April 8, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Frax Finance is considering buying billions worth of crypto assets to back its algorithmic stablecoin FRAX.

-

The Pudgy Penguins floor price has tripled after a change in ownership.

-

The total value locked in Ethereum layer 2s is over $7 billion.

-

BreederDAO released a whitepaper.

- The Crypto Council for Innovation announced five new hires.

Today in Crypto Adoption…

-

Treasury Secretary Janet Yellen made her first speech about digital assets and called crypto “transformative.”

-

A special economic zone in Honduras recognized crypto as legal tender, and an autonomous region of Portugal revealed it will focus on Bitcoin adoption.

-

Bitcoin 2022 experienced its first big announcement when Robinhood Chief Product Officer Aparna Chennapragada told the audience that the trading platform had activated crypto wallet functionality for two million customers.

-

Crypto.com will be paying bonuses in BTC to UFC fighters.

-

CashApp now offers a way to get paid directly in BTC and will offer Lightning capability soon.

The $$$ Corner…

-

Blockchain security firm CertiK announced an $88 million funding round that saw participation from traditional behemoths like Tiger Global, Goldman Sachs, and Sequoia Capital. CertiK is now valued at $2 billion.

-

Crypto payments firm Wyre was acquired by Bolt in a deal valued at roughly $1.5 billion, reports The Block.

-

eToro announced a $20 million creator fund for NFTs.

-

Community Gaming raised $16 million in a Series A.

- Improbable, a British metaverse company, raised $150 million.

What Do You Meme?

What’s Poppin’?

UST Adds AVAX to Its Reserves

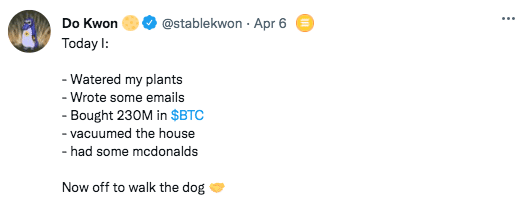

Terra expanded its UST reserve plans to incorporate AVAX yesterday.

Luna Foundation Guard announced an over-the-counter purchase of $100 million in AVAX, the native token of the layer-1 smart contract platform Avalanche. AVAX is the first addition to UST’s forex reserve scheme outside of BTC.

In a tweet thread, the team described the move as the “beginning of a diversified and non-correlated asset pool supporting the $UST peg,” further hinting, as Do Kwon did on Unchained, that LFG will continue adding other assets besides BTC and AVAX to its forex reserves.

The Avalanche x Terra relationship is being further expanded in a separate $100 million token swap between Avalanche Foundation and Terraform Labs, which spearhead development on their respective chains. Terraform Labs now holds $100 million in AVAX while Avalanche Foundation holds $100 million in LUNA, and according to Terra’s Twitter account, $100 million in UST from the LFG purchase.

The news comes shortly after Terra’s largest DeFi protocol, Anchor, was implemented on Avalanche. Terra revealed that “several more” Terra protocols are considering a similar move.

According to Emin Gun Sirer, the founder of Avalanche, the partnership is motivated by getting exposure to UST. “A little known rule, after ‘Don’t roll your own crypto,’ is ‘Don’t try to roll your own stablecoin, you’ll screw it up.’ This is why Ava Labs partnered with the pros in this game instead of launching its own,” he wrote.

As of press time (5 pm ET), LUNA is down 7% on the day. AVAX is up 1.37%.

Recommended Reads

-

Messari’s @dunleavy89 on sports NFTs:

-

Joel John on how web3 grants should be utilized:

-

Grant Gulovsen on how to promote your DeFi token without running afoul of securities law:

On The Pod…

Here’s Why USDN De-Pegged From the Dollar – And Why UST Might Too

Kevin Zhou, co-founder of Galois Capital, discusses a crazy week in the world of algorithmic stablecoins that saw USDN de-peg from the dollar and Terra unveil plans to create a new liquidity pool on Curve to strengthen UST. Show highlights:

-

how USDN and Waves works

-

what made USD de-peg

-

why Kevin thinks algorithmic stablecoins fail so often

-

what Kevin thinks about backing UST with BTC

-

how 4pool works in the context of Curve Finance, 3pool, UST, Frax Finance, and Redacted Cartel

-

why Kevin believes Anchor is the reason UST could de-peg

-

what might happen to Terra and the crypto market writ large if UST were to de-peg

-

why lowering yields on Anchor could depress LUNA’s price by 8x

-

how UST and LUNA redemptions work

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians