OpenSea, long the dominant NFT marketplace, has struggled to reverse its fortunes since losing its trading volumes lead.

OpenSea’s dropoff comes as the competitive landscape — and the business tactics that derive profits — for non-fungible token marketplaces has shifted.

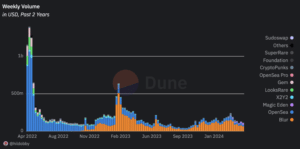

Nearly two years ago, before the launch of rivals Blur and Magic Eden, OpenSea’s weekly trading volume stood at over $1 billion, accounting for three-quarters of all NFT transactions executed on marketplaces.

OpenSea has since given up a great deal of ground. Volumes on the exchange last week dropped below $20 million, accounting for about 16% of the total market, according to a Hildobby Dune dashboard. The fact that just $20 million now accounts for roughly 16% of the total underscores how far market-wide interest and trading of NFTs has since fallen from their late April 2022 highs.

Read more: NFT Market Cools as Traders Flock to Soaring Memecoins

While the decline in OpenSea’s volumes stems from new entrants, overall NFT trading has fallen substantially over the past two years as interest in digital collectibles fell off a cliff. Roughly two years ago, total weekly trading volume stood at $1.4 billion. The figure has since dropped about 92% to $115 million.

Representatives for OpenSea, Magic Eden, and Blur did not return Unchained’s requests for comment for this story.

According to the Hildobby Dune dashboard, Magic Eden surpassed OpenSea in weekly trading volume for the first time during the week of April 15, bumping OpenSea to third place. Blur, meanwhile, booked volume of $64.4 million, maintaining the top position it’s held since Feb. 2023.

Expectations of OpenSea’s Decline

OpenSea losing its lead is “very expected… [OpenSea] keeps losing key segments to competitors. [And] they lack clear target segments and capability to win them,” wrote Eddie Wharton, a Web3 data science consultant in a message to Unchained on X. Wharton is also an NFT trader.

According to Wharton, OpenSea’s “first huge loss” was to Blur. OpenSea’s rival launched with zero trading fees and airdropped its governance token for the first time in Oct. 2022. Paying out royalties to NFT creators has also proved contentious for OpenSea. The decision for the marketplace to make royalties optional soured creator relationships with OpenSea, “fully burning that bridge,” Wharton said.

Some say OpenSea’s lack of a points program has contributed to the company losing its edge. OpenSea falling behind in volume was “expected as they don’t have any incentives like Blur/Magic Eden, [which] have points programs,” wrote Martin Lee, content lead at blockchain analytics firm Nansen, to Unchained via Telegram.

Unlike OpenSea, Magic Eden also supports NFT trading on various blockchains, such as Bitcoin and Solana — not just Ethereum.

Even so, OpenSea “still having a decent amount of users shows the strength in their brand,” Lee added. Per the Dune dashboard, OpenSea has more daily and weekly traders compared to its two rivals, even though it trails Blur and Magic Eden in volume.

OpenSea remains “the first NFT trading platform that most newcomers think of,” Andrew Forte, head of strategy at web3 consulting agency Unfungible, recently wrote on X. “Seasoned NFT-ers prefer other platforms while newcomers still use OpenSea,” Forte added.