JUP, the governance token for decentralized exchange aggregator Jupiter, has extended its recent climb to reach a new price record to start the week, coinciding with the conclusion of a controversial governance vote to allocate 4.5 million JUP tokens to a four-person core working group.

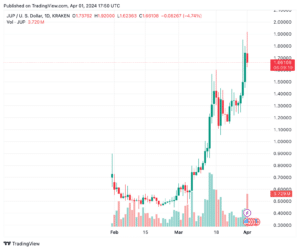

The price of the native token for the Solana-based aggregator has increased 7.6% in the past 24 hours and nearly 24% over the previous seven days to $1.66, a dip from earlier in the day when it was $1.92, a new all-time high, data from TradingView shows. The new token was airdropped about two months ago. Jupiter’s current market cap stands at $2.25 billion.

The price movement of the cryptocurrency comes as JUP stakers voted in favor of funding Jupiter’s first core working group (CWG), which will be composed of four key actors in the Solana ecosystem who go by the screen names C2yptic, Slorg, Kemosabe, and Durden.

“As the CWG concludes its 3-month introductory period, it presents a proposal for long-term operational funding and incentive alignment with the Jupiter ecosystem,” wrote the proposal’s author C2yptic, who is a former core team member of Marinade.Finance, a liquid staking protocol on Solana. The core working group aims “to steer the Jupiverse towards a new era of decentralized finance, not only for Jupiter but for the entire Solana ecosystem.”

The Funding Plan

The core working group has proposed a funding plan with two elements : a one-year $450,000 USDC budget for the four members, moderator compensation, and additional hires, as well as a controversial two-year 4.5 million JUP allocation plan “intended for long-term alignment and talent retention, according to the discussion forum.

The allocated JUP for the core working group, worth nearly $7.43 million, will first be unlocked after 12 months and will be completely unlocked in two years, around March 2026.

The governance vote, created on March 29, ended this afternoon at 12:03 p.m. ET, with 75% of the votes supporting the proposal, 19% against, and the remaining 6% abstaining.

Opposition to the JUP Allocation

While JUP stakers signaled support for the proposal with their votes, some in Jupiter’s forum discussion and on social media have been vocal in their disapproval of the 4.5 million JUP allocation to the core working group.

“Crypto distorts our perception of what things cost – we get used to seeing multi-billion dollars coins absolutely ripping and it makes us look at $5+ million and say ‘Yeah that’s not a lot.’ But it is. It’s a huge amount of money for a zero skill job… Voting millions to people for thinking about stuff and being involved in crypto is how we crash this project into the ground,” wrote one commenter in the forum discussion.

Another had reservations about the lack of clarity about the details of the JUP allocation. “From my perspective, this [4.5 million JUP allocation] seems somewhat excessive. The absence of defined Key Performance Indicators (KPIs) and unclear accounting of the time commitment by the members raise questions.”

One user on X indicated that the core working group’s “highest deliverables will not bring back more than 4.5M$ to the DAO,” going as far to say, “This is what I call — egregious attempted robbery via salaries as usual in crypto.”