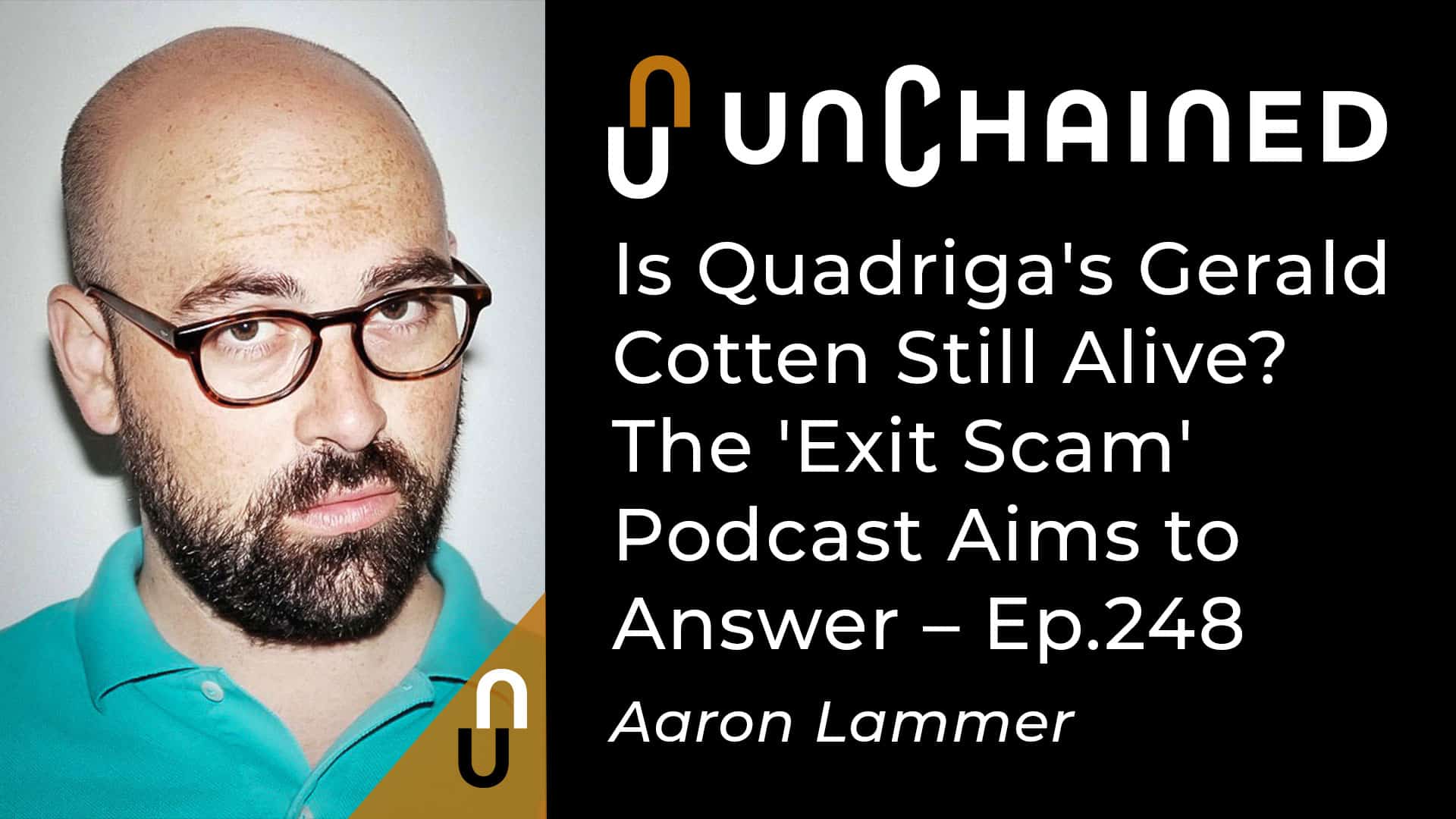

Aaron Lammer, author and host of the Exit Scam podcast, recounts the mysterious and controversial death of QuadrigaCX’s founder Gerald Cotton. Show highlights:

- A quick recap of QuadrigaCX

- why Aaron felt compelled to create a series on QuadrigaCX

- how Gerald Cotton, a lifelong Ponzi-addict, came to be the CEO of Canada’s largest crypto exchange

- what Ponzi-schemes Gerald ran before starting Quadriga CX

- why customers trusted QuadrigaCX and what red flags were readily apparent looking back

- the sketchy tactic Gerald used to single-handedly boosted QuadrigaCX’s trading volume by 30%

- a new wife, empty wallets, a hastily written will, and the circumstances surrounding Gerald’s shocking death

- how Gerald’s dark web background might have prepared him to fake his own death

- what the chances are that Canadian authorities exhume Gerald’s body

- why Aaron is skeptical Gerald’s widow was “in” on the QuadrigaCX fiasco

Thank you to our sponsors!

Crypto.com: https://crypto.onelink.me/J9Lg/unchainedcardearnfeb2

Conjure: https://conjure.finance

Episode Links

Aaron Lammer

- Co-founder of Longform.org + co-host of Longform Podcast (2010+)

- Treats Media — podcast platform (2018+)

- Exit Scam

- CoinTalk: https://medium.com/s/cointalk

Podcast

Twitter: https://twitter.com/exitscampod

Episodes:

- The Lost Password

- The Co-Founder

- The Ponzi Schemer

- The Chris Markay Account

- The Old Friend

- The Coffin

Quadriga

Deep Dives:

- CBC News

- Vanity Fair

- Amy Castor timeline

- Ontario Securities Commission

Details

- Ontario Securities Commission deems Quadriga an “old fashioned fraud” + “Ponzi”

- Crypto officially recognized as property in Canada due to this case

- Fun Reddit stuff

- Is a Gerald Cotten alive? — a poll:

- Graphic connecting Michael Patryn to Omar Dhanani

- Lawyers publicly request that RCMP exhume Gerald Cotten’s body

- Report on Gerald Cotten transferring funds into a personal account

Show Transcript

Laura Shin:

Hi, everyone. Welcome to Unchained, your no hype resource for all things crypto. I’m your host, Laura Shin, a journalist with over two decades of experience. I started covering crypto six years ago and as a senior editor at Forbes, was the first mainstream media reporter to cover cryptocurrency full-time. This is the June 22nd episode of Unchained.

Crypto.com:

The Crypto.com App lets you buy, earn and spend crypto, all in one place! Earn up to 8.5% interest on your Bitcoin and 14% interest on your stablecoins – paid weekly! Download the Crypto.com App and get $25 with the code “LAURA” – link is in the description.

Tezos:

Tezos is smart money that is redefining what it means to hold and exchange value in a digitally connected world. Discover how people are reimagining world around you on Tezos!

Conjure

Conjure brings any asset you want onto Ethereum by allowing for users to create synthetic assets which track other markets. With 0 interest loans and unlimited assets, it’s helping defi to consume tradfi. That’s conjure.finance, so check it out!

Laura Shin:

Today’s guest is Aaron Lammer, the host and producer of the podcast series, Exit Scam, which is all about QuadrigaCX. Welcome Aaron.

Aaron Lammer:

Hi, glad to be here. I’m a listener.

Laura Shin:

Thanks for listening. So Exit Scam is this pretty amazing podcast series that you’ve put out. Why don’t you give us a short synopsis of what it’s all about?

Aaron Lammer:

I think people who are religious listeners to the show will have heard about QuadrigaCX before. I think your piece with Taylor Monahan has to have been one of the first big podcast things about QuadrigaCX.

So for a little recap, QuadrigaCX was a Canadian Bitcoin exchange. It was the largest Bitcoin exchange in Canada. It collapsed in early 2019 after the founder, Gerald Cotten, died in India. His death was somewhat mysterious to begin with and got even more mysterious when it was revealed that he had not left behind the passwords to unlock Quadriga’s cold storage wallets. Then it got even more mysterious when some blockchain forensics people, like Taylor Monahan, actually revealed that not only were these cold storage wallets locked, they were empty and had been so for some time.

So what we really did with the show was try to solve two mysteries: what really happened to Gerald Cotten, the founder, and what happened to all of that money that was missing.

Laura Shin:

So before we dive into all the various rabbit holes that you went down to try to solve these questions, why don’t you tell us a little bit about your background? What were you doing before? How did you come to do this podcast series, et cetera?

Aaron Lammer:

So I’m one of the founders of longform.org, which is a journalism aggregator. For old people who were on the internet 10 years ago, you may remember when it was difficult to find reading material on your phone. So we were kind of trying to fill that niche. Through Longform, I ended up starting to do the Longform podcast, which is how I got into podcasting.

Laura Shin:

By the way, that is is one of my favorite podcasts for listeners. If any of you are media people, you should definitely check it out.

Aaron Lammer:

For the four people who listen to the show who don’t hate journalism, it’s a great resource. And through that, I got really into podcasting. I always like doing podcasts about my own interests. I’m not like the kind of person who can just get assigned something. I kind of have to be into it myself. I got really into crypto in 2017 is I guess when I started getting into crypto. Part of my way of getting into things is to shill them to other people. And I started shilling crypto to my friend, Jay Kang, who I knew was kind of vulnerable to it cause he’s a poker player and kind of a gambler and that’s always a good person to show crypto to.

So I got him really into it, and we did this show called CoinTalk, which I guess ran for about a year, a year and a half, basically until Jay had to start writing his book.

That show was about crypto, but not the most serious show about crypto. I would say we kind of went into it knowing not very much, got a lot of things wrong. Tried to learn as we go. We kind of tried to take an experiential approach to crypto. So like we were doing things like I had a market on Augur when Augur was first out about whether Donald Trump p tapes would come out. We were just kind of like doing all sorts of fun things you could do.

And pretty much the thing that grabbed me the most over and over and crypto were the charlatans, the scammers, the people who did really outlandish wild west stuff in crypto. And I know that a lot of crypto kind of wants to sweep those people under the rug and say they don’t exist, or they’re a few bad apples that don’t represent the whole space. For me, that’s the stuff that really kind of interests me.

I don’t know if I’m an immoral person or what, but I’ve always been fascinated by that stuff. And basically when QuadrigaCX happened, we were still doing the show. I was like, there’s just never going to be a story that tops this. As a connoisseur of the crypto scam, this one is just on the Mount Rushmore of crypto scams. Not because of its scale. There’s been bigger exit scams, even Mt. Gox was bigger, but simply the audacity of the whole thing and how many different competing mysteries that were all kind of circling around this one person, who honestly, people didn’t know that much about.

A lot of these founders have been on your show. They are people who are out and about and kind of promoting themselves. Gerald Cotten wasn’t really like that. He was kind of an enigma. When we started looking into him, there was only a couple of pieces of audio of him talking. A few videos on YouTube. He was really like a kind of ghost as a figure, which made it difficult to figure out much about what really happened to him.

Laura Shin:

So tell us a little bit more about him. What his life was like and and what his lifestyle was like before he died.

Aaron Lammer:

So he was living the high life. He was a big international traveler. Private jets all around the worlds. There are some insinuations that on a lot of those private jets, he was carrying large amounts of cash and that his trips may not have been purely tourism, but involved moving money around the world. I have some theories about that.

Laura Shin:

When you say that, who are your sources?

Aaron Lammer:

The source is one of the guys who was part of the flight center where he would fly. He was into flying private planes. People who saw him, including this guy in private airport, said, yeah, he would often have a duffel bag full of money. I have a photograph of $1 million of cash on his counter. I can tell you definitively where that cash came from and how it came to be on his counter.

So he had these deals with ATM operators in which he would trade them Bitcoin for cash, and they would show up to his house or to a private airport with a large sum of cash. The stuff I’m describing, isn’t even contentious. This is in the Ontario Securities Commission’s report. In fact, that photograph is in the Ontario Securities Commission’s report.

But going back further, and this was something I was actually really kind of excited to talk about on the show. Gerald had roots in the pre-Bitcoin digital currency world. Another thing that crypto people like to sweep under the rug, but there is a fascinating history of these centralized pre-Bitcoin digital currencies. Liberty Reserve is probably the most famous one. Eagle before that. And the way that Gerald got involved in those was he was running Ponzi schemes as a teenager.

You couldn’t buy into those Ponzi schemes with PayPal. You needed to use these digital currencies to buy-in. At some point, he jumped from scamming people using these digital currencies to being an exchanger himself. He started an exchange called Midas Gold that was run by his future Quadriga co-founder Michael Patyrn — at that point, I believe using a different name. And they ran the Liberty Reserve exchange.

And you can see these interviews with Gerald Cotten where he says, I have 10 years experience in the digital currency space. And this is when Bitcoin is only five or six years old. So if you were reading between the lines and you knew enough about the real history of this stuff, you would know that he was involved in it before Bitcoin, which gave him this interesting leg up on anyone who wanted to start an exchange.

There was all of these guys at Bitcoin meetups who could talk a big game, but they hadn’t really done what it takes to run an exchange, which is a very bizarre, specific skillset. He started off in that world and successfully transitioned into Bitcoin exchanging. The stuff he was exposed to in those days is some pretty dark, criminal stuff. That’s kind of what was going on on Liberty Reserve. A lot of money laundering. Cartels were involved. A lot of scamming, I would say scamming is the dominant theme in all of his history.

Laura Shin:

And when you say that how, how do you know it’s a scam? What was he doing exactly?

Aaron Lammer:

So he was involved in these things called high yield investment programs. There was a very popular forum called PotGold that they were operated on. And that’s where he met most of his friends. That’s where he met the future founder of QuadrigaCX. You can actually go back on this forum via Wayback machine and see them interacting with each other when Gerald is 15 years old and his co-founder Mike is 19 or 20. And so he was operating these high yield investment programs, which accepted E-gold to buy-in. The way that these high-yield investment programs operated, it may be familiar to some people who are kind of gambling on algorithmic stable coins. Basically people would buy in and the first people would get paid out fairly outrageous returns. And then the thing would collapse and the person operating it anonymously would disappear.

And this is something Gerry did many, many times as a teenager. And we know that people who knew him were kind of weirded out. They asked, where is he getting all this money? Well, now we know where he was getting that money. He was running these high-yield investment programs, which I would just refer to as Ponzi schemes. They were very low level internet Ponzi schemes in which I would argue are much like algorithmic stable coins. A lot of the people who are buying in are kind of aware that they’re involved in something sketchy that’s probably eventually going to collapse. And the gambling part is whether you get out before the whole thing collapses. Gerry, at some point, jumped from running those schemes to realizing you could probably make more money selling the digital currency that that was going into these schemes and got into exchanging.

And it’s a really interesting period. In some of my research, there are forum posts by Satoshi Nakamoto in which he talks about Liberty Reserve and proposes a Liberty Reserve Bitcoin trading pair. This is before there would have been any fiat on-ramps into Bitcoin. Liberty Reserve was considered kind of as like maybe we can use it as our Tether, basically, as we’re getting Bitcoin off the ground. Now I have no indication that there actually ever was Bitcoin Liberty Reserve trading. Liberty Reserve shut down in 2013. It actually ended up being kind of the last gasp of centralized digital currencies before Bitcoin came onto the scene.

Laura Shin:

So here we have this larger than life character with this sketchy background, although all this comes out later, this was not known at the time. Tell us a little bit about Quadriga’s story and status at the time of his supposed a death.

Aaron Lammer:

So QuadrigaCX had become the biggest Bitcoin exchange in Canada kind of by accident. I think Cavirtex was previously the biggest exchange in Canada and Cavirtex shut down. And there’s kind of different stories about exactly why Cavirtex shut down. It was hacked, they lost money. And then I believe it was also absorbed into Kraken in some way. Is that right? Do you remember that history?

Laura Shin:

I did read that when I was doing research for this show, but I don’t know the details.

Aaron Lammer:

So QuadrigaCX shot up and became the number one Bitcoin exchange in Canada. And when you talk to a lot of people about why they trusted QuadrigaCX, they’ll cite that it was the biggest Bitcoin exchange in Canada. There’s a lot of circular logic like this in crypto. Another reason why people will say why they trusted it, is that it was run by a Canadian guy and people in Canada liked trusting their money to a fellow Canadian. So Gerald had all of these things working for him in that way. But beyond that, there was really very little known about QuadrigaCX. We know now that it was based on white label software called WLOX, that was originally developed by Crypto Capital, which is another scandal.

Laura Shin:

For listeners who may not recall: that was the company that Tether made the loan to, and didn’t get its money back at I forget the amount, but it was a huge amount, $860 million or something. I don’t remember. Or maybe that was what they had after. So I don’t know the amount, but they had a huge amount of that got tied up with Crypto Capital and that’s how Tether’s reserves ended up being less than what they should have been.

Aaron Lammer:

We couldn’t even get into this in the show because we had so much we needed to get into about Gerald Cotten, but there’s a whole nother story about the payment processors that Quadriga was using. Many of whom froze money and had large sums of QuadrigaCX money at the time it shut down. And Crypto Capital is definitely part of that story. But also they made this white-label exchange software. So in retrospect, it looks kind of like a very small team of people used white-label software to put up an exchange that people perceived to be a legit, big-time exchange. But once you sort of peeled the back that layer of reality, you pretty much realized it was just Gerald Cotten pretty much running it by himself with a couple, maybe like a team of like two or three people who were really involved. And then he had hired some like customer service reps, but these were people who had never met him, who were just responding to support tickets basically. In terms of like power and access to the money, it was pretty much just Gerald Cotten.

Laura Shin:

And so earlier you talked about how one of the mysteries is what happened to the money. So once he died, kind of fill us in from that moment until the discovery that most of the money was gone.

Aaron Lammer:

So the missing sum or the sum that customers had on the exchange at the time it shut down was about $250 million Canadian. And that was a combination of Bitcoin, ether, Canadian dollars, which they call Quad Bucks, in the QuadrigaCX system, and maybe a little bit of some other altcoins that were traded. But it was primarily those three things.

In terms of the Quad Bucks, it was very difficult to know where they were because there was no information about where Gerry had had bank accounts, even. So that mystery, it was kind of like, whoa, we don’t know anything here. In terms of the Bitcoin and Ethereum, they should have been in a wallet somewhere that someone could pretty easily find. And it turned out that people who ran other exchanges or wallets kind of have a good insight into that because they had interacted with Quadriga wallets. And so they were able to pretty quickly discern what might be QuadrigaCX cold storage wallets. By hopping from wallet to wallet, people were able to sort of map out some of the major Quadriga wallets. And very early, like, honestly, if you look on Reddit, it does not take people very long. Now, those people didn’t know for sure, but people had the suspicion very early that there was no money in these wallets. And in fact, that those wallets had been emptied out more than six months before Gerald Cotten took this honeymoon trip to India that he died on. Immediately, there was another mystery, which was why had these wallets been cleaned out six months earlier? And where was that money now? Depending on how much we want a spoiler it, I can get into a little bit more where that money ended up. But early on, it was just kind of, well, it’s not here. It’s not anywhere we can see.

Laura Shin:

So my feeling about this is that probably most of my audience knows this story. So I do feel that for anybody who has not listened to Exit Scam, that you should stop the recording and then binge-listen to all the episodes, which by the time this comes out, they’ll all be out on Audacy, which is a new app that I guess Exit Scam has partnered with.

Aaron Lammer:

The last episode comes out on Monday on Audacy. And then a week from Monday. If you start bingeing now you’re going to be timed perfectly to just go right into the ending.

Laura Shin:

Then you can come back and listen to the rest of the show, but I do actually want to get into those details because I do feel like probably most of my audience has been following this for a while. I mean, one thing that I will have to say, when you talk about how quick on Reddit people jump to notice that the cold storage wallet seemed to have been emptied. I remember that that day, one of my sources texted me about this. And I really think — I should look back at what the message actually says — within like a very brief period, like an hour or something, he was just like there’s something fishy here.

And yeah, I’ll have to look at exactly what that says, but it’s just fascinating how right away, everybody kind of picked up that there was something wrong. And so what were the other like hints at that time that this may not just be a normal person who randomly died by accident?

Aaron Lammer:

Well, this was an interesting thing when I started talking to people. People at first were like, oh, this came out of left field. We had no idea. And then I started talking to some people who are a little bit better plugged in in crypto. And people said, well, actually people had been warning me for several months that I ought to get my coins off of QuadrigaCX. So this was not a total secret that something was wrong at QuadrigaCX. And in fact, if you go back through the Reddit history, you can see people saying, I can’t withdraw from QuadrigaCX. I put in the withdrawal requests two months ago, it hasn’t been paid out, and I’m getting no response. This is difficult to parse because I want to be fair. You can find similar complaints that the Coinbase subreddit, and Coinbase wasn’t on the verge of collapse.

But looking backwards, you start to see a pattern where basically they stopped paying out withdrawals. They’re still taking in money, but they’re not putting out any money. And this pattern actually extended for the month after Gerald Cotten died. So after he died, QuadrigaCX waited a month to announce his death. During this month, people were still putting dollars basically into the system, but anyone who tried to withdraw their money wouldn’t be able to. So you had people putting in money to buy Bitcoin, trying to immediately withdraw Bitcoin, and having it frozen on the exchange. I put a kind of an asterisk when people are like, well, dumbasses like leaving their money on exchange. Like they got what they deserved. Some of these people had no intention to leave their money on the exchange. They simply didn’t realize that they were putting money into a slot machine that had already had the power plug pulled from it.

And that’s even true before Gerald Cotten died. People who thought that they could be on the exchange just to make a trade were unable to get the money off. Finally they announced that he is dead, and then people kind of rewind through the last year and see a lot of red flags. A lot of indication that QuadrigaCX didn’t have the money to payout its withdrawals and that some of Gerald Cotten’s actions kind of look like a person who was maybe at the end of some kind of a scheme. He had told his head of customer service that he wanted to retire and give the business over to him. There’s just various indications that he didn’t see himself being the person running this exchange for the long run, which is generally a big red flag with an exchange. You don’t want to be at an exchange that the person running it is planning to take off sometime soon.

Laura Shin:

Yeah. Well, especially now. I think people will be on the lookout for that. So we briefly did cover his co-founder Michael Patryn, but why don’t you just explain what happened to the relationship? Just so it’s clear why at this point it was really just about Gerry.

Aaron Lammer:

Michael Patryn and Gerry started QuadrigaCX together. Michael Patryn is a little older than Gerry. And I think he kind of represented himself as the veteran businessman and Gerry as the young wonder kid. They actually intended, at one point, to take QuadrigaCX public. They were going to do, it’s not actually an IPO, it’s sort of a reverse takeover where they would get a shell. Anyway, in retrospect, that seems totally nuts. I mean, I think their revenue at the time was like $22,000 a quarter or something like that. The plan for whatever reason failed. And they had a big fight after this. From what I understand, the fight may have been about Gerry sort of sabotaging the going public idea. But there’s some dissent about that, about exactly what they were fighting about, but both of them agreed that they had a big fight and that Mike quit the company and left.

The whole board actually took off too. Mike had kind of installed his own board there. So from that point forward, for the last two or three years of QuadrigaCX, it was basically just Gerry. And that was kind of the last point there was anyone else looking at what was going on. And from that point forward, you pretty much see Gerry starting to leach money and crypto off of the exchange, either into his own pocket or on to other exchanges where he started getting involved in margin trading shitcoins and stuff like that.

Laura Shin:

Tell us about the Chris Markay account.

Aaron Lammer:

So one of the big mysteries had been sort of how Gerry managed to get all this money off of the exchange without being detected. And it turned out that he was creating these fake user accounts in the QuadrigaCX system. One of the great dangers about crypto is that you’ve got this real system, which is the blockchain that’s immutable. If you see a coin on the blockchain, you know it’s real and you know someone really possesses it. And then you have this Quad Bucks system that only existed in the CMS of QuadrigaCX. It’s just a number, right? It doesn’t literally represent a dollar in the bank account. Wow. I didn’t realize that this whole thing would have so many Tether-ish undertones to it, but I’m not talking about Tether right now, I’m talking about Quadriga. So in the case of QuadrigaCX $1 in the QuadrigaCX CMS could have any relationship to $1 in a bank account.

So what Gerald started doing was crediting these fake user accounts with large numbers of Quad Bucks. I think Chris Markay was ultimately credited over $500 million worth of Quad Bucks. And then he would use these Quad Bucks, which were backed by nothing and were totally fictional like Chris Markay, which was the name on these accounts, to buy up real cryptocurrency that was held by people on the exchange. And he didn’t do this selectively. He did this industrially. He was the largest trader on QuadrigaCX. By some estimates he did over 30% of the overall trading. So this actually had a dual benefit to him. Not only was he getting people’s real crypto with fake dollars, he was also boosting the volume of QuadrigaCX. So early on, when QuadrigaCX would claim that they had the most volume of any exchange in Canada, you have to remember that 30% of that volume is the founder trading against his own clients.

Another thing people saw then was that there was often a premium on the price of Bitcoin on QuadrigaCX. People would pay more for Bitcoin on QuadrigaCX. And this is something that people were lured into Quadriga. International customers would see this arbitrage opportunity on QuadrigaCX.

So why was the price of Bitcoin higher on QuadrigaCX? Because there was always a guy who always had money to buy your Bitcoin for more and more. And his name was Chris Markay. Chris Markay was driving a localized Kimchi Premium. It was not as extreme of a spread as the Kimchi Premium, but you don’t need a huge spread to draw new clients in. If the spread is 1% higher on Quadriga, that’s a great incentive if you’re anywhere in the world and want to go sell Bitcoin. And in fact, one of the biggest internet detectives on this case, that’s how he ended up having money on Quadriga. He’s not Canadian, he’s a trader who was seeking out arbitrage opportunities. And that was how he ended up having money on QuadrigaCX. So ironically, some of the biggest volume accounts on Quadriga weren’t actually Canadians, they were people who wanted to take advantage of this guy who just loved buying everyone’s crypto all the time.

Laura Shin:

Okay. That makes a lot of sense because when I was listening to the shows, he sounds Australian.

Aaron Lammer:

He’s Australian. I probably should have explained that. But it was like a weird, I was like, I don’t want to dox you, but you’re pretty obviously Australian. And if we use your voice…

Laura Shin:

Well, you know, I mean, he could have immigrated to Canada or whatever, but anyway. Okay. All right. So in a moment, we’re going to talk about Gerald Cotten’s death, and I’m going to use air quotes here. Or maybe it should be a question mark. But first, a quick word from the sponsors who make this show possible.

Crypto.com:

With over 10 Million users, Crypto.com is the easiest place to buy and sell over 90 cryptocurrencies. Download the Crypto.com App now and get $25 with the code: “LAURA.” If you’re a Hodler, Crypto.com Earn pays industry-leading interest rates on over 30 coins, including Bitcoin, at up to 8.5% interest and up to 14% interest on your stablecoins. When it’s time to spend your crypto, nothing beats the Crypto.com Visa Card, which pays you up to 8% back instantly and gives you a 100% rebate for your Netflix, Spotify, and Amazon Prime subscriptions. There are no annual or monthly fees to worry about! Download the Crypto.com App and get $25 when using the code “LAURA” – link is in the description.

Tezos:

Tezos lets you easily exchange smart money throughout our digital world. A self-upgradeable blockchain with a proven track record, Tezos seamlessly adopts tomorrow’s innovations without disruptions today. Because of this adaptability, engineers, conservationists, entrepreneurs, collectors, game develeopers, and artists from around the world are building, creating, and using Tezos everyday. Discover how people are reimagining the world around you on Tezos.

Conjure

Do you want to trade gold, currencies or even bananas on Ethereum?

Conjure opens access to the global financial market for Ethereum by allowing for permissionless, user created Synthetic Assets. Conjure allows you to create, borrow and trade synthetic assets which track the value for any conceivable asset, real or abstract using any price feed you want.

Asset creators are able to earn fees on every mint, and scale revenue with direct use for their assets. Synths are minted by providing Ether to collateralize the asset as %0 interest loans.

Conjures helping to bring tradfi to defi and turn Ethereum into the real global financial settlement layer.

Trade Synths for USD, gold, BTC or make your own! Check it out at conjure.finance.

Laura Shin:

Back to my conversation with Aaron Lammer. So tell us the circumstances surrounding Gerald Cotten’s death.

Aaron Lammer:

So in the last few months of his life, he got married, signed a new will that left everything to his new wife, and they took a honeymoon trip to India. It was actually a dual honeymoon trip. They had donated money to have this orphanage built in an Indian village. So the trip was supposed to take them around India for a period, and then they were supposed to go to the grand opening of this orphanage. Before they got there, he landed in Jaipur and he started having stomach pains. He had Crohn’s disease and was being treated for it. They decided it was serious enough that he needed to go to the hospital. And he spent the night at the hospital and died the next day. And that was basically going in, everything we knew about his death — was that it was this sort of sudden tragedy in India.

Laura Shin:

And so tell us some of the other facts that came up that led people to question whether or not he actually died.

Aaron Lammer:

I think the will was one of the first suspicious things. That it was filled out only three days before he took off. And that it meant that his wife, who had only been married to for a few months, was going to inherit over $10 million worth of real estate in Canada. That alone, I think, would have set off a fair amount of suspicion. The fact that those cold storage wallets were empty, really ramped up the suspicion. And there was certainly the question of whether someone could have faked there death in India. There is a real industry in India that helps Westerners fake their deaths. Most of those people are doing insurance fraud. It’s for different ends than Gerry would have, but the apparatus was there. And realizing that Gerry had these dark web connections and had been involved in this kind of shady money-laundering underworld stuff.

At least, for me, convinced me that if he had wanted to fake his death, he would have had the right toolset to do so. That doesn’t mean he did. Early on, we didn’t have much to go on. If he did fake his death, no one had figured out where he went. We knew that there was this large sum of money missing from QuadrigaCX and that was also a relevant piece of evidence was, well, if he really is dead, then where is all this money? Where did all the money go?. Even if you accepted that he had died a natural death, you had to account for something like $80 million that was still unaccounted for. So all of those factors, I think, made people suspicious that he was really dead. It seemed like too great a coincidence.

Laura Shin:

There were a few other details where — I can’t remember who —but there was somebody in India who was asked to embalm the body and she refused for some reason. Can you explain that?

Aaron Lammer:

What we know about what happened in India is really just from going and asking each person along the way who encountered Gerry’s body. The person who was first asked to embalm his body. His body had been brought there by two employees of the hotel that he and his wife had been staying at. She felt like this was a non-standard way that a body would come to her embalming center. I think it’s actually a college. And so she refused to embalm the body. She gave, you know, you can hear the explanation she gave for it. And then it went to a different embalmer and that embalmer gladly embalmed the body and sent it on.

I don’t think that this is definitive proof that something sketchy happened. But basically we wanted to know whether any of this stuff looked unusual from the perspective of people in India who were actually there when it actually happened. And this is kind of the first wrinkle in that story where someone says, no, actually it was kind of nonstandard what happened. It did raise my suspicion at the time. I will say that a counterpoint is that the person who was the second person who did successfully embalm him, had a copy of his passport there. When someone went and checked and confirmed, yes, I am embalmed him and he was the guy, he looked like the person.

Laura Shin:

Cause there was something in the description where I was like, oh, it would be so useful if bodies were like blockchain based tokens where you could check the provenance. There was something about the chain of transfer, where it did raise questions about whose body was actually being moved.

So one of the more intriguing episodes or interviews you did was with this person who investigates people who fake their own deaths. And I wondered, what were some of the other things that he picked up on that kind of lent credence to the theory that Gerald Cotten could have faked his own death?

Aaron Lammer:

One thing that people have said is when there’s this much money at stake, you want a body or you want DNA. And we looked very closely to try to show that anyone had confirmed that this was the right body and the right coffin. Originally we thought they would’ve checked it at the airport or when it was coming through customs. And we talked to Canadian authorities who said, well, actually, if there’s no suspicion of foul play or anything unusual, if it’s just a tourist coming back, there’s nothing in the law that says, we’re going to force you to open this coffin and take a fingerprint or a DNA test.

So we were able to find no proof that such a thing had actually happened. For Steven Rambam, who’s the death faking PI, his tact is that you should just sort of be suspicious of everything and that until someone has proven any of this stuff, it merits further investigation.

Certainly in his case, he’s seen situations where people confirm the death, whether it’s local police or medical staff, and this isn’t just in India, this is all over the world. The Philippines is a place this happens a lot. He talked about a case in Mongolia.

Some of the things that are these basic checks that to me are like his doctor, his doctor couldn’t be lying. When your talking to a guy who’s an expert in this stuff, he’ll say no, no, his doctor could be lying — that he’s actually dealt with a lot of cases where this stuff has come up. One of the things that was very relevant to him was Gerry’s past as a scammer and the fact he had an organized life history of these kinds of deceptions. They follow a pattern. He gets a bunch of people to give him money. He makes excuses and then he disappears and this fit into that pattern. So it’s a little bit like if someone who is a suspect in a murder, you find out that 20 years ago they were accused of a similar murder. That’s not in any way grounds to convict them, but it is kind of the point where you’re like, yeah, we really would like that DNA confirmation.

Laura Shin:

Some of the other things that fascinated me was he described how somebody who had the kind of like means and skills that Gerald Cotten had, could have faked their own death and truly be alive now. And he talked about how, because Gerry knew how to fly his own planes and those wouldn’t necessarily have to go through the normal kind of like border control or customs or whatever it might be. Or even his sailing capabilities. That all those things would enable him to kind of live out life on the rest of the planet without encountering the kind of authorities who might pull him in for questioning. Is there anything more to add other than those details I mentioned?

Aaron Lammer:

Not to mention his deep experience with VPNs and Tor and cloaking where he was online, an ability to move funds across bank accounts and crypto accounts. The hardest thing about faking your death, from what I understand, and I’m not talking specifically about Gerry, this is just, I learned a lot about people who successfully fake their death, is you need a new identity set up somewhere else, and it’s gotta be all waiting for you. If you’re trying to set this up after you faked your death, you’re in trouble. You need a passport, you need a place to stay. You need a local bank account that is already funded with money. All this is the kind of stuff that Gerry was really experienced with.

Moving money across international borders. You’re right, private airports are great for that. Did he stash money at casinos? We know that he frequented international casinos. One of the things I learned that is a way to stash some money in another country is to go to the casino and deposit a lot of money and then get back a claim ticket that you have money sitting at the casino. All of these techniques would be useful to someone who wanted to start a new life somewhere else that had no connection to his old life. Certainly privacy coins would be something I would think about it in that situation. And we know that that Gerald was interested in privacy coins and was actually a big Zcash holder at one point. So again, these are all skills, rather than actual evidence that he is living a new life.

But when you really think about it, there’s not that many people who have all of these skills who could even try something like this. He was an early Bitcoin holder during the Silk Road era. One of the big things sold on Silk Road and a lot of darknets was fake passports, fake identification. All of these things would have been useful if he did decide that he was going to do something like this.

I think the flip side of all of this is that QuadrigaCX was almost out of money. And so he was on the verge of being revealed. At a certain point, people weren’t just going to post on Reddit about how they hadn’t got their withdrawal. People were going to do something about it. So there was kind of a perfect storm of pressure coming down on him that he needed to do something he needed to get out of the situation he was in. If you just look at the course of 2018, there’s the big market crash. That pretty much wipes out almost all the money that he’s been gambling on behalf of his customers, and people start pulling their money off of the exchange. So a bear market and a crash are very bad for someone running a fractional reserve Ponzi. As soon as more people are pulling out than are putting in, you’re in trouble. As long as there’s a bull market, you’re kind of fine. You can just assume more people are going to want to buy that are going to want to withdraw. But as the ocean started to pull back there, I think he would have found himself quite exposed. In fact, he actually funded money back into QuadrigaCX in the last few months. So money had already embezzled out, he started funding back into the exchange simply so that it could pay out some of these withdrawals.

Laura Shin:

Hm. And where was that coming from?

Aaron Lammer:

I believe also in the Ontario Securities Commission’s report. So they basically have a sum of all of the money that he took off the exchange, and then they show actually some money came back in, about $10 million, over the last few months he was alive. And I know he was also really waiting for the CIBC to unfreeze. They had about $26 million worth of the money frozen in bank accounts. And he was eagerly awaiting that money getting unfrozen so he could use it to pay out withdrawals. It actually got unfrozen just before he died, like a couple days before he died.

Laura Shin:

The private investigator who investigates people who have faked their death, once he kind of looked at all the evidence, did he say what he really thought? Where would he put the odds that Jerry’s alive or dead?

Aaron Lammer:

He thought it was very suspicious. I believe the phrase he used is every red flag you can raise, he’s managed to raise that red flag. Now, whether that means the red flag of he faked his death or the red flag of this merits investigation. I think that’s ambiguous. He never gave me a percentage chance that he was alive or dead. He looked at it more like, as an insurance investigator, you either investigate or you don’t investigate when someone files a claim. This one, this is the one that you send the A team on. This is the one you really, really want to look into. When I interviewed him, it was probably closer to a year after this happened. And now it’s two and a half years, which, you know, the longer it goes without something happening, that also could be seen as some form of evidence.

The longer Gerry goes without getting caught, I do think that there’s a very realistic chance that he is really dead. And if that’s true, and this is kind of the conclusion of the show, so double spoiler alert, if you’re still listening, my view is that he was performing an exit scam either way. We basically factually know that he had taken a lot of money out of Quadriga and was planning to try to escape the consequences of doing so — whether that was by faking his death or he happened to be in the middle of that, and he suffered this bizarre, tragic, natural, accidental death.

In both cases, I think his motivation was actually kind of the same. It’s almost like him dying in the middle of it is even greater coincidence or even more improbable. It’s a bit like if Bernie Madoff had had a heart attack the night before they busted it on his office and arrested him. I think people would have probably never accepted that that really happened. Just like people will probably never accept that Epstein died by suicide or a lot of these other c’mon, this coincidence is too crazy, kind of stories.

Laura Shin:

This gets really dark, but I did think, well, if he really did die, it could be because he obtained some substance that enabled him to get ill in such a way that it would look like he died of the causes that the doctor said.

Aaron Lammer:

That is something we looked into. Poisoning by murder-suicide is something we considered. And I also considered the fact that someone who had just committed one of the biggest crimes in Canadian financial history, has existing health problems, and is $200 million in debt… it’s not healthy. It could give you an ulcer believing that people were on your trail.

Laura Shin:

Although, it was something like his body had gone into sepsis, like he had some infection that caused heart attacks. And then he died from that. Wasn’t that what happened?

Aaron Lammer:

Technically he died of cardiac arrest, but his death was consistent with complications from Crohn’s disease. He had a perforation in his intestine, which later caused him to go into cardiac arrest. So from what I’ve heard from talking to doctors, his death was, at least as documented by his doctor, was consistent with away a 30 year old could die of Crohn’s disease. It is unusual for a 30 year old to die of Crohn’s disease, but it is possible. We actually have some information that he had had previous medical breakdowns that had required intervention. So he would have been aware that, that he had a troublesome health situation.

Laura Shin:

It’s just with the timing, you know, shortly after the will. So a lot of the customers of QuadrigaCX did ask that the body be exhumed and it looks like that’s not going to happen, which is surprising. So can you talk a little bit about that situation?

Aaron Lammer:

So there’s a group of creditors who are represented by lawyers, and they have their lawyers basically send a letter to the RCMP requesting that they exhume Gerald’s body and do DNA testing to prove that whatever is in his coffin is really him. And the crypto press picked up on this as if it was like a sure thing. They’re like, they’re digging him up. Which, it turns out, was a little bit premature because the Royal Canadian Mounted Police have no obligation to listen to a letter of this kind. It has no real legal statutes. Like, if I sent you a letter that said, I want you to have this guest on your podcast, you could consider it, but you don’t have to do it. And in fact, from what I understand, the Royal Canadian Mounted Police are kind of loath to investigate this case any further in terms of him faking his death period.

They believe, from what I’ve been told, that he is really dead. They’re satisfied. It’s possible that they have information that I don’t have that proves he’s dead. That’s a real possibility that we’ve always sort of had out there is maybe the reason law enforcement doesn’t want to dig him up or investigate this further is they actually know something that we don’t know. But, from what I understand, the chances of that body getting exhumed are very low. People have put it at below 1% to me. So while it would help me finish my story, it doesn’t look like it’s happening.

Laura Shin:

I have to say, frankly, their decision does boggle the mind, at least in my opinion. But you’re right, maybe they know something we don’t know.

We’re just gonna run through all the spoilers. One of the more intriguing episodes was the one you did on Jennifer Robertson, Gerald Cotten’s wife/widow. There were a couple of things after she returned back from India that I found really suspicious/notable. But one of them was about how his desk had been cleaned up while they were in India. Can you talk about that? And I almost didn’t even really know what the show was kind of implying there. So what was the significance of that?

Aaron Lammer:

Well, I don’t mean to imply anything specifically other than the facts. So I’ll run through the facts, which are that after Gerry died in India, before Jen returned to their house with the coffin, a group of people were in the house. Gerry’s parents and I believe his brother and his sister-in-law. And when Jen got back, everyone wanted to look for this password. Cause at this point they still believed that there was $215 million in these cold storage wallets. So they tore the house upside down. They cut open furniture, even. Basically trying to find anywhere that Gerry might have left his password. And one of the biggest beliefs was that maybe it was in Gerry’s safe because he had a safe in his house and he had espoused the use of paper wallets repeatedly. He said the best way to keep your private keys is with paper wallets. I use paper wallets, and I have a safe in my house where I keep my valuables.

Occam’s razor was, if these passwords are anywhere as paper wallets, they’re probably in the safe. So the safe was in his attic, and it was bolted to the rafters. When the first time anyone from the outside came into the house these are our things they said. They said that Gerry’s office, which had a reputation of being messy and full of papers, had been cleaned up. And it appeared that things that had previously been inside it, were gone. The safe, which had previously been bolted to the attic, was found on the floor of his home office and it was open and it was empty.

Laura Shin:

But wait, I don’t understand because.. doesn’t that mean that the family could have gone through all those things?

Aaron Lammer:

That’s right. Yes.

Laura Shin:

But is that suspicious? I don’t feel like I’m connecting all the dots.

Aaron Lammer:

If there was a password written down, anyone who was in the house, which is a small list of people, could have ended up with that password before investigators were on the scene. I offer that with with no specific implication.

It was believed that Gerald had a personal cryptocurrency stash, which is referred to as his nest egg. We know that he was a pre-sale Ethereum buyer. He had a large amount of personal Ethereum. He was friendly with Vitalik actually. He was working out of Decentral Toronto at the same time Ethereum was getting off the ground there. So my only implication in bringing up the home office and his safe was that while people were looking for this stuff, they could have found private keys to wallets that contained cryptocurrency.

It’s unclear if they did, whether they would have disclosed that to anyone. This was before anyone was investigating, this was before anyone knew Gerald was dead. So these are all things that happened in the period between when he died and when anyone from the public knew that he was dead. If he did die, I think it does merit investigation what happened to this private cryptocurrency stash and where could have the private keys been and who could have gotten them. And that nest egg has still never been found. And I couldn’t tell you how large it is. What’s inside it or where it is. Never been seen again.

Laura Shin:

One other piece I didn’t quite know what to do with was how apparently Jennifer and Gerald Cotten’s family of origin are no longer on speaking terms. What was your read on that?

Aaron Lammer:

It’s difficult to read. At the time that they stopped speaking together, as far as I knew, Jen, at that point, stood to inherit millions of dollars from his will and his parents stood to get nothing from the will. So that could have been a reason for conflict between the two of them. I don’t know. I haven’t been able to speak to them.

Gerry’s parents haven’t said anything since he died, so we have very, very little insight there. But I would say, in a larger sense, that even if you believe that Gerry really did die of natural causes, when you look at who was left behind, they had sort of competing objectives. You have Alex Hayden, who was Gerry’s lead programmer, that’s the most crypto knowledgeable person, the person who had the best chance to know what was really going on at QuadrigaCX.

And then you’ve got his widow, Jen, who initially stood to inherit a lot of money and then had all of that money seized. And you have the creditors. You have his parents. And each one of these people has slightly different objectives and a slightly different view of what should happen. And so I kind of take everything that all of them say with a grain of salt in terms of what were people’s agenda and, more specifically, how much did they really know about what Gerry had been up to? It’s very easy to look negatively at his wife and say, well, she didn’t tell people for a month he was dead. That’s shady, that’s sketchy. But we ought to look and say, well, who gave her that advice? And what did she know at the time? There’s the possibility that she knew almost nothing about what Gerry was up to.

She just thought she was married to a successful crypto dude who was rich and was going to take care of her no matter what. So in a lot of these things, I feel like you kind of have to take them at face value and say, well, we really don’t know. It’s a really big difference whether you read this as her true belief, which is that she didn’t know anything, or you think she’s hiding something. And we tried to consider it in both ways.

Laura Shin:

So first to update us kind of on her financial situation, because what Gerry put in his will was not exactly what happened. But then also tell us a little bit about the different theories about whether she was in on it or any other theories you have about her.

Aaron Lammer:

So basically after the Ernst and Young fifth monitor’s report came out, it pretty clearly showed that all of the stuff that Jen had inherited from Gerry had been purchased directly with embezzled funds. So Gerry was taking this customer crypto and sending it to OTC brokers who were cashing him out, transferring the money that he was directly using to buy houses, buy a plane, buy a boat. That’s all the stuff Jen inherited. So she voluntarily actually entered into a settlement with QuadrigaCX creditors in which she gave everything back. She was allowed to keep, I believe, $90,000 in her checking account, her 2015 Jeep Cherokee, and her wedding ring. Everything else went back to QuadrigaCX creditors. And actually those houses have mostly, I think, been sold now. Gerry and Jen’s house was like on a Canadian real estate website, if you ever want to take a virtual real estate tour of it, I think it’s still out there.

She lost everything. She was very, very briefly rich and then went back to having the same life she had before she met Gerry, I guess you could say. As far as we know, she’s living in Halifax. She’s back on social media. I believe she’s started to date again. And it seems like she’s moving on with her life. It doesn’t seem like she’s still kind of in this realm. And what you read from that, I think, you know, kind of depends on what you think happened. I think it’s very possible that she is telling the truth and that she really didn’t know what her husband was up to and did get hit with a shocking secret that she dealt with as best she could.

Which was that her husband was an epic fraud. One of the biggest frauds there was out there. I do think it’s somewhat credible that she could have not known that, particularly with something like crypto, I think it’s very easy to be like, yeah, I don’t know what he’s doing. We’re rich. Let’s not ask too many questions. And the ironic part in all of that is that Gerry could have been rich without stealing from people. He was into Bitcoin in 2014. He was an Ethereum pre-sale buyer and he ran an exchange. I mean, any one of those things is plenty to make you rich. With Gerry, I came to believe that we were really dealing with someone who was addicted to scamming, addicted to ripping people off. That it was not really just about the money because, by my count, he had a lot of money already when he was stealing from people. Maybe it’s a form of gambling addiction.

It depends what you want to call it, but it definitely seems to me like this stuff that he was engaged in went beyond simply trying to get money and into the realm of sort of scamming for sport. It was an escalating thing too, where he went from doing these very like low level internet, high yield investment schemes, to he gets involved in Bitcoin and all of a sudden the stakes go up a thousandfold. You’re not stealing a hundred thousand bucks, you’re stealing a couple of hundred million bucks. And I think it looks like he got in over his head, you know?

Laura Shin:

I think one of them, probably most memorable moments is at the end, Jennifer connects with Michael Patryn and why don’t you tell that story? But that for me was just like, wow.

Aaron Lammer:

This is one story. Maybe I’ll hold this story. Oh,

Laura Shin:

You don’t want it to be a spoiler? Okay.

Aaron Lammer:

I feel like it’s better if you kind of get it in context of what was happening when. Most of the story takes place in like the one month after he dies. That story I think is best left to the end.

I’ll give a different spoiler actually, which is Jen is writing a book. She’s writing a tell all memoir about her experiences. And that, in addition to the story that you just referenced, are, in my opinion, evidence that that maybe she’s telling the truth and maybe Gerry really is dead. Otherwise you have to believe that she’s writing a book about a lie that could potentially get her in a lot of trouble. And that feels like pretty hubris-y to me.

So when I looked into Gerry, all I found was sketchiness and scams. Looking into to Jen and what’s happened to her in the last year, I have some trouble believing that she’s really keeping this horrible secret that could fall apart at any moment. But again, I’ll leave it to everyone to come to their own conclusions about it. Personally, my conclusion has veered back and forth many times in the two years I’ve been working on the show. And I still wouldn’t say I’m confident at all in my conclusions.

Laura Shin:

Oh, interesting. That was gonna be my last question at you. What do you really think happened? Do you feel you have an answer for that?

Aaron Lammer:

I feel like I set out to figure out what happened to Gerry and what happened to the money. And I feel satisfied now that I know what happened to the money. And that’s an easier thing to note, because there’s a record on the blockchain of where a lot of the money went.

In terms of Gerald Cotten himself, I don’t feel like we were able to definitively prove that he’s alive. In order to do so, I think I would have to find him alive. I would have to find him on a beach somewhere or find definitive evidence that he’s out there doing stuff. And to prove that he was dead, at this point, I think that exhumation would have to happen, or someone would have to reveal something that law enforcement knows that I don’t in order to do it. So in terms of proving either way, I don’t think that proof exists. I think without the power of law enforcement, it will be difficult to achieve that proof.

Laura Shin:

But you had to bet your favorite crypto, which way would you bet?

Aaron Lammer:

The longer it gets away from what happened and he doesn’t show up somewhere and get caught, I think slowly I inch towards thinking that there’s a good chance he’s really dead. But short of an exhumation, I wake up in the night sometimes thinking about this, and I think of a different way than he could have tricked me or manipulated reality. So I still believe both could be true. I’m always going to believe that on some level, even if what it would have taken to pull this off was totally grandiose… Gerald Cotten does seem sometimes like he is the kind of person who could have done something like that. I’ll hold off on my final judgment until I see proof one direction or the other.

Laura Shin:

All right. Okay. Well, this has been super fun talking with you about your journey. Where can people learn more about you and Exit Scam?

Aaron Lammer:

You can find out about that you can just search Exit Scam in any of the podcast stores or it’s on exitscam.show. You can just follow me on Twitter @aaronlammer. I do all kinds of podcast stuff. So if you like podcasts, check me out.

Laura Shin:

Great. Thank you so much for coming on Unchained.

Thanks so much for joining us today. To learn more about Aaron and Exit Scam, check out the show notes for this episode. Unchained is produced by me, Laura Shin, with help from Anthony Yoon, Daniel Nuss, and Mark Murdock. Thanks for listening.