June 17, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

-

Finblox, a crypto yield platform, announced a $500 daily withdrawal limit and a $1,500 maximum monthly withdrawal limit for all users in light of a “highly volatile market” and due to their relationship with Three Arrows Capital.

-

Tron DAO Reserve announced that it is withdrawinganother $180 million worth of TRX from various exchanges to help support the USDD peg.

-

Elon Musk is being sued for $258 billion over Dogecoin.

-

Circle announced the launch of Euro Coin this week, a fully-reserved, Euro-backed stablecoin.

-

Inverse Finance was exploited for $1.2 million in a flash loan attack.

-

xDEFI, a crypto wallet, added support for Arbitrum.

-

Huobi is shutting down in Thailand after the country revoked the exchange’s operating license.

-

BitMEX co-founder Benjamin Delo was sentenced to 30 months probation.

Today in Crypto Adoption…

-

McKinsey believes the metaverse could be worth $5 trillion by 2030.

The $$$ Corner…

- Animoca Brands acquired an 80.45% stake in blockchain education platform TinyTap for $38 million in cash and shares.

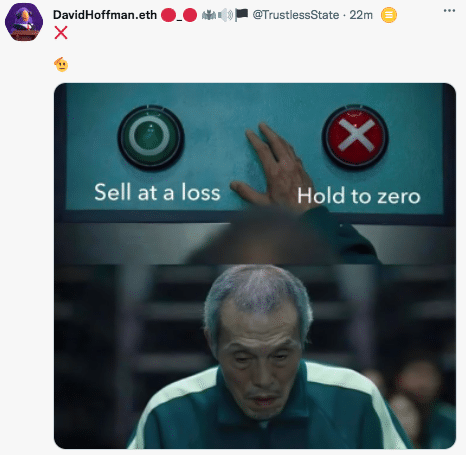

What Do You Meme?

What’s Poppin’?

Here’s the Latest on Celsius

Investors in the crypto lender Celsius are “unlikely” to provide more funds to bail out the crypto lender, according to a reportfrom the Wall Street Journal. The article names previous investors such as Caisse de dépôt et placement du Québec, a Canadian pension fund, and WestCap Group as entities that are not interested in providing more capital to Celsius at this time.

The news coincides with a report from Reuters stating that regulators across a variety of states are beginning to investigate Celsius Network in lieu of its decision to freeze customer withdrawals. Reuters says that state securities regulators in Alabama, Kentucky, Texas, and New Jersey are looking into the matter, with Texas regulators specifically being quoted as making the probe a “priority.”

“I am very concerned that clients—including many retail investors—may need to immediately access their assets yet are unable to withdraw from their accounts,” said Joseph Rotunda, Texas State Securities Board’s director of enforcement, to Reuters. “The inability to access their investment may result in significant financial consequences.”

Rotunda also mentioned that regulators have been in touch with Celsius since Monday, a day after Celsius announced to its 1.7 million customers that it was pausing withdrawals.

There has been little else communicated from Celsius since their Monday statement to users about halted withdrawals. On Wednesday, CEO Alex Mashinsky tweeted that the lender was “working non-stop,” though he did not disclose any details about what the team was working on. One course of action that is being hinted at is a financial restructuring. The Block reportedearlier this week that Citigroup was brought on to the case by Celsius to advise on possible financing options, such as an offer from rival crypto lender Nexo to acquire Celsius’ assets. Furthermore, Celsius also hired restructuring attorneys from Akin Gump Strauss Hauer & Feld LLP.

Recommended Reads

-

SEC Commissioner Hester Peirce on the bitcoin ETF:

-

Vitalik Buterin on using ZK-SNARKs:

-

The DeFi Edge on 3AC (slight correction: 3AC is mostly a proprietary trading firm):

On The Pod…

Mika Honkasalo, independent crypto researcher, discusses what is happening with Celsius and Three Arrows Capital, the importance of having proper risk management, and the contagion effects on the industry.

Show highlights:

-

why is it so significant that Celsius paused withdrawals

-

what is stETH and why is it important to understand the Celsius situation

-

how the Luna/UST debacle started a contagion effect in the crypto space

-

why Celsius’s investors won’t bail the company out

-

what will happen to Celsius’s retail customers

-

what Three Arrows Capital (3AC) is and whether they have a solvency problem

-

how 3AC was levered long and whether they had poor risk management

-

who will be hurt if 3AC goes under

-

what would be the effect of 3AC and Celsius collapsing

-

which types of funds that Mika will be eyeing to see if they also end up in a similar situation to 3AC and Celsius

-

why Mika would counsel anyone who keeps their money with centralized crypto lenders to scrutinize their practices

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians