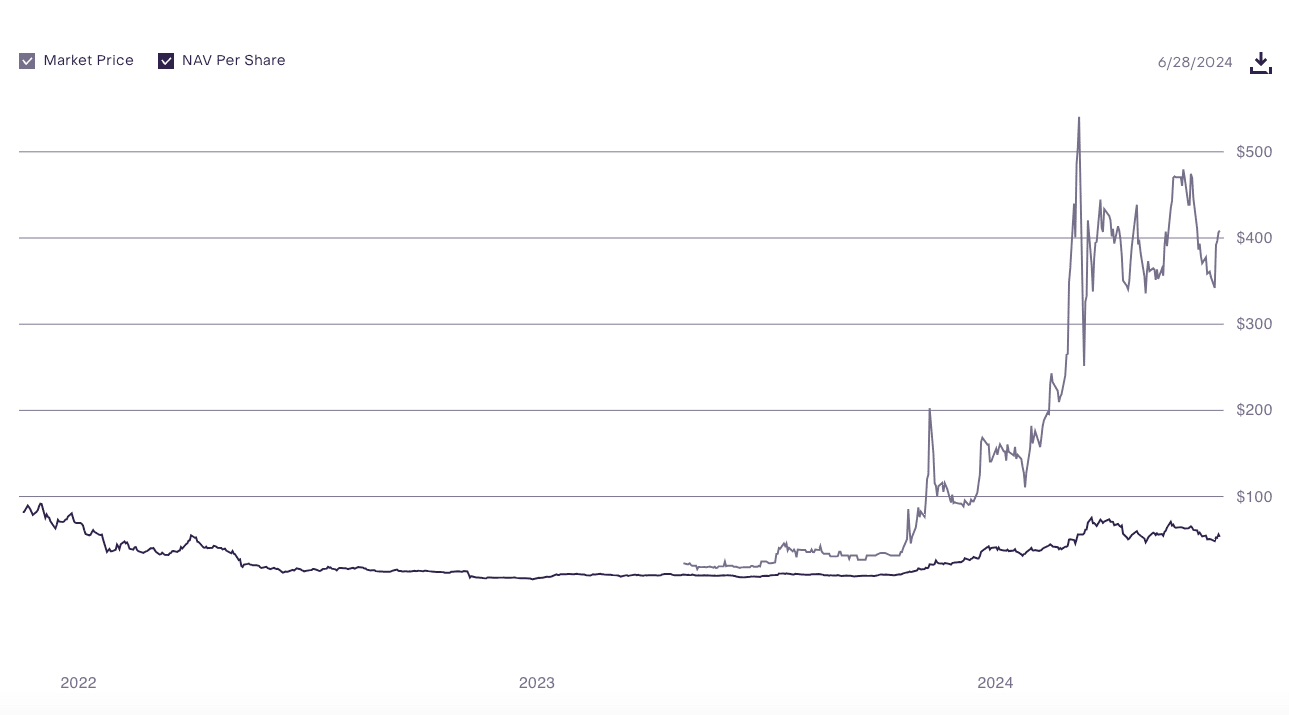

After VanEck filed on Thursday for the first Solana spot ETF in the U.S., followed by 21Shares submitting its application on Friday, Grayscale’s Solana Trust (GSOL) continues to trade at a significant premium, with the latest data showing a market price per share of $408 against a NAV (Net Asset Value) of $52.62, compared to $396 against a NAV of $51.59 on Wednesday, the day before VanEck’s filing.

This means that investors are still willing to pay much more for shares of GSOL than the actual value of the underlying assets, which is known as trading at a premium to NAV.

Grayscale’s trusts are closed-end funds that have a limited number of shares, meaning new purchasers need to buy from existing holders, in contrast to open-ended funds whose shares are regularly issued and redeemed based on investor demand. Even when they trade at a higher relative to the price, investors can still prefer them because these trusts can more easily be placed into tax-advantaged accounts than spot crypto assets.

Su Zhu, cofounder of defunct crypto hedge fund Three Arrows Capital, commented on X that GSOL “is implying $1k per SOL” and that “the numbers are very similar to when ETH was $200 but [ETHE] implied $1k, in 2020.”

GSOL is not the only Grayscale trust trading at a premium. Its Chainlink, Filecoin, and Stellar trusts are also trading well above their respective net asset values.

A Commentary on SOL ETF Prospects

Still, if the Solana spot ETF was expected to be approved, it would likely lead to a reduction in the premium at which GSOL is trading. A spot ETF would offer investors a more direct and cost-efficient way to invest in Solana, aligning its price more closely with the underlying asset’s value. As a result, investors might shift their funds to the new ETF, leading to decreased demand for GSOL shares and consequently reducing the premium.

However, as is evident from the data, this is not happening, thus likely conveying that investors are not confident that the ETF will be approved anytime soon.

Why VanEck Filed Now

However, some commentators are suggesting the timing of the filing could be opportune. Scott Johnsson from Van Buren Capital suggested that the timing of VanEck’s filing may have been influenced by the upcoming U.S. elections.

Commenting right after the filing, he posted on X, “SOL bags just got a bigger election outcome catalyst. Not great for Biden at the margins.” Johnsson implies that because approval of a spot Solana ETF becomes more likely if there is a change in the administration, Solana holders may be more inclined to vote against President Biden, whose administration has been unfriendly toward the industry.

X user @Evanss6 pointed out that the deadline to move the SOL ETF approval along could coincide with the potential departure of Biden and Gensler in the coming months.