New York Attorney General Letitia James has fined Galaxy Digital and several subsidiaries collectively $200 million in disgorgement over three years because of its failure to disclose its sale of Luna tokens while it was promoting them to the public.

An Assurance of Discontinuance filed Monday on the NYAG’s website revealed that the AG had begun an investigation into market manipulation by Galaxy Digital Holdings, Ltd. and related entities for violation of the Martin Act, which prohibits fraudulent practices related to the purchase, sale, promotion and advertisement of securities and commodities. (According to definitions of the Martin Act, the AG filing states LUNA would be considered both a security and a commodity. The Martin Act also gives the AG broad authority to bring fraud charges without proving the intent to defraud ).

Although Galaxy and the other defendants named in the Assurance did not admit or deny the AG’s findings, they agreed not to violate any applicable laws. For instance, they agreed to refrain from making favorable public statements about a cryptocurrency in exchange for compensation or other benefit without full disclosures, among other requirements.

In addition, the monetary relief Galaxy will pay to the state of New York is $40 million with 15 days of the filing on March 24th, $40 million within one year of that date, $60 million within two years, and $60 million within three years.

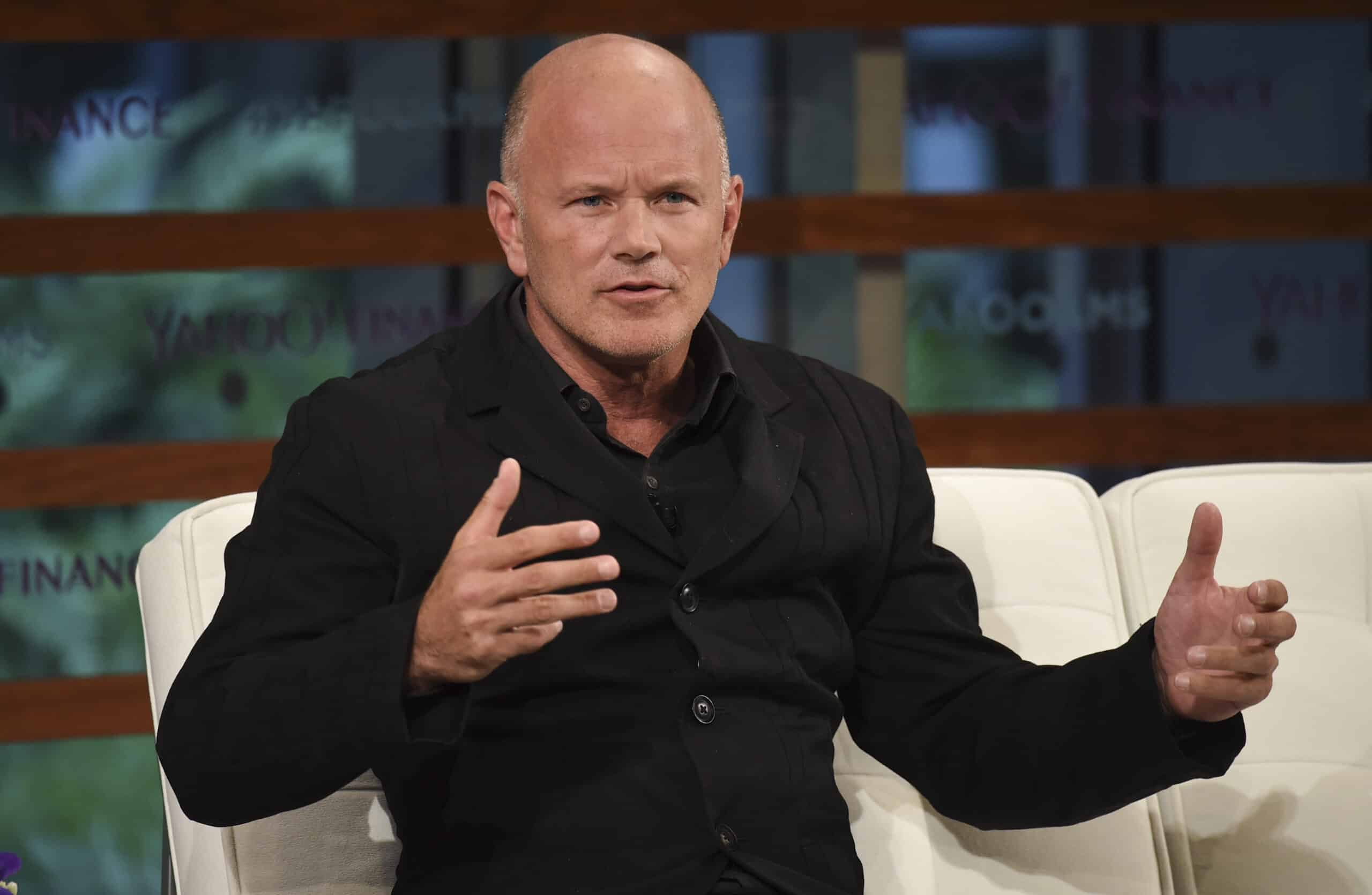

In response to Unchained’s request for comment, Mike Novogratz, CEO and Founder of Galaxy, said, “This was not an easy decision and one that we considered carefully. Settling this matter will help Galaxy move forward and minimize distractions so that we can focus on our mission of driving innovation and growth in digital assets and artificial intelligence infrastructure. Do Kwon and Terraform, the creators of LUNA, deceived us and many other prominent institutional investors. Over the last few years, Galaxy has cooperated fully with regulators – including the New York Attorney General. Indeed, the SEC relied on our former employee’s testimony in its case against these bad actors. We only recently became aware that the NY Attorney General was going forward with this matter, which led to settlement discussions that culminated with the outcome today.”

Galaxy’s Sweet Deal

In August 2020, Terraform Labs was looking for a “good advocate in the west,” so it made an offer to Galaxy’s ventures team: Galaxy could receive a preferential deal if it agreed to promote the token publicly. During their negotiations Terraform Labs cofounder Do Kwon revealed that the most generous offer had been for a 30% discount with a 12-month lockup.

What Galaxy was able to get was far sweeter: it would receive 18 million tokens over the course of a year, in monthly tranches, at a price of $0.22, representing a 30% discount on the market price with the tokens vesting monthly as well. This meant Galaxy would be able to sell the tokens they received every month.

Novogratz Cries Wolf

After Galaxy began posting about LUNA on social media in late 2020, LUNA gained traction and its price rose from around $0.31 in October 2020 to $119 by April 2022. Galaxy’s founder and CEO Mike Novogratz was a vocal backer of LUNA during this time, famously unveiling a tattoo inspired by the token after it reached the $100 mark.

“But while Novogratz posted pictures of his tattoo and expressed his Luna bullishness to the public, Galaxy sold millions of tokens into the market at many multiples of its initial cost without disclosing that it was selling,” read the filing.

Novogratz made numerous social media posts and public media appearances talking up LUNA, including a 2021 interview with Unchained where he said “one of the cool things about Luna is this Chai payment system,” claiming that it accounted for 7% or 8% of all payments in South Korea.

The NYAG’s assurance says this statement was partly false and partly misleading. Not only did Chai represent less than 1% of total transactions in South Korea, Chai did not actually run on the Terra blockchain either. The filing notes that Galaxy did not “take sufficient steps to verify” that the assertions were true.

On March 2, 2021, on Twitter, Novogratz praised Terra founder Do Kwon as an innovator who was “well on his way to being the next SBF [Sam Bankman-Fried].”

That same day, Galaxy received over 1.5 million LUNA tokens from Terraform Labs — Galaxy sold the entire batch the very next day at prices ranging from $7.35 to $7.70.

In the fall of 2021, the assurance notes multiple instances of bullish posts by Galaxy founder Mike Novogratz as well as a research report giving a positive mention to LUNA along with other well-regarded cryptos such as ETH and SOL, timed near sales of LUNA at prices ranging from $43 in October to $73 in December.

In December of that year, Novogratz tweeted he would get a tattoo commemorating LUNA breaking $100. The filing notes multiple instances of Novogratz tweeting bullish sentiment about LUNA timed near, and sometimes on the same day as, Galaxy’s sales of LUNA into the public markets, without disclosure.

On Jan. 4, Novogratz posted a photo of his LUNA tattoo of a wolf howling at the moon. Between Jan. 5 to Jan. 13, Galaxy netted more than $104 million from sales of LUNA at prices between $69 to almost $85, and from Jan. 17, 2022, to Jan. 22, 2022, Galaxy sold LUNA tokens at prices ranging mostly from around $60 to $85 and netted over $7 million from the sale.

On Jan. 22, he noted LUNA’s price volatility to his Twitter followers, urging them, “Keep the faith” without disclosing any of Galaxy’s sales at the time. Galaxy sold an additional 1.1 million Luna in the following days, netting $68.4 million.

Exit Strategy

The firm continued to sell tokens through February from their initial purchase in October 2020, and was left with just 2,060 LUNA on its books by the end of that month.

In March 2022, the firm’s research arm Galaxy Digital Research warned that LUNA might be subject to “the risk of a death spiral,” in which significant sales could result in a bank-run-like scenario. Although this risk had always been present, it was the first time the research group had mentioned it in a report.

In a public appearance at the Barclays Crypto and Blockchain Summit on March 30, 2022, Novogratz said that Galaxy had “made a whole lot of money being long his [Do Kwon’s] tokens.”

The NYAG’s report says, “Novogratz’s statement failed to disclose that Galaxy had sold its tokens all along, on most occasions right after receiving them, and that on the date of his statement, Galaxy held minimal Luna tokens.”

It wasn’t until the next day that Galaxy disclosed LUNA (along with Bitcoin and Ether), was one of the largest contributors to net realized gains on digital assets. At this point, Galaxy had sold nearly all of its LUNA tokens.

After LUNA’s collapse in May 2022, Galaxy reported a $300 million loss for that quarter, but said it maintained a $1.6 million liquidity position.

Editor’s Note – 3:30pm EST: Story updated to include comment from Galaxy founder and CEO Mike Novogratz