After Nvidia reported on Wednesday its first-quarter earnings, which beat financial analysts’ estimate, the largest artificial intelligence cryptocurrencies by market cap initially dropped, suggesting traders locked in their gains.

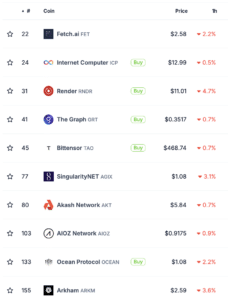

According to data from CoinGecko, the top five AI tokens by market cap – FET, ICP, RNDR, GRT, and TAO, which had made gains ahead of the earnings report – each slid right after Nvidia’s announcement, with RNDR, the native token of peer-to-peer GPU marketplace Render, taking the title as the biggest lagger dropping 4.7% within an hour of the announcement.

Four of these tokens are still trading below their price at the time of Nvidia’s announcement which was published to Yahoo Finance at 4:20 p.m. EST. FET was trading around $2.65 at the time of the announcement and has since dropped 4% to $2.54. ICP, RNDR and GRT are just a smidge below their price at the time of the announcement.

Read More: 5 Use Cases of AI in Blockchain

Nvidia’s quarterly revenue increased 18% from last quarter to $26 billion in Q1 of 2024. Nvidia’s Q1 report also announced a ten-for-one forward stock split of NVIDIA’s issued common stock—an effort to make “stock ownership more accessible to employees and investors,” per the announcement.

According to Reuters, Nvidia’s first-quarter revenue of $26 billion beat analysts’ estimates of $24.65 billion.

The price action of the top AI tokens may come to a surprise to some traders as positive news about Nvidia in the past has coincided with AI tokens increasing in price. For example, at the time of Nvidia’s GTC 2024 in March, a developer conference for artificial intelligence, AI tokens soared, per blockchain sleuth Lookonchain.

While the top AI tokens were in the red after earnings, BTC and ETH remained stable, per CoinGecko. NVDA slid 0.46% on the day to have a closing price of $949.50, but rose about 6% to $1,009 in extended trading hours on Wednesday, according to data from Yahoo Finance.

Nvidia is a company headquartered in Santa Clara, California focused on engineering chips, systems, and software for artificial intelligence factories. The AI-focused company has a market cap of $2.3 trillion, rivaling the entire crypto ecosystem which has a total market cap of $2.7 trillion.