KuCoin’s exchange reserves have decreased by $273 million in the past several hours since U.S. federal prosecutors announced charges against the cryptocurrency exchange and its two founders, Chun Gan and Ke Tang, for violating anti-money laundering laws.

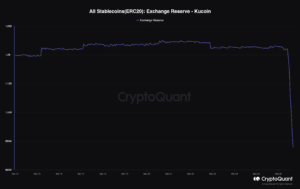

According to data analytics firm CryptoQuant, the value of ERC-20 stablecoins such as USDT and USDC in KuCoin’s exchange reserve has dropped from $1.217 billion at 10 a.m. to roughly $944 million at presstime, a 22% decrease.

The Justice Department has accused KuCoin of being a “multibillion-dollar criminal conspiracy,” with federal prosecutors charging its founders with “willfully failing to maintain an adequate anti-money laundering (“AML”) program designed to prevent KuCoin from being used for money laundering and terrorist financing.” The withdrawal of assets from KuCoin is a sign of fear among crypto users about holding their assets in an exchange that is getting indicted by the Department of Justice.

“The charges from U.S. federal prosecutors against KuCoin and its founders, under the Bank Secrecy Act, signal significant concerns,” said analytics firm Nansen in an email. KuCoin has seen a “notable increase in [outflow] withdrawals” on both Ethereum and EVM-compatible chains, highlighting “potential broader market impact.”

In an email to Unchained, the KuCoin Media Team indicated that the exchange “is operating normally,” insofar as users can deposit and withdraw their funds. “In the context of recent significant market fluctuations, it’s a common occurrence for users to transfer assets between exchanges for their own financial needs… While respecting user behaviors, we will stay dedicated to serving users as a secure and reliable trading platform,” the KuCoin Media Team wrote.

UPDATE (March 27 12:06 a.m. ET): Included quote from the KuCoin Media Team and updated the chart to show KuCoin’s stablecoin exchange reserves the past several days and not since Dec. 2023.