s native token LUNA hit an all-time high of $59.38 on Tuesday afternoon — marking the second time LUNA broke a new price record in November.

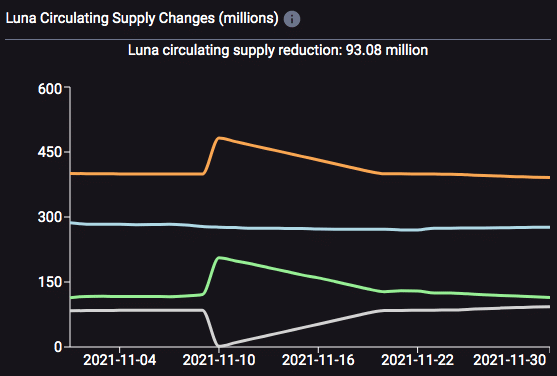

The skyrocketing price coincides with LUNA becoming a deflationary asset, as the token’s supply was decreased in 28 of the 30 days in November, according to data from Terra Analytics.

Deflationary supply for LUNA is new and stems from the introduction of Columbus-5, a recent network upgrade.

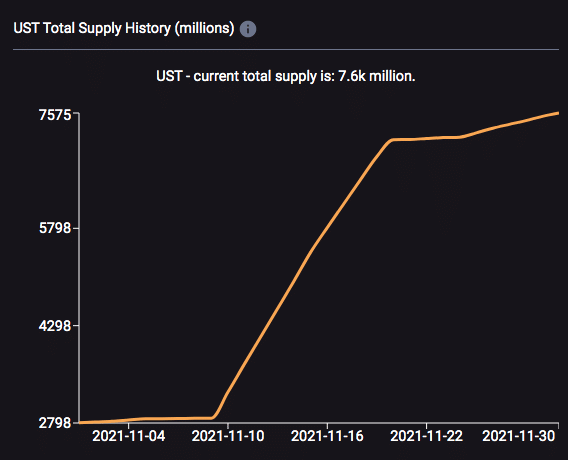

To refresh your memory, Terra is a smart-contract layer 1 network that facilitates the minting and usage of a wide variety of algorithmic stablecoins via the burning of LUNA. Essentially, when a stablecoin is minted on Terra, such as the dollar-pegged UST, LUNA is burned or minted to keep the value of the stablecoin as near to the fiat peg as possible. When demand for UST is low, LUNA is minted and when demand for UST is high, LUNA is burned.

Previously, when LUNA was “burned,” it was actually sent to a community pool. With Columbus-5, the aforementioned network upgrade, all LUNA used to mint UST is now permanently burned.

This appears to be creating quite a cycle for LUNA’s price. As more UST is minted, more LUNA is burned, making LUNA more deflationary — which is a highly sought-after characteristic in the crypto industry. The whole concept is very similar to EIP-1559’s effect on Ethereum. It also helps that demand for UST has more than doubled in the last month, with the supply of UST increasing from 2798 to 7.6 billion in the past 30 days.

In addition to the deflationary aspect of LUNA helping pump the price, Terra has also seen the total-value-locked in its DeFi platforms increase. Data from DeFi Llama shows that Terra is the fifth-largest chain by total value locked (TVL), trailing Avalanche and Solana by less than $3 billion.

Recommended Reads

- Variant Fund’s Jesse Walden on product versus protocol:

- Infinite Learner on web3 education:

- Zee Prime Captial’s Matti G on boomers versus online tribes:

On The Pod…

Will Solana Be the Execution Layer and Ethereum the Settlement Layer?

On Unchained, two co-founders of Solana Labs, Anatoly Yakovenko and Raj Gokal, dive deeply into the Solana ecosystem, discussing everything from the price of SOL to the Solana network outage to the competition between Ethereum and Solana. Show highlights:

-

- why Raj thinks SOL’s market cap grew from $86 million to $68 billion in less than a year

- Anatoly’s and Raj’s background and how they found themselves working together to build Solana

- why Anatoly thinks Solana will be a general-purpose blockchain rather than specializing in gaming or high frequency trading

- Anatoly’s goal to make Solana the first billion-user blockchain

- why Raj thinks NFTs on Solana have been so popular

- why, in the opinion of Raj and Anatoly, Solana’s purpose has shifted away from high-frequency trading

- how NFTs could replace ads

- why “everything is DeFi”

- how Solana Labs plans to allocate the recent $314 million funding round it raised

- what lessons Anatoly learned from the 18-hour September network outage

- technically speaking, what happened to cause Solana’s network outage

- why Anatoly believes that outages, at this stage, aren’t necessarily a bad thing

- whether “trading mercenaries” dominated at Solana Breakpoint

- why developers are interested in building on Solana

- how Solana and Ethereum compare as execution and settlement layers

- why Raj doesn’t like framing competition between Solana and Ethereum as a fight

- how Anatoly views the competition between Ethereum and Solana

- whether the arrival of Neon Labs, which is bringing EVM to Solana, could lead to developers leaving Ethereum

- how NFTs and Phantom wallets are bringing in new users for Solana

- whether Raj and Anatoly would roll back Solana if something like Ethereum’s DAO hack were to occur

- why Solana has the competitive advantage in throughput, according to Anatoly

- what would happen if FTX cofounder and CEO Sam Bankman-Fried gave up on Solana

- their predictions for Solana five years from now

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians