The tickers of the 11 recently-approved spot Bitcoin ETFs could become an overlooked differentiating element among them, as fees continue to shrink.

Not only have the majority of the ETF providers waived their fees completely for an introductory period, but they have continuously cut their longer-term fees in order to remain competitive. On Friday, Franklin Templeton cut its post-waiver fee to just 0.19%, the lowest in the group, while Valkyrie dropped its post-waiver fee to 0.25%, right in the middle of the pack.

Read more: Why Spot Bitcoin ETFs Are (But Mostly Aren’t) a Big Deal for Crypto

With this intense fee competition, the names of the ETF tickers may emerge as an important distinction to attract investors. For example, VanEck’s HODL and Valkyrie’s BRRR ETFs reference popular memes and jokes.

Hold on for Dear Life

“HODL,” based on the incorrect spelling of the word “hold,” is widely known in the crypto ecosystem to mean “hold on for dear life,” implying not selling when markets are volatile. A Bitcoin enthusiast, who goes by the screen name “GameKyuubi,” first used the term on Dec. 18, 2013, on the Bitcointalk forum to persuade people to not sell their BTC.

VanEck, which did not immediately reply to Unchained’s request to comment, decided to capitalize on one of the longest-running memes in the crypto space by naming its spot Bitcoin ETF “HODL,” which is “legendary,” Jim Hwang, chief operating officer at Firinne Capital, wrote in a text message to Unchained.

“Tickers are like branding. Establish a good brand and it becomes memorable,” noted Hwang. “Tickers with simple mnemonics help investors recall and associate with the investment product.”.

Money Printer Go BRRR

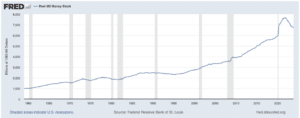

“BRRR,” on the other hand, is a reference to how the United States Federal Reserve has a money machine that can print an endless amount of money, making the sound “BRRR,” a stark contrast to Bitcoin’s maximum supply of 21 million tokens. The United States’ money supply has increased almost sevenfold since 1960, according to data from the Federal Reserve Bank of St. Louis.

Crypto enthusiasts – especially Bitcoin maximalists, people who have an unshakable belief that Bitcoin is the only worthwhile cryptocurrency – often joke about how the U.S. dollar does not have a maximum supply.

Money printer go brrr 👇 pic.twitter.com/wgGF4CFvrT

— Altcoin Daily (@AltcoinDailyio) November 12, 2021

Like VanEck, Valkyrie’s ETF ticker therefore also references a crypto meme in an attempt to differentiate itself from other ETF tickers such as Grayscale’s GBTC or BlackRock’s IBIT. Valkyrie did not immediately respond to Unchained’s request for comment.

Tool for Marketing

“Tickers have long been recognized as an effective marketing tool for ETF issuers. Since there are more than 3,000 ETFs in the market, a fun and memorable ticker would help investors search and track, especially for self-driven trading platforms,” according to ETF-veteran-turned-crypto-investor Kelly Ye, who is the portfolio manager at Decentral Park Capital.

“For Bitcoin ETFs in particular, since the target audience is more likely to be young investors, a cool and memorable ticker could go viral,” wrote Ye to Unchained on Telegram.

An ETF’s ticker could even become more important than the actual fee structure, according to Firinne Capital’s Hwang. “There are a lot of similarities across these ETFs so sponsors are competing on brand, their marketing efforts, and fees.”

James Seyffart, an ETF analyst with Bloomberg Intelligence, said the more whimsical tickers could signal that those ETFs are aimed at retail, rather than institutional investors.

“The less fun a ticker is, the more it might be that the target market is more for financial advisors and institutions and the affluent investors they service,” Seyffart told Unchained. “The more fun the ticker like BRRR, HODL, and [Hashdex’s] DEFI might signify those issuers are a little more aimed at retail investors. Or in this case — the crypto and Bitcoin crowd. That said, this is just a small part of the calculus.”

“It’s complicated,” added Ye when asked if a ticker’s name can become more important than its actual fee. “Since the underlying asset is Bitcoin, which is straightforward and already a hot topic among retail, marketing plays a big role. Ticker is one of the marketing tools issuers use.”

However, at the end of the day, investors will consider a range of factors, such as fees, tracking error, execution, and issuer background, Ye said.