January 14, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

DeFi lottery protocol PoolTogether is facing a lawsuitpertaining to whether it truly is decentralized, autonomous project.

-

Tether froze $160 million in USDT across three Ethereum addresses yesterday.

-

On-chain derivatives exchange dYdX plans to fully decentralize in 2022.

-

Synthetix founder Kain Warwick is considering moving the protocol to multiple L1s.

-

Swiss National Bank concluded a central bank digital currency trial that included the Bank for International Settlements, Goldman Sachs, Credit Suisse, Citi, UBS, and Hypothekarbank Lenzburg.

-

ConsenSys is facing a legal battle with a former venture partner.

-

OpenSea volume is on track for its biggest month ever.

-

Hackers from North Korea stole nearly $400 million in BTC/ETH in 2021.

-

Gemini acquired BITRIA, a crypto portfolio manager.

-

Former CFTC chair Chris Giancarlo is joining CoinFund as an advisor.

-

Bitcoin and Ethereum ETFs could be soon coming to India.

- Michael Hsu, the acting comptroller of the OCC, thinks bank-like regulation would be good for stablecoins.

Today in Crypto Adoption…

-

Tesla is testing DOGE payments on its website, according to source code.

-

Visa is partnering with Ethereum infrastructure firm ConsenSys to help traditional finance companies integrate central bank digital currencies.

- Candy Digital launched an NFT marketplace for officially licensed Major League Baseball products.

The $$$ Corner…

-

DeFi Alliance raised $50 million and will rebrand to AllianceDAO.

-

The Fan Controlled Football League closed a $40 million Series A investment round led by Animoca and Delphi Digital.

-

The SEC filing of Rhodium, a Bitcoin miner, implied a market cap of $796 million for its upcoming IPO.

- Proof of Learn raised $15 million in a funding round that will help grow the “learn to earn” platform.

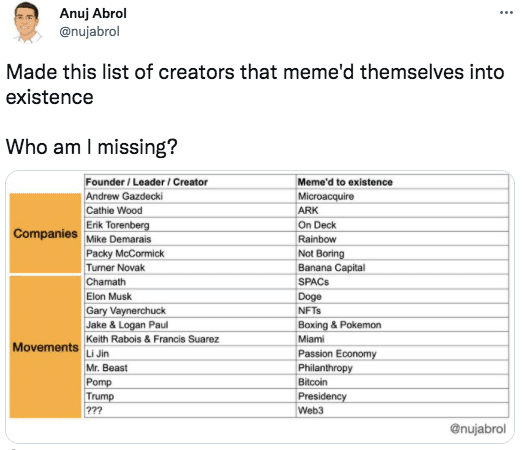

What Do You Meme?

What’s Poppin’?

Block 🤝 Mining Blocks

In October, Block (formerly known as Square) CEO Jack Dorsey revealed the payments company was considering building a Bitcoin mining system.

Yesterday, Thomas Templeton, Block’s general manager for hardware, announced that Block is officially going ahead with its plans to build mining hardware in an open-source manner.

According to Templeton, earning Bitcoin is the least interesting part of building out mining hardware and infrastructure. “We want to make mining more distributed and efficient in every way, from buying, to set up, to maintenance, to mining. We’re interested because mining goes far beyond creating new bitcoin. We see it as a long-term need for a future that is fully decentralized and permissionless,” wrote the general manager.

Templeton went on to say that availability (i.e., creating hardware that anyone, anywhere can purchase a rig), reliability (i.e., solving issues with heat dissipation), and performance (i.e., lower power consumption) will be the three cornerstones of Block’s mining hardware. He also noted that Block would consider making a new type of ASIC.

Block’s stock was down 5.86% yesterday.

Recommended Reads

-

Fidelity on digital assets in 2021:

-

@punk6529 on NFTs:

-

The Tie on $MAGIC:

On The Pod…

The Chopping Block: Why the Crypto Markets Have Been Down This Week

The Chopping Block is back! Crypto insiders Haseeb Qureshi, Tom Schmidt, and Tarun Chitra chop it up about the latest news in the digital asset industry. Show topics:

-

why crypto assets experienced a drawdown after last week’s FOMC meeting that hinted at accelerated rate hikes

-

which emerging assets Tarun, Haseeb, and Tom envision weathering a bear market

-

which assets could be further hurt by a continued bear market

-

the significance of Paradigm and Sequoia investing in Citadel Securities

-

what aspects of Signal CEO Moxie Marlinspike’s web3 article Haseeb, Tom, and Tarun take umbrage with

-

whether Cryptoland is crypto’s Fyre Festival or whether it’s the metaverse

-

what the heck is going on with the Pudgy Penguins community

-

the lessons from the CFTC’s fine of Polymarket (disclosure: a former sponsor of my shows)

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians