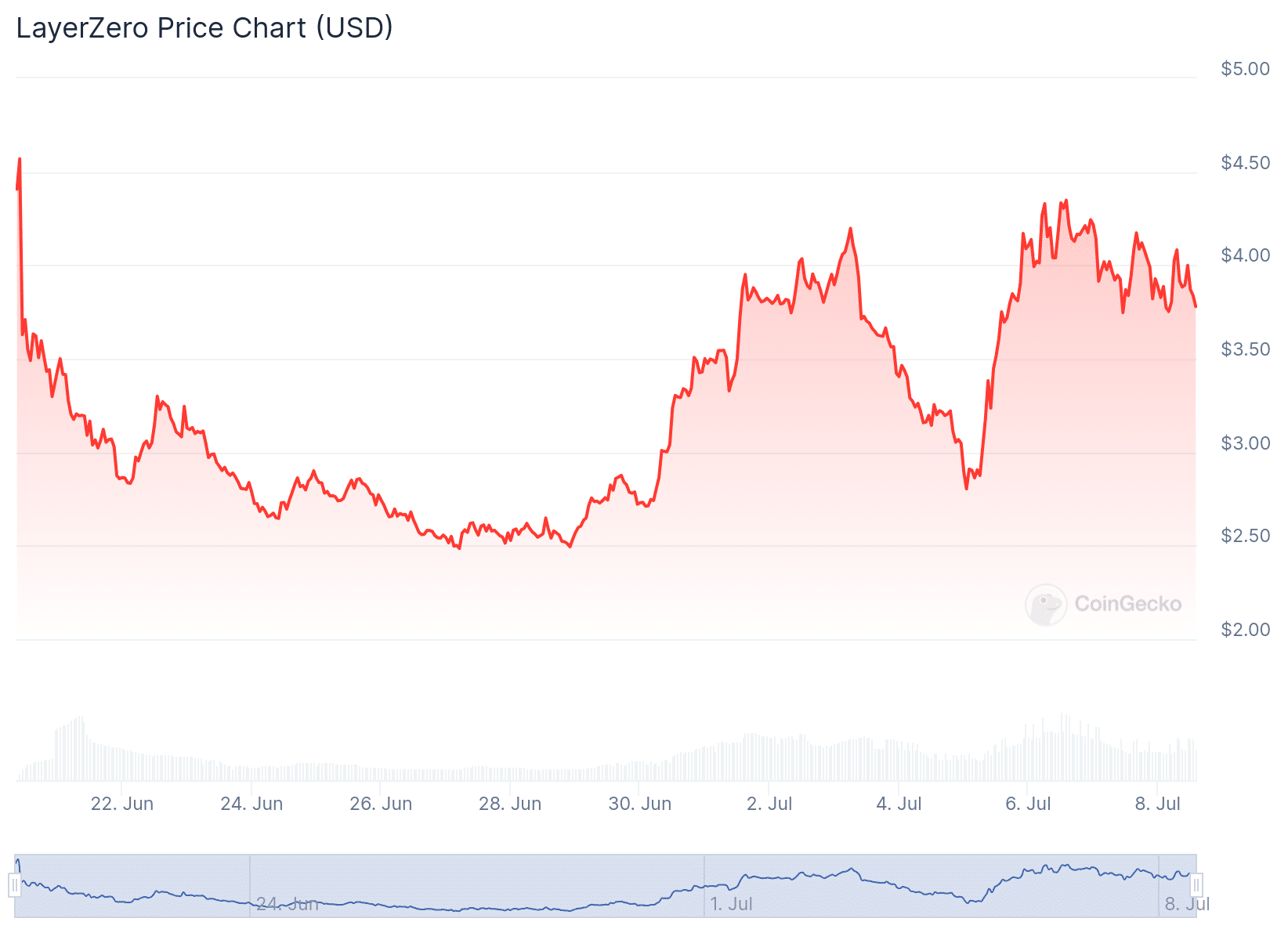

It’s been 19 days since LayerZero’s highly anticipated airdrop on June 20, and the performance of the ZRO token has taken many by surprise. Despite an initial wave of selling, which drove the price from a high of $4.57 to lows of $2.48, ZRO has shown remarkable resilience and growth, especially when compared to other recent launches.

LayerZero’s ZRO token experienced a sharp sell-off immediately following the airdrop, as seen in the chart from CoinGecko. This market reaction has been typical for newly airdropped tokens, as seen with ZKsync’s ZK, Blast’s BLAST, Wormhole’s W and Starknet’s STRK, but ZRO has since bucked the trend. The token has climbed steadily, now trading at $3.93, up 40% since Friday.

ZRO has not only recovered but has outperformed both ETH and BTC in the same period.

Though there’s no clear reason why the token has outperformed, one factor could be its Unrealized Gains to Circulating Market Cap Ratio. This concept was highlighted by Delphi Labs’ founder Jose Macedo on a recent episode of Unchained. Macedo explained the importance of evaluating tokens based on unrealized gains, which represent the profits that have not yet been realized by early investors or the team. A lower ratio of unrealized gains to market cap indicates that less of the token’s value is tied up in unrealized profits, which can reduce selling pressure when tokens unlock.

LayerZero’s latest investment round brought the company’s valuation to $3 billion, while ZRO’s fully diluted valuation (FDV) sits at $3.9 billion. Token investors have an unrealized gain of $900 million, calculated by taking ZRO’s FDV against the company’s latest valuation. While the team, with a 25.5% allocation, hold a $765 million unrealized gain. ZRO has an unrealized gains ratio of approximately 3.85, based on the total unrealized gains amount of $1.66 billion compared to its market cap of $431 million.

Delphi Labs’ Macedo pointed out that many tokens trade at a ratio of 4 to 8, meaning there is four to eight times the project’s circulating market cap in unrealized gains. This can lead to significant sell-offs as tokens unlock, putting downward pressure on the price. In contrast, ZRO’s ratio of 3.85 suggests a healthier balance, potentially contributing to its recent price stability and growth.

Additionally, LayerZero’s anti-Sybil measures, including mandatory donations to the Protocol Guild and offering a self-report option for Sybil attackers, could have also contributed to the positive reception and robust performance of the ZRO token.

Read more: Why LayerZero’s New Anti-Sybil Policy Is Getting Both Backlash and Praise