June 8, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

MicroStrategy intends to offer $400M in notes to purchase more BTC.

-

Bank of England said stablecoins should “meet equivalent standards as those provided by commercial bank money.”

-

Unchained Capital raised $25M, led by Stone Ridge and NYDIG.

-

A Goldman Sachs survey showed Bitcoin to be the least favorite asset of CIOs.

-

China’s Ministry of Innovation and Information Technology published a blockchain plan.

- Former US President Donald Trump said Bitcoin “just seems like a scam.”

What Do You Meme?

What’s Poppin’?

Federal Officials Recovered BTC From Colonial Pipeline Attack

The Department of Justice announced yesterday that they had seized 63.7 BTC of the 75 BTC that Colonial Pipeline had paid as ransom to DarkSide, a hacking group.

The DOJ press release explains “by reviewing the Bitcoin public ledger” a law enforcement agent was able to track multiple Bitcoin transfers to a specific address, for which the FBI had the private key, or “the rough equivalent of a password needed to access assets accessible from the specific Bitcoin address.”

Colonial Pipeline suffered a ransomware attack in May, which, according to The Block, triggered a temporary shutdown and an East Coast gas shortage in multiple states in that region. The initial ransom payment of 75 BTC had been worth $5M. Due to BTC’s recent price drop, the recovered 63.7 BTC is now worth $2.3M.

For a more in-depth breakdown of this developing story, click here, here, or here.

Three Bitcoin Metrics You Need to Know

It appears that Bitcoin is in a rut, stuck muddling between $30K-$40K.

Three statistics paint a somewhat dour picture for BTC:

-

According to CoinShares, Bitcoin investment products registered $141M in outflows over the past 7 days. In contrast, Ethereum investment products saw $33M in inflows.

-

The Block reports that daily Bitcoin transactions (aka network activity) fell to 217,000 on Sunday — a number not seen since 2018. In dollar terms, this is roughly a $10B difference in on-chain volume for Bitcoin, which decreased from $17.3B per day to just $7.7B. Additionally, daily active addresses on the network and new addresses per day have dropped.

-

Frank Chapparo of The Block noted that Bitcoin tweet volumes “have nosedived” since the middle of May — which is somewhat surprising after the hype from the Bitcoin Conference.

Recommended Reads

- Jay Clayton and Brent McIntosh on why crypto does not necessarily require wholesale regulatory change:

- Bitcoin as legal tender??

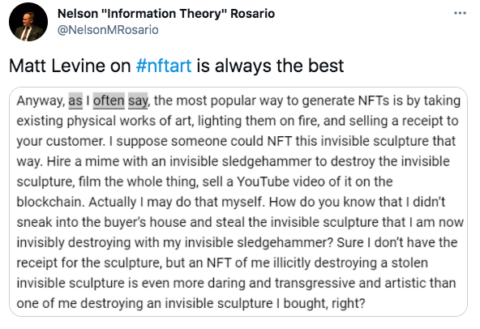

- Check out this fantastic NFT idea:

On The Pod…

June 14th is the 5-year anniversary of Unchained. 🎉

On Tuesday, June 15th, we’ll publish a 5-year anniversary episode with questions or messages from you listeners to me.

- record a video or audio message of 60 seconds or less stating your name, where you’re from and your question or message.

- email it to hello@unchainedpodcast.com with “anniversary” in the subject line (or just respond to this email)!

The deadline to get your submissions in is Thursday, June 10 by 5 pm ET/2 pm PT.

Thanks so much for supporting Unchained all these years! 🙏

Check out the latest episode of Unchained:

Will Bitcoin’s Price Go Up Again? Yes, According to On-Chain Analytics

Willy Woo, on-chain Bitcoin analyst and writer of the Bitcoin Forecast, a market intelligence newsletter, and Rafael Schultze-Kraft, co-founder and CTO of Glassnode, discuss Bitcoin and what the on-chain metrics tell us about the price. Here to discuss is. Episode highlights:

-

what factors pushed the price of BTC down in May

-

why Elon’s Twitter account hold so much sway over the market

-

why Willy believes Bitcoin is good for renewable energy

-

who sold during the last month

-

which type of BTC investors stopped purchasing in Feb/March

-

what trends Willy and Rafael have noticed from coins moving to/from exchanges

-

their thoughts on exchange-traded products, like GBTC and Canadian ETFs

-

how derivatives trading has played a role in Bitcoin’s price

-

why stablecoins were trading above their peg in the months leading up to the Coinbase direct listing

-

how Willy values Bitcoin (specifically using NVT ratio)

-

whether the trend of corporate treasuries investing in Bitcoin will continue

-

how they expect Ethereum’s adoption of a deflationary monetary policy to impact the price of Bitcoin

-

when the market could turn bullish once again and predictions for the rest of the year

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians