September 26, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- Interpol issued a red notice for Do Kwon, according to Korean prosecutors.

- Two Celsius investors filed a motion to establish a committee to advocate for them in the bankruptcy case.

- Harmony announced an update on the recovery plan for the $100 million Horizon Bridge attack and said the goal is not to mint any tokens.

- SudoAMM, a royalty-free NFT trading platform, reached over $50 million in total trading volume two months after launch.

- NFT marketplace OpenSea announced that it would automatically index and list Solana-based NFT collections.

- The CFO of bankrupt crypto lender Voyager Digital resigned to pursue other opportunities.

- Veritaseum Capital sued Coinbase over a patent infringement.

Today in Crypto Adoption…

- Singapore banking giant DBS introduced a crypto trading product for wealthy clients.

The $$$ Corner…

- Bitcoin miner Iris Energy agreed on a $100 million equity purchase deal with investment banking firm B. Riley.

- Hadean, a metaverse infrastructure builder, closed a $30 million Series A funding round.

- Coinsquare, a Canadian digital asset firm, signed a deal to acquire CoinSmart, merging the two trading platforms.

- Cipher Mining, a BTC mining company, wants to sell $250 million worth of stock.

- Kwil, a decentralized database infrastructure provider, raised $9.6 million in a funding round backed by FTX Ventures and DCG.

What Do You Meme?

What’s Poppin’?

CFTC Files Lawsuit Against a Decentralized Autonomous Organization

The Commodity Futures Trading Commission (CFTC) filed charges against a DAO, sparking a firestorm of criticism from the crypto community – and a CFTC commissioner.

The CFTC imposed a $250,000 fine on bZeroX LLC founders Tom Bean and Kyle Kistner for allegedly “illegally offering leveraged and margined retail commodity transactions in digital assets,” as well as failing to follow KYC rules. Bean and Kistner settled the charges that were presented against them. bZeroX LLC founded a decentralized finance protocol for margin trading, borrowing, lending and staking with the same name.

In the same filing, the regulatory agency also revealed charges against Ooki DAO, which now manages the bZx protocol. The CFTC is seeking civil monetary penalties, potential trading and registration bans, and disgorgement.

“The order finds the DAO was an unincorporated association of which Bean and Kistner were actively participating members and liable for the Ooki DAO’s violations of the CEA (Commodity Exchange Act) and CFTC regulations,” wrote the Commission.

This move from the CFTC is unprecedented. It appears that, as it is suing the DAO, it’s suing all Ooki DAO token holders. The Commission refers to the DAO as an “unincorporated association,” which is a vehicle to coordinate group efforts.

The key thing here is that the liability associated with an unincorporated association can be attached to any individual of that group. Therefore, it means that any token holder can be liable for the charges the agency is presenting.

“This is a horrible precedent. It means that both on-chain governance voters AND multi-sig signers have liability, but on-chain governance spreads liability to many more people,” said Will Papper, cofounder of Syndicate DAO.

CFTC Commissioner Summer Mersinger published a dissenting statement and called the agency’s action “blatant regulation by enforcement.” She wrote, “I cannot agree with the Commission’s approach of determining liability for DAO token holders based on their participation in governance voting for a number of reasons.”

“The CFTC’s bZx enforcement action may be the most egregious example of regulation by enforcement in the history of crypto,” said Jake Chervinsky on Twitter.

The majority of the crypto community has long believed that the CFTC should be the main regulator of the industry rather than the SEC. However, this latest act by the CFTC indicates that crypto and the agency don’t always see eye to eye.

Recommended Reads

- Kaili Wang on reversible transactions

- Cevo on Kujira

- Aidan Ryan on Apple and NFTs

On The Pod…

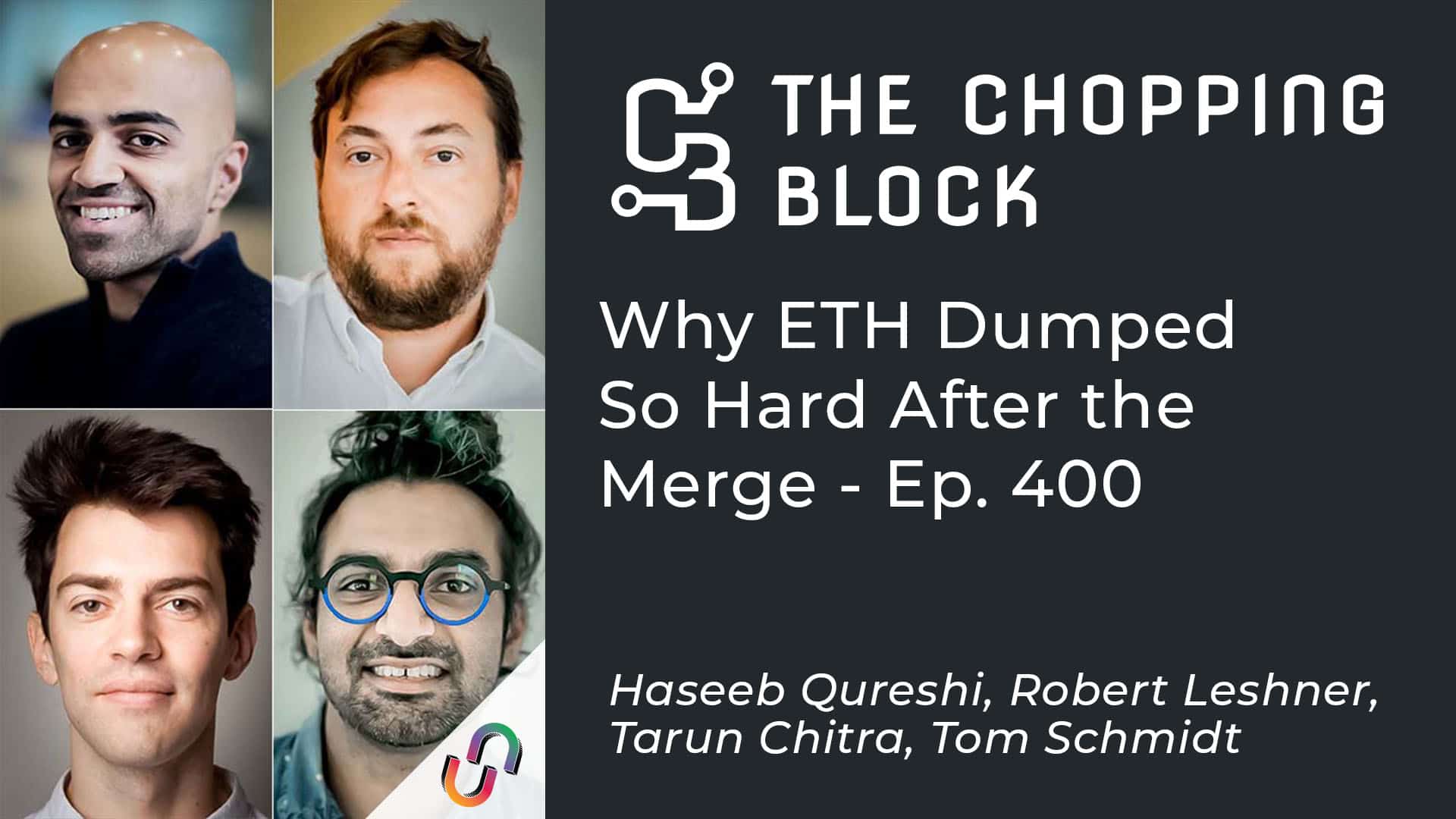

Welcome to The Chopping Block! Crypto insiders Haseeb Qureshi, Robert Leshner, Tom Schmidt, and Tarun Chitra chop it up about the latest news in the digital asset industry. Show topics:

- Why the ETH price slumped after the Merge even though it was successful

- Whether the BTC security model is flawed and why Robert thinks Bitcoin will change

- Why Tarun thinks Bitcoin won’t change and why he’s bearish on Bitcoin development

- Whether the Lightning Network can succeed with so many competitors getting better more quickly

- ETHPoW’s performance after the Merge, whether it’s dead and why Robert wouldn’t rule out the PoW fork

- Why Haseeb thinks the criminalization of the collapse of Terra is a bad precedent

- The broader impacts of the Terra meltdown and whether Do Kwon not disclosing the fact that he had been involved with Basis Cash, which failed, is problematic

- The House’s draft bill on stablecoins and whether it is necessary to study algo stablecoins

- What happened with the Wintermute hack

- Why Tarun thinks the Wintermute team is incompetent

- Whether there is any positive news in crypto lately

- Who would be a better pick for deploying treasury funds between Three Arrows Capital and Wintermute

- What Haseeb, Tom, Robert and Tarun are excited about

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians