Stablecoins are about as perfect a business as one can get. Customers give you money, you issue them a token representing $1, and then you can invest that stockpile of money in U.S. treasuries and other short-term holdings.

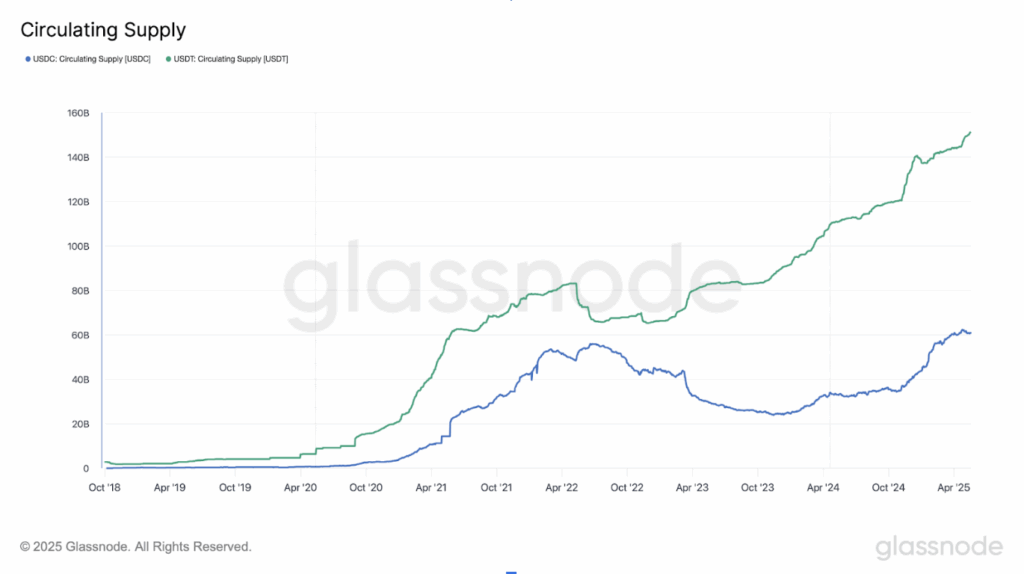

You don’t have to share any of the profits with customers. In fact, according to the text of the GENIUS Act, which achieved cloture in the U.S. Senate Monday night, it would be illegal to do so. What’s more, people hardly ever ask for their money back, so their bankroll keeps going up. The two largest stablecoins, Tether (USDT), with a market cap of $151.3 billion, and USD Coin (USDC), at $60.26 billion, account for over 87% of the $238.7 billion stablecoin market. With the exceptions of 2022, which saw a series of collapses in crypto, and the 2023 banking crisis, which specifically hurt USDC, their supplies have consistently moved up and to the right.

What types of profits are we talking about? Last year, Tether made $13 billion. That is more than double BlackRock, the world’s largest asset manager, which brought in $6.3 billion on a GAAP basis, and over 5 times Coinbase’s profits of $2.58 billion. Circle’s profits last year were considerably smaller, $156 million, but the company is currently in the process of going public via an IPO that will net it billions, while being the target of a bidding war between Coinbase and Ripple that will likely value it at $5 billion or more.

With crypto now gaining mainstream acceptance, these numbers are only likely to grow. Recently, the U.S. Treasury’s Borrowing Advisory Committee estimated that as much as $6.6 trillion of the M1 money supply could be diverted to stablecoins.

These companies clearly have profits to spare, and their coffers are likely to swell even higher with the seemingly imminent passage of the GENIUS Act in D.C., which will legitimize stablecoins for the first time in history. But customers are going to be prevented from partaking in any of this growth — a concession demanded by Democrats. Why would the party typically anti-big business and pro-consumers not insist on customers partaking in the spoils?

Community Bank Blowback

Lawmakers could be reluctant to allow yield-bearing stablecoins for a number of reasons. For starters, such stablecoins would likely be securities according to the Howey Test, a judicial precedent used to determine such matters. That would introduce additional regulatory scrutiny, and perhaps recklessness if they engage in riskier lending to maintain current profit levels. That could be seen as dangerous for an industry that has already had a couple of close calls.

The TradFi analogy to this last situation is Net Interest Margin (NIM). Banks make money by borrowing short and lending long. The difference between the two rates is the NIM, or profits for banks. As a simple analogy, the national average savings rate for a bank is 0.42% today. The current average for a fixed 30-year mortgage is 6.89%. In this scenario the difference would be the NIM, and it would be a healthy one.

One could imagine that stablecoin issuers could create a win-win scenario for their clients by offering a yield higher than the 0.42% average and still make a strong profit given that the annual yield of a 30-day Treasury is 4.37%. Plus, they have considerably less overhead than brick-and-mortar banks. They should be able to get by on a smaller NIM than a bank, which, according to the FDIC, dropped 8 basis points for insured institutions to 3.2% from 2023 to 2024.

So why was this Goldilocks scenario outlawed in the GENIUS ACT? Simply put, community banks, which are closely aligned with the Democratic party, did not want the added pressure to their already challenging operating environment. They are afraid of stablecoin issuers sucking their source of demand deposits dry, not only hurting their profitability but also sapping credit from the U.S. financial system when it is needed most dearly. According to the Independent Community Bankers of America, these institutions account for 60% of total small business loans in America.

In a May 16 letter to the Senate, the ICBA wrote, “The prohibition on yield-bearing payment stablecoins is an important provision of the Act. This language should be further strengthened to ensure the intent of the legislation cannot be evaded through affiliate relationships or by offering other incentives. As noted in the TBAC report, yield-bearing stablecoins in particular pose a significant threat to bank deposits and would impair credit availability in communities across the country.”

In fact, this threat came at a particularly dangerous time for these institutions. Ever since the Great Financial Crisis in 2008, credit facilitation has been moving outside of the banking system. Then came the regional banking crisis in 2023, during which prominent institutions such as Silicon Valley Bank and Signature Bank were placed into receivership, putting additional strain on these institutions that saw deposits flee to the likes of JPMorgan and Wells Fargo, which were seen as too big to fail.

How Consumers Could Still Benefit from Stablecoins

Absent an unexpected amendment being added to the GENIUS ACT during its floor debate this week, which would require 60 votes to be included in the final bill, yield-sharing stablecoins will likely be on the back burner. In a statement sent out after the bill achieved cloture Monday night, Democrats highlighted the ban on yield-bearing assets as a key victory, saying that it “Expanded the prohibition on interest-bearing stablecoins to cover all domestic and foreign stablecoin activities. Strengthened the prohibition to bar any interest, yield, credits, or other financial considerations that could be interpreted as yield.”

So what can the yield-hungry do? For starters, they can explore the growing world of tokenized treasuries. These operate similarly to stablecoins, with the exception being that the collateral is in short-term government debt. They have grown to become a $7 billion industry, in many cases because of the extra yield that they provide to holders. But there is some important fine print. These assets are not as easily transferable as stablecoins, as they must go through a rigorous AML/KYC process, and some are even banned from being sold in the U.S. because they would be considered unregulated securities.

If that is not an option, then there are a few ways to benefit from the growth of stablecoins. For starters, it can be orders of magnitude cheaper to transact in stablecoins than to use the expensive legacy payment rails in the U.S. A domestic wire can cost $26 on average, while sending the equivalent amount of a stablecoin over a blockchain only costs the usual transaction fee. That amount can vary based on the specific blockchain and the size of the transaction pool. However, for some ultra-fast layer two blockchains like Coinbase’s Base, it can cost one thousandth of a cent. This is even orders of magnitude cheaper than debit card interchange fees, which average about $0.21 even if they are substantially cheaper than credit cards.

And speaking of Coinbase, another option for U.S. customers to get exposure is buying stock in the newest entrant to the S&P 500. Aside from being a possible purchaser of Circle, the company has a lucrative USDC distribution agreement with the company that paid it $910 million in 2024. That means that Coinbase made 5.83x as much profit from USDC as Circle did.

But all that said, it may still take time for stablecoins to find their niche in the U.S. payments system. They are still primarily used for crypto trading, and they have become a useful way for non-U.S. citizens to de-risk themselves from hyperinflationary local currencies. And for these people, giving up 3% yield is worth avoiding 40% annual inflation. I did a profile on Tether back in 2022 when I wrote for Forbes, and at that time CEO Paolo Ardoino gave me this interesting quote: “We want to be used by Turks, Venezuelans, and Argentinians. The only thing that matters to us is that our product is getting used by people in emerging markets and developing countries. They are the ones that really desperately need access to the dollar.”