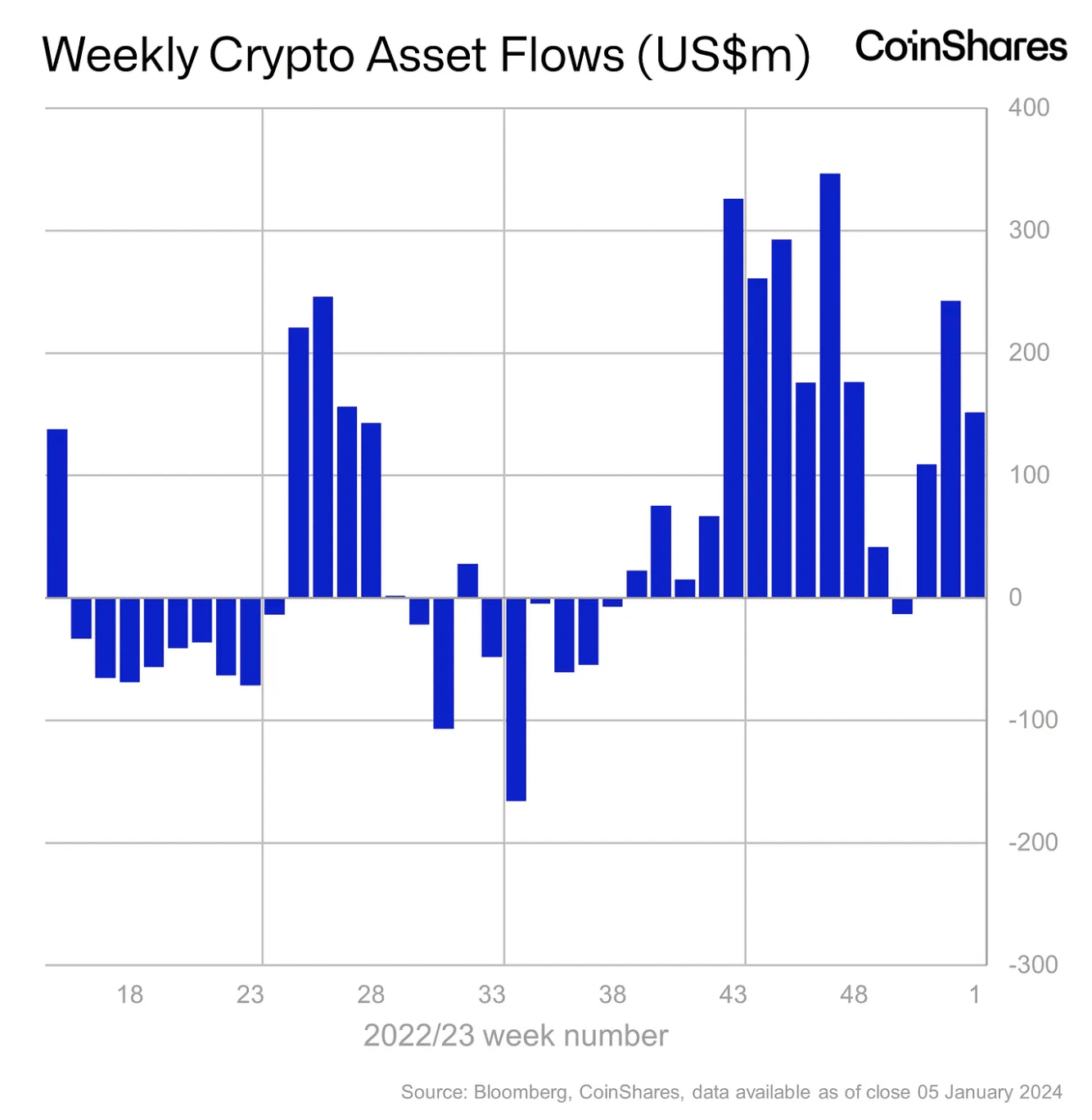

Investors have deployed over $151 million into digital asset investment products during the first week of the new year, signaling “a good start to 2024,” according to European crypto asset manager CoinShares.

In a report published Monday morning, CoinShares’ head of research James Butterfill noted that investors flooded $113 million into Bitcoin, the lion’s share of inflows, while Ethereum, the second-largest blockchain by market capitalization, saw inflows totaling $29 million.

“Despite the spot-based ETF not being launched yet in the U.S., 55% of the inflows were from U.S. exchanges, with Germany and Switzerland seeing 21% and 17% respectively,” Butterfill added.

The influx of investments is not a new trend in 2024 as investors channeled roughly $243 million into digital asset investment products in the last week of the prior year, adding to the more than $2 billion of total investments for 2023.

The inflows come amid current market expectations that the U.S. Securities and Exchange Commission will approve spot Bitcoin exchange-traded funds this week, bringing new buyers and sellers of BTC into the crypto ecosystem, such as everyday Americans as well as financial heavyweights from Wall Street.

The price of BTC — the largest cryptocurrency by market capitalization — has increased more than 4% in the past day to $45,992 at presstime, outpacing the CoinDesk Market Index, an industry benchmark for the crypto ecosystem.