August 18, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

- Bitpanda announced a $263M funding round valuing the crypto broker at $4.1B.

- Galaxy Digital filed for a bitcoin futures ETF with the SEC.

- CertiK raised $24M in new funding — just one month after its Series B.

- SuperRare introduced $RARE and is airdropping 15% of the token supply to previous users.

- 1inch, a DEX aggregator (and disclosure: a previous sponsor of my shows), is expanding to Optimism, an Ethereum layer 2 solution.

- Representatives Tom Emmer and Darren Soto will soon reintroduce the Blockchain Regulatory Certainty Act, which hopes to provide a safe harbor for blockchain firms.

- BinanceUS is hiring its CFO as interim CEO in the wake of Brian Brooks’s abrupt departure.

- The Dogecoin foundation has been re-established, with Vitalik Buterin joining the team as an advisor.

- Galaxy Digital lost $175M in Q2 2021.

- BitDAO raked in $365M from its governance token sale yesterday.

What Do You Meme?

What’s Poppin’?

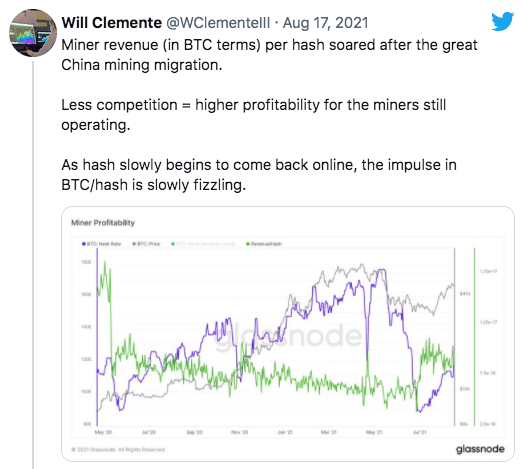

Bitcoin miner revenue appears to be on the rise. After bottoming out at $13 million on June 27th, Bitcoin miner revenue hit $50M for the first time since mid-May this weekend.

The jump in Bitcoin miner revenue comes two months after a “crack down” from the Chinese government that led to the majority of the country’s miners going offline. As a result, Bitcoin’s hashrate, a measure of the computing power protecting the network, dropped by more than 50%.

According to Blockware’s Will Clemente, the drop in hash power has resulted in “less competition” for BTC rewards, leading to “higher profitability for the miners still operating.”

With miner revenue booming, it should come as no surprise that mining companies are reporting large Q2 revenue jumps. For example, Bitfarms, a Canadian mining company, announced its sales jumped 396% when comparing Q2 2020 to Q2 2021. Marathon Digital also had an impressive second quarter, bringing in $29.3M in revenue — a 220% increase compared to Q1.

Recommended Reads

- a16z’s Chris Dixon on why blockchains are the new app stores:

- @RealNatashaChe on ETH and government bonds:

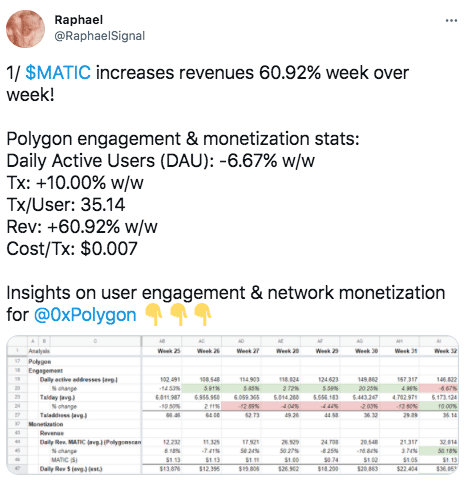

- @RaphaelSignal on Polygon engagement and monetization:

On The Pod…

On-Chain Analytics Show ETH Accumulation Is Greater Than That of BTC

NFTs are the talk of the metaverse, EIP 1559 just went live, and DeFi stats are rebounding. On Unchained, Fredrik Haga, cofounder and CEO at Dune Analytics, along with Richard Chen, general partner at 1confirmation, discuss the booming Ethereum ecosystem through the lens of on-chain data, diving into NFTs, DeFi, ETH, and their favorite layer 2s. Show highlights:

- why Ethereum is on such a pronounced upswing

- why on-chain metrics lead to superior information reporting

- mind-blowing OpenSea statistics

- why NFTs are so hot at the moment

- how Richard explains NFTs to normies

- whether the NFT market is sustainable

- what makes an NFT drop pop and why profile pics (PFPs) matter

- how Polygon NFTs compare to Ethereum NFTs

- the main driving force behind DeFi usage

- how Richard measures the total amount of DeFi users

- what brings new users into DeFi

- what DEX trends Fredrik is keeping his eye on

- why structured products are crucial to DeFi’s continued success

- how Ethereum is doing since the London hard fork

- why NFT drops are like 2017 ICOs

- what metric shows ETH adoption outpacing BTC adoption among institutions

- which layer 2 solutions are Fredrik and Richard excited about

- why Richard considers Binance Smart Chain a centralized blockchain

- why Fredrik likes what Solana is building

- Richard and Fredrik’s predictions for the NFTs, DeFi, and ETH going forward

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians