Is this how adoption begins?

The global race to launch a dominant stablecoin is heating up in a major way, with the IMF prompting central banks to get started, the Libra Association formally signing its charter, China racing to launch its cryptocurrency, former CFTC Chair Christopher Giancarlo advocating for a digital dollar, a Fed official acknowledging the Fed is actively debating this now, the G-8 issuing guidelines for regulating digital currency and much more. Plus the IRS is making sure it gets a piece of the action.

But not all forces are pushing forward. Two senators sent letters to payment companies that had initially signed on to be members of the Libra Association threatening to give them greater scrutiny over their existing businesses if they stayed in the Libra Association, and the SEC filed a restraining order against messaging app Telegram for its yet-to-be-launched cryptocurrency.

Meanwhile, on the podcasts, I had a fascinating conversation about DAOs with Mariano Conti and Peter Pan on Unchained, where we got into why Mariano voted against Peter’s application to join MolochDAO, Mariano’s attempt at on-chain corruption called SelloutDAO, LAOs, and why these DAOs actually require a lot of off-chain social coordination. Plus, Jonathan Levin talked about how Chainalysis helped law enforcement shut down the largest child porn site, leading to 337 arrests in 38 countries. Bravo to Chainalysis.

This Week’s Crypto News…

Global Stable Coin War Heats Up

It wasn’t that long ago that the industry was simply hoping that regulation wouldn’t kill innovation off. This week, there was a ton of activity in the race to create a global stable coin from both central banks and tech companies.

- As a Bloomberg article put it, “When finance ministers and central bankers come to Washington this week, the International Monetary Fund has a message for them: Digital currencies are on your doorstep. Get involved.”

- The FT has a story on how various initial members dropped out of Libra, with some former members saying they felt Facebook underestimated the amount of regulatory scrutiny Libra would receive, and also that they thought it was a mistake for the project to be so closely tied to the tech giant.

- But none of this has stopped Facebook. Libra formally signed the Libra Association Charter this week, making the 21 existing signers the initial members of the Libra Council.

- Meanwhile, China is racing ahead on its digital currency. RBC analysts Mark Mahaney and Zachary Schwartzman said in a research note Tuesday. “If U.S. regulators ultimately dismiss Libra and decide not to draft regulation to encourage Crypto innovation in the U.S., China’s [Central Bank Digital Currency] may be strategically positioned to become the de facto global digital currency in emerging economies, largely through Alipay, WeChat, UnionPay and other messaging & payment apps.”

- But it doesn’t look like the US is entirely asleep at the wheel. A Fed official did say the central bank is actively debating a digital dollar.

- And former CFTC chair Christopher Giancarlo wrote an op-ed in the WSJ advocating that the US create a blockchain-based digital dollar.

- Plus, the IRS is making sure it doesn’t miss out.

Senators Make Thinly Veiled Threat Over Libra

Senators Sherrod Brown and Brian Schatz sent letters to payment companies that had initially signed on to be members of the Libra Association threatening to give them greater scrutiny over their existing businesses if they stayed in the Libra Association.

SEC Files Restraining Order Against Messaging App Telegram

What was to be Telegram’s soon-to-be-launched cryptocurrency is now delayed, after the SEC filed a temporary restraining order to prevent Telegram from distributing any Grams.

Avichal Garg of Electric Capital published a great tl;dr on the SEC’s filing against Telegram. As he puts it, “The SEC went to town on the assertion that Telegram actually raised money to benefit Telegram Messenger, Telegram controls the TON Foundation, and the only people building TON are Telegram employees. Thus, it is a common enterprise and profits are driven by efforts of others.” He goes on to say, “Some issues the SEC highlights that other projects will try to avoid in the future: A/ Don’t have the company and foundation controlled by the same people; B/ Don’t use funds to finance an existing company; C/ Don’t have only company employees committing code.”

Binance Crosses $1 Billion in Profit

The most popular crypto exchange has its second-highest quarterly profit ever. Larry Cermak of the Block notes that this is despite trading volume being down, which indicates that Binance is successfully diversifying its revenue.

Why Multi-Collateral Dai Is About More Than Just New Types of Collateral

For those of you looking for more details on the upcoming launch of multi-collateral Dai, Cyrus Younessi of MakerDAO notes that governance and security will be big focus areas.

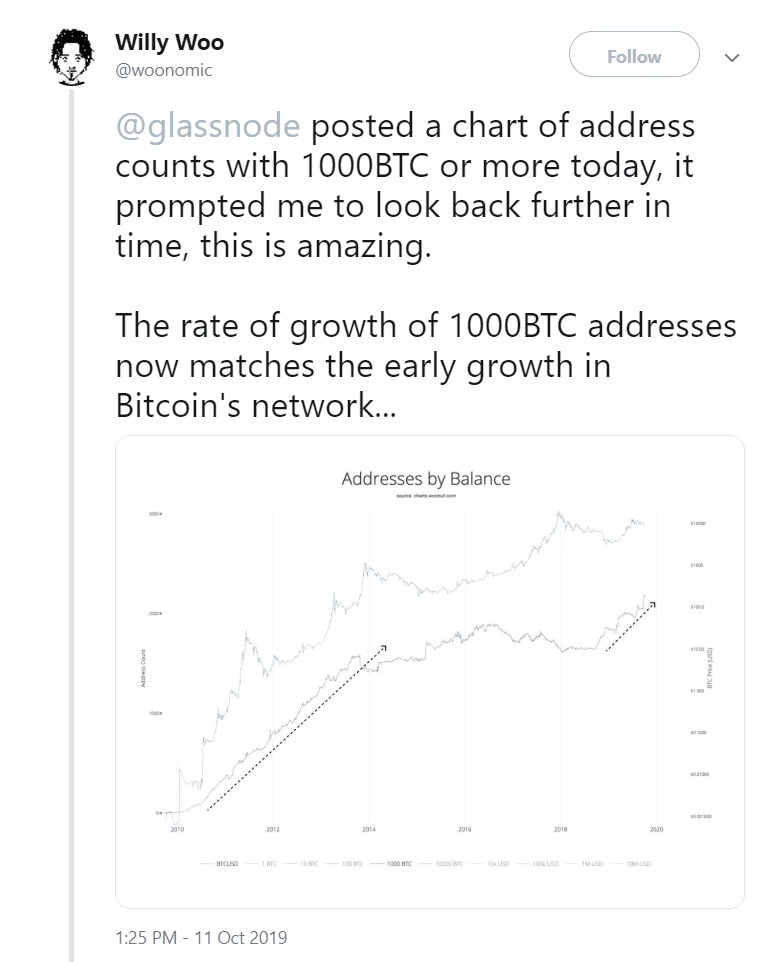

Crypto Milestones: 1,000-BTC Addresses Growing at a Rate Not Seen Since the Early Years of Bitcoin

Willy Woo posted a fascinating chart showing that the growth in the number of Bitcoin addresses with at least 1,000 now matches what it was in the early years of the network. As he says, “In the early years, gaining 1000BTC was a matter of being an uber geek, knowing how to mine it, and some investment in hardware and electricity. … In 2019, 1000BTC means an investment of ~$10m … IMO we’re likely in a new renaissance of Bitcoin, this one is powered by capital influx of high net worth investors, while the early one was from the tech savvy who were bootstrapping the network. Super Bullish.”

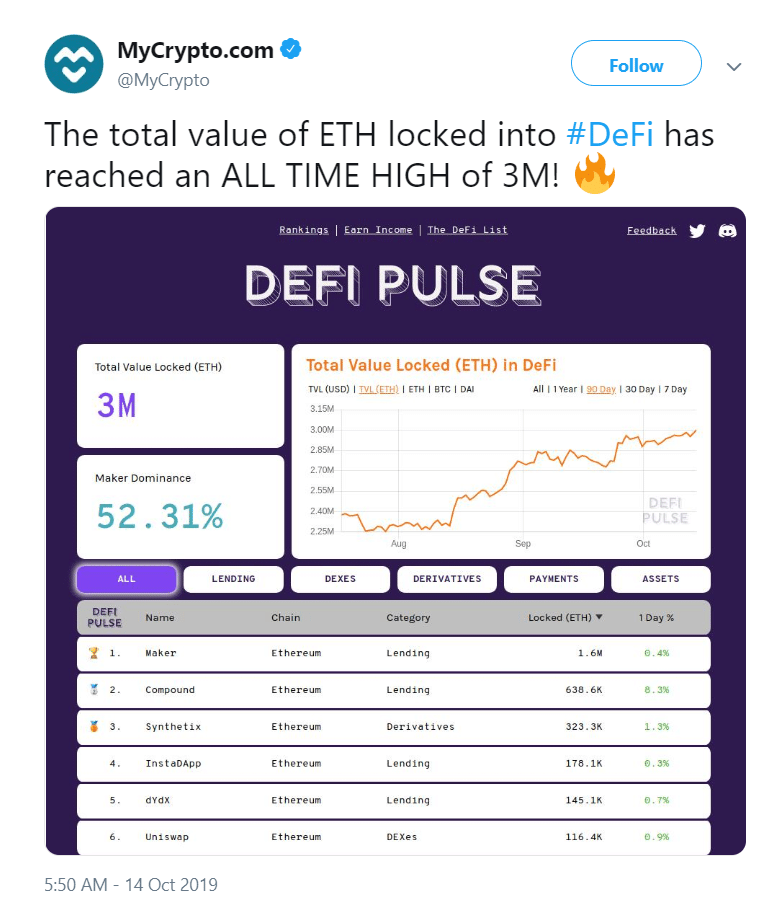

Similarly, MyCrypto noted that the amount of ETH locked into DeFi has hit 3 million ETH.

12 Crypto Questions

Ali Yahya of a16z wrote up 12 questions that remain to be answered in crypto. It’s a great distillation of the uncertainties, such as when are where decentralization matters most, how many networks will dominate, where value will be captured, etc.

Massive Hurricane Hits DevCon 5 as God Attempts to Rid the World of Ethereum Community

Coin Jazeera killed it this week with its own recap of DevCon 5. My favorite part was definitely the reference to how the dinosaurs died: “The only thing preventing God from going Biblical on Japan and sending a meteor to scorch the earth was Coindesk reporter Leigh Cuen’s controversial article calling Ethereum a scam, pissing off every bagholder at DevCon. This amused God enough to not send us all the way of the Dinosaurs.”