+ Michael Saylor on Unchained

Aside from the news that Coinbase will go public via a direct listing, it was a somewhat quiet news week in crypto. However, Crypto Twitter was following every twist and turn of the GameStop epic. On Unconfirmed, Sam Bankman-Fried of FTX and I discuss the GameStop saga — how it was similar to the way crypto markets function, whether blockchain technology could prevent these types of situations in the future, and how FTX was able to create tokenized version of Wall Street Bets stocks.

On Unchained, Michael Saylor talks about his upcoming Bitcoin for Corporations events, how many queries he’s been receiving from corporations interested in adding bitcoin to their balance sheets, as well as whether or not Microstrategy would ever “take some off the table” if Bitcoin were to enter a bubble.

Be sure to read to the end for the best of Crypto Twitter on the GameStop/hedge fund/Robinhood spectacle.

This Week’s Crypto News…

Coinbase Announces Plans to Go Public via a Direct Listing

As revealed in mid-December, Coinbase will go public later this year. On Thursday, the crypto exchange stated it intended to do so via a direct listing, rather than an IPO. In a direct listing, instead of new shares being created and sold to the public, only existing, outstanding shares will be sold. This is not only a less expensive process but also enables Coinbase to avoid certain restrictions that must be followed with an IPO, such as lockup periods that keep insiders from selling their shares for defined periods.

More Institutional Investors Pile Into Bitcoin

Bill Miller of Miller Value Partners, and the former chairman of Legg Mason, wrote, for its Q4 letter, that it had purchased shares of Microstrategy’s 0.75% convertible bond. After a detailed analysis of why it believes in Bitcoin’s promise, as well as a rebuttal of common criticisms of the cryptocurrency, he writes that the Microstrategy bond offered “very little downside and an almost-free call option on Bitcoin.”

Meanwhile, CoinDesk reported that the Harvard, Yale, Brown and University of Michigan endowments have been buying bitcoin directly on Coinbase and other exchanges, a fact alluded to in Coinbase Institutional’s 2020 Year in Review.

Because of the institutional demand for bitcoin exposure, Pantera Capital, one of the oldest funds in the space, is launching a new fund in the next few months for institutional bitcoin investors, the Block reports.

Ethereum 2020 Year in Review: Transferring More Value Than Bitcoin

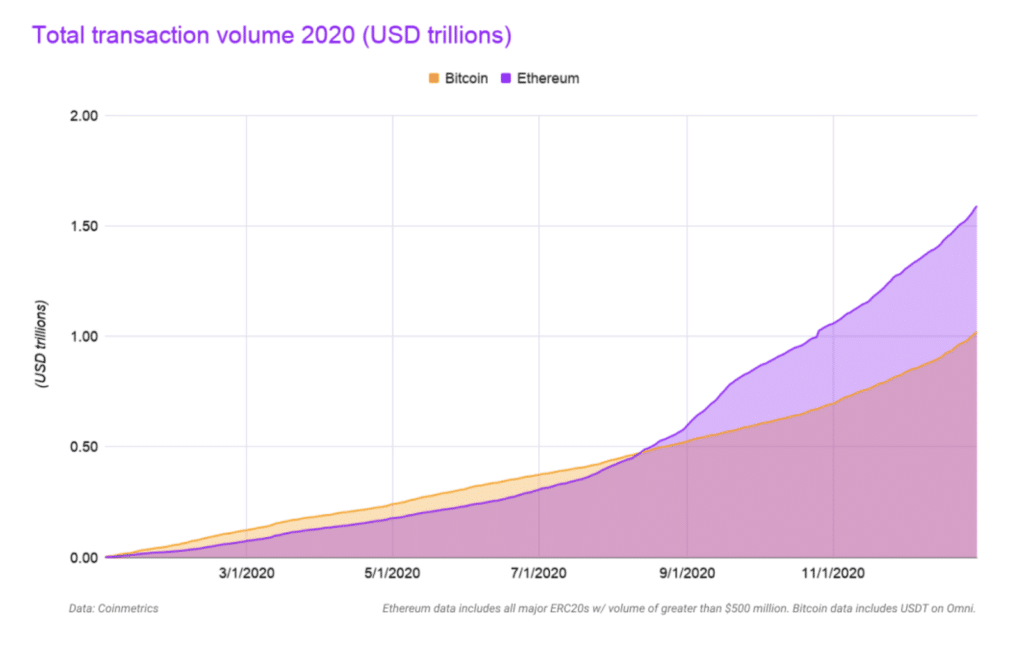

Josh Stark of the Ethereum Foundation and Evan Van Ness of the Week in Ethereum newsletter, published a 2020 year in review for the second-largest blockchain by market cap. The first takeaway was that 2020 was the first year in which Ethereum transferred the most value — $1.6 trillion worth of assets, 60% more than Bitcoin’s $1 trillion.

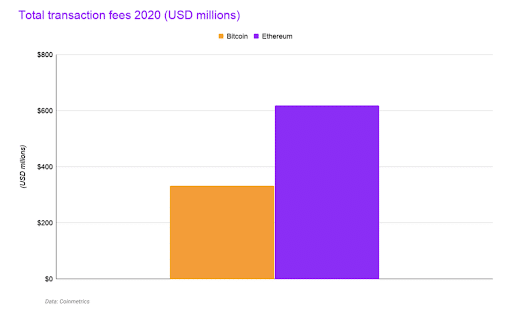

Transaction fees on Ethereum, at more than $600 million, were also almost double that of Bitcoin’s.

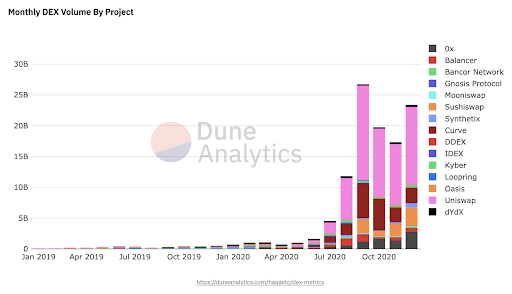

Another trend cited was the growing creator economy on Ethereum, with crypto art volume totalling $23 million, which sounds small, but makes it about 5% of the $500 million paid out by Patreon to its creators in 2019. The report also noted the rise in decentralized exchanges, with volumes averaging between $17 billion and $26 billion in the fall.

Coinbase Institutional’s 2020 Year in Review report also saw an increased number of institutional clients investing in ether, which will also get a boost next month when CME launches ether futures contracts. CoinDesk quotes Denis Vinokourov, head of research at digital asset prime broker Bequant, who says that many see ETH as a way to get indirect exposure to DeFi protocols. He says, “Not everyone is comfortable with the risks that are still associated with DeFi, but the hyper growth of these projects boosts activity on the Ethereum network and, thus, supports capital appreciation.”

Coinbase Institutional’s 2020 Year in Review report also saw an increased number of institutional clients investing in ether, which will also get a boost next month when CME launches ether futures contracts. CoinDesk quotes Denis Vinokourov, head of research at digital asset prime broker Bequant, who says that many see ETH as a way to get indirect exposure to DeFi protocols. He says, “Not everyone is comfortable with the risks that are still associated with DeFi, but the hyper growth of these projects boosts activity on the Ethereum network and, thus, supports capital appreciation.”

Meanwhile the Ethereum Foundation and Reddit announced a partnership to “help accelerate the progress being made on scaling and develop the technology needed to launch large-scale applications like Community Points on Ethereum.”

Grayscale Files for Several New Trusts, Including Some in DeFi

On Wednesday, Grayscale Investments, the largest digital asset manager, filed for five new trusts for crypto assets: Aave, Cosmos, Polkadot, Monero and Cardano. Over the weekend, CoinDesk reported that Grayscale had also registered trusts for Chainlink, Decentraland, Livepeer, Tezos and Filecoin.

It’s perhaps not surprising a few of these are DeFi-related. The Block reports that OTC desks are seeing an uptick in interest in DeFi. Genesis is seeing trades in DeFi coins such as UNI, CRV and SUSHI. Richard Rosenblum, founder of GSR Trading, said, “now that BTC has had time to calm down, people are looking for the next thing to invest in.” Similarly, volumes on dexes hit $45 billion in January, more than double compared to December.

Paradigm’s Guide to Optimistic Rollups

Paradigm published an in-depth explainer on how Optimistic Rollups work. It starts with the problem of the system wanting to scale without losing its properties of low-cost and low-trust, both of which help keep the system decentralized. It explains that the route Optimistic Rollups take in scaling is to limit on-chain transactions and to use fraud proofs to cancel invalid “state transitions.” Since fraud proofs are on-chain, it also has a method to disincentivize fraud, called a fidelity bond, required from so-called sequencers, who store and execute those off-chain transactions and submit a minimal amount of data about them called merkle roots to the Ethereum blockchain. If a sequencer’s data is proven to show fraud, then that bond would be slashed and distributed to the so-called verifiers, whose role is to watch for fraud. It’s a complex system, but Paradigm does a great job of explaining how it works, for those inclined to learn more about what is likely to be the short- to medium-term scaling solution for Ethereum.

For the Math-Minded, Vitalik’s Introduction to zk-SNARKs

Another possible scaling solution for blockchains is zk-SNARKs, which Vitalik Buterin, the creator of Ethereum, recently cited as the most promising long-term solution, as the technology improves. This week, in a new blog post dedicated specifically to zk-SNARKs, he explains how they make possible solutions to two problems that blockchains face: scalability and privacy. As he describes it, “A zk-SNARK allows you to generate a proof that some computation has some particular output, in such a way that the proof can be verified extremely quickly even if the underlying computation takes a very long time to run.” Also, he adds — and this is the part that makes it a potential privacy solution, “The “ZK” (“zero knowledge”) part adds an additional feature: the proof can keep some of the inputs to the computation hidden.” He says that this would make it possible to prove that you have the right to transfer some asset without revealing which asset you received. He says, “This ensures security without unduly leaking information about who is transacting with whom to the public.” Those are the main takeaways, but for those interested in the details about how this works, he goes into detail on it — just a warning that it requires a fair bit of math.

Crypto Twitter Can’t Stop With GameStop

If, like me, you can’t get enough of this game of chicken between Redditors and the 0.1%, here is a roundup of choice tweets from Crypto Twitter.

Author and speaker Andreas Antonopoulos tweeted, “Time to regulate ‘outsider trading’

LOL”

Time to regulate "outsider trading"

LOL

— Andreas (aantonop Team) (@aantonop) January 28, 2021

Elizabeth Stark, CEO of Lightning Labs, tweeted, “2008: Too big to fail

2021: Too small to win”

2008: Too big to fail

2021: Too small to win

— elizabeth stark ⚡ (@starkness) January 28, 2021

Jake Chervinsky, general counsel at Compound Labs, tweeted, “Imagine the SEC denying a bitcoin ETF proposal because of market manipulation concerns after all this.”

Imagine the SEC denying a bitcoin ETF proposal because of market manipulation concerns after all this.

— Jake Chervinsky (@jchervinsky) January 27, 2021

Tyler Winklevoss, CEO of Gemini, tweeted, “If I was the CEO of GameStop $GME, the next move would be to purchase #Bitcoinand put it on the balance sheet.”

If I was the CEO of GameStop $GME, the next move would be to purchase #Bitcoin and put it on the balance sheet.

— Tyler Winklevoss (@tyler) January 26, 2021

Many took the opportunity to promote DeFi, with Ryan Adams tweeting:

Robinhood just banned Gamestop and AMC!

The wrong people are winning so they delisted the assets.

Here’s what they don’t know…

They just recruited another 1m people into DeFi.

UNISWAP NOT ROBINHOOD

PROTOCOLS NOT BANKS

This is why we go bankless.

Robinhood just banned Gamestop and AMC!

The wrong people are winning so they delisted the assets.

Here's what they don't know…

They just recruited another 1m people into DeFi.

UNISWAP NOT ROBINHOOD

PROTOCOLS NOT BANKS

This is why we go bankless.

— RYAN SΞAN ADAMS – rsa.eth 🦄 (@RyanSAdams) January 28, 2021

Soona Amhaz of Volt Capital tweeted, “Robinhood isn’t fit to be called that anymore.”

https://twitter.com/soonaorlater/status/1354789344704397312