PLUS: Bitcoin as a Chinese weapon????

After years of regulatory obscurity, the SEC will be releasing its internal communications to Ripple on how it determines if a cryptocurrency is a security or not. Whether that will help or hinder Ripple’s case in the SEC’s lawsuit against the company remains to be seen, but it should help the general public better understand the SEC’s stance on crypto. In other regulatory news, the Crypto Council for Innovation, an alliance of leading crypto companies, launched this week with hopes to direct public policy towards responsible acceptance of crypto technology.

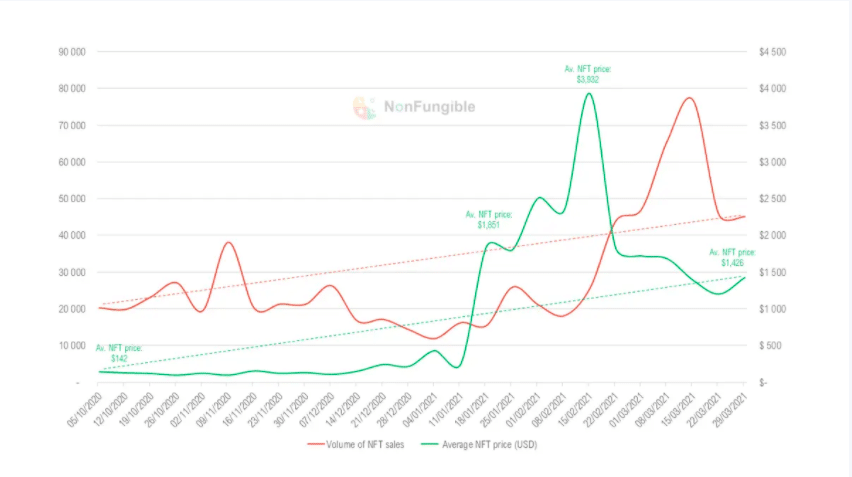

In the world of crypto acronyms, NFTs took a bit of a dip, with the average price dropping from a peak of $4,000 to $1,500 in a little over a month. The NFT correction did not stop the wacky NFT headlines as Tom Brady, Brian Armstrong, and Forbes made NFT adjacent news. Grayscale also published plans to launch its own three-letter acronym in a blog post that outlined its intention to convert the fabled GBTC into an ETF. The digital asset firm refrained from setting a timeline on the conversion, mentioning they are confident in their current position with the SEC. Meanwhile, NYDIG, the New York Digital Investment Group, announced a $100 million funding round, adding to its recent $200 million raise last month.

In other news, Signal, an encrypted messaging app, is launching a payment feature using the cryptocurrency MobileCoin. The stablecoin protocol Fei has proven to be somewhat unstable after its billion-dollar launch left users unable to sell the coin due to a vulnerability in its software. Lastly, the WSJ published a timely article analyzing China’s digital yuan just a few days before Peter Thiel’s head-scratching comments about Bitcoin as a Chinese financial weapon.

On Unchained, Mark Cuban — billionaire investor, owner of the Dallas Mavericks, and Shark Tank “shark” — discusses the ETH vs. BTC store of value debate, issues that are holding back DeFi, his NFT investment thesis, and a few different NFT use cases. And on Unconfirmed, Larry Cermak, director of research at The Block, talks about the upcoming Coinbase direct listing in light of its astounding Q1 revenue performance.

A note on last week’s newsletter regarding Outlier Ventures: I reported the Web 3 accelerator had raised a funding round of $350 million — only to find that recent podcast guest Jamie Burke was playing a well-executed April Fool’s prank.

Listen to the Latest Episode of Unchained

Mark Cuban on Why He Thinks ETH Is a Better Store of Value Than BitcoinMark Cuban — billionaire investor, owner of the Dallas Mavericks, and Shark Tank “shark” — shares his thoughts on the Ethereum vs. BTC debate, issues with DeFi, and how NFTs could change content distribution.

Listen to the Latest Episode of Unconfirmed

Larry Cermak, director of research at The Block, discusses the upcoming Coinbase direct listing in light of the exchange’s recently released Q1 revenue hitting an impressive $1.8 billion.

Thank you to our sponsors!

Download the Crypto.com app and get $25 with the code “Laura”:

Check out InterPop, a superteam redefining the future of NTFs and fandom!

This Week’s Crypto News…

Crypto Industry Leaders Forge Alliance to Champion Digital Currencies

The Crypto Council for Innovation, a group consisting of Fidelity, Coinbase, Square, and Paradigm, launched on Tuesday to lobby governments and institutions on crypto-related policy. The CCI will provide extensive informational resources aiming to educate crypto participants, policymakers, and governmental bodies on the benefits of using cryptocurrencies.Gus Coldebella, chief policy officer at Paradigm and one of the CCI organizers, suggests the CCI’s work “will require sharing insights and analysis about crypto while correcting the misperceptions that inevitably accompany a transformative new technology.”

The Council’s inception comes in the same week that, in a letter to shareholders, JPMorgan CEO Jamie Dimon, who infamously declared bitcoin a fraud in 2017, included the “regulatory status of cryptocurrencies” as an emerging issue the U.S. must deal with if it is to bounce back from the economic fallout from COVID-19. Regulations regarding crypto remain rather complicated at the moment. For example, the SEC claims authority over most Ethereum-based tokens while the CFTC oversees Bitcoin-adjacent assets like futures and options contracts.

Grayscale States Intention to Launch an ETF

Grayscale, the world’s largest digital asset manager, is “100% committed to converting GBTC into an ETF,” according to a Medium post published by the company. The Grayscale Bitcoin Trust was the first publicly traded bitcoin fund launched in the United States and helped Grayscale become the first and only company to convert a bitcoin fund into an SEC reporting company.

Grayscale first applied for a bitcoin ETF in 2016 but withdrew the filing due to an immature regulatory environment surrounding digital assets. The investment company has not submitted another ETF filing, declaring only that the regulatory environment will drive the timing of its next application. Shareholders of GBTC will see their fees go down when the fund is converted to an ETF.

Meanwhile, alternative asset manager NYDIG secured another $100 million in funding just one month after announcing a $200 million round. The additional capital comes from Starr Insurance and Liberty Mutual. They join the previous round of investors, including Stone Ridge Holdings, Morgan Stanley, New York Life, MassMutual, and Soros Fund Management.

NFT Market Correction Doesn’t Slow Down the NFT Craze

The NFT market seems to have corrected. The average price of an NFT dropped from its February peak of $4,000 to $1,500 at the start of April, with trade volume mimicking the mountainous rise and fall of average NFT prices, peaking at ~80,000 weekly trades before settling at ~45,000 in early April. However, before you go out and sell all of your NFTs, the current average price of $1,500 represents a 10x increase in the average cost of an NFT from six months ago, and NFT weekly trade volume has more than doubled compared to Q4 of 2020.

As if to spite the bubble-popping narrative, the NFT headlines were just as wacky as usual — if not more so. A few of the more interesting stories include…

- Tom Brady and Peyton Manning are now fighting for NFT supremacy. Brady, the seven-time Super Bowl champion, is launching an NFT platform called Autograph, seeking to extend the idea of an autograph into the digital world. Manning, along with his brother Eli, is set to launch the Manning Legacy Collection, made up of eight unique art pieces, through MakersPlace on April 16th.

- Forbes dropped an NFT of its recent Winklevii profile on Nifty Gateway. The cover, depicting Cameron and Tyler Winklevoss smiling behind the title “A New Billionaire Every Day,” sold for $333,333. The proceeds will go to the Committee to Protect Journalists and The International Women’s Media Foundation.

- Two Coinbase employees decided to get married on the blockchain. The happy couple exchanged NFTs in addition to the traditional swap of rings, cementing their marriage on Ethereum for all-time.

- As if Brian Armstrong doesn’t have enough going on right now, the Coinbase CEO is collaborating with DJ DAVI to produce electronic music — a skill he picked up during COVID last year. The songs will be released as NFTs.

If you want a deeper understanding of how NFTs work or what they may become, I highly recommend a16z’s NFT Canon, a carefully curated collection of articles and resources for the NFT curious.

Ripple Wins Lawsuit for Access to Internal SEC Communications on Crypto

In December, the SEC announced a lawsuit against Ripple Labs, claiming that XRP was a security and that the company had raised more than $1.3 billion in unregistered offerings. On Tuesday, Ripple Labs won a discovery ruling that will require the SEC to hand over internal communications on how it determines whether a cryptocurrency is a security. The SEC does not consider Bitcoin and Ether to be securities, but has not issued any formal guidance explaining how it arrived at those conclusions. Ripple likely hopes the SEC mentions XRP as a virtual currency similar to BTC and ETH — which would help its case to be treated as a non-security. Barring a blatant mention of XRP in the same vein as Bitcoin and Ethereum, the ruling could still offer the general public its first in-depth look at how the SEC regulates crypto.

Ripple Lab’s token, XRP, is up nearly 20% since the report broke.

VC-Backed Stablecoin Protocol Fei is Off to a Shaky Start

FEI, an algorithmic stablecoin pegged to the dollar, recently concluded its Genesis event. In total, the protocol minted 1.3 billion of its FEI tokens. As a stablecoin, FEI got off to a shaky start, trading between $.05 and $.10 off of the targeted $1 mark for the first few days before tanking to under $.80 on Thursday.

The situation emphasizes the difficulties in creating an algorithmic stablecoin. The protocol aimed to create a stablecoin that would purchase assets outright with its token rather than holding them as collateral (like a Tether); FEI is created with a trade instead of debt.

However, a vulnerability in its incentive mechanism made it prohibitively expensive for users to sell in the days following the Genesis event. To enforce its peg, Fei had established a Uniswap burn penalty that penalizes traders for transacting with FEI under its $1 peg and a reweight of FEI tokens on Uniswap that burns under-pegged tokens — thereby increasing demand back to $1. However, eventually, the penalty became so high that, at times, the burns would exceed 100% of a trade’s value, effectively making the token worthless when attempting to sell it on Uniswap. Additionally, the team was alerted to a bug via its bug bounty program and so had to suspend the minting rewards that come with buying FEI, leaving only the sell disincentives.

FEI currently has a market cap of $1.6 billion.

Messaging App Signal to Integrate Cryptocurrency Payment Feature

Signal, an encrypted messaging app, is rolling out payments using the cryptocurrency MobileCoin. Unlike WhatsApp and iMessage, which allow payments to be sent via bank accounts, Signal is looking to provide a way to send money that nobody outside the sender or recipient can track. While Zcash and Monero are the most popular cryptocurrencies with that sort of privacy capability, Signal chose MobileCoin for its user experience, minimal storage requirements, and quick transaction time. In a blog post announcing the news, Signal clarified that it would not have access to user balances, transaction history, or funds.

While many in the crypto community expressed excitement, there were a few dissenting voices. Matt Corallo, a developer at Square Crypto, tweeted, “there is no technical justification for Signal requiring its own blockchain in order to get the payment throughput they want. There is no reason at all for requiring the token issuance go entirely to the small number of founders except to maximize profits. There is zero reason even to require their own token at all, when this could absolutely have been built using existing cryptocurrency systems pegged to traditional fiat currencies, which would offer significantly better UX and avoid the massive value-fluctuation risk that Signal is now hoisting onto its userbase.”

China’s Digital Currency Headstart

The Wall Street Journal wrote an in-depth analysis of China’s digital yuan, calling it “a first for a major economy.” It launched through a mobile app that has since been downloaded over 100,000 times. The government-issued digital money can be used to track people’s spending in real-time, speed relief to disaster victims, or flag criminal behavior. The article also notes, “The money itself is programmable. Beijing has tested expiration dates to encourage users to spend it quickly, for times when the economy needs a jump start.” However, it adds that the digital yuan may also be used to tighten President Xi Jinping’s authoritarian rule as a tracking tool — making it possible to collect fines as soon as an infraction is committed.

The article also points out the digital yuan could undermine the supremacy of the dollar, saying, “It would provide options for people in poor countries to transfer money internationally. Even limited international usage could soften the bite of U.S. sanctions, which increasingly are used against Chinese companies or individuals. Josh Lipsky, a former International Monetary Fund staffer now at the Atlantic Council think tank, said, ‘Anything that threatens the dollar is a national-security issue. This threatens the dollar over the long term.’” The WSJ notes that a Chinese marketing campaign depicts a man in an American flag shirt being knocked out by an animated digital yuan.

Conversely, PayPal co-founder Peter Thiel wondered if Bitcoin should be considered a Chinese financial weapon against the U.S. His comments, especially coming from someone who considers themselves a Bitcoiner, brought out vociferous opposition from Crypto Twitter. As Nic Carter tweeted:

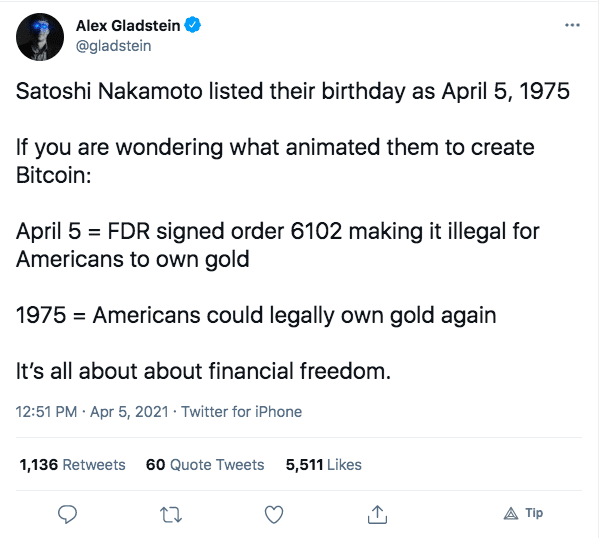

Happy Birthday, Satoshi!

Happy 45th birthday to Satoshi! (maybe)

The pseudonymous Bitcoin creator celebrated his birthday on April 5th. On Twitter, Alex Gladstein, chief strategy officer at the Human Rights Foundation, offered some insight on why Satoshi may have chosen that particular date: