September 1, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

- Offchain Labs, the developer behind Arbitrum, an Ethereum L2 solution, launched its mainnet, dubbed Arbitrum One and announced a $120M Series B raise yesterday.

- El Salvador’s Congress approved a $150M fund to help facilitate fiat-BTC conversions.

- Larva Labs (the company behind CryptoPunks, Meebits, and Autoglyphs) signed a deal with United Talent Agency (UTA), representing the NFTs across film, TV, video games, publishing, and licensing.

- Syndicate, an community investment DeFi protocol, raised a $20M Series A.

- For the week ending August 27th, Bitcoin investment products saw outflows for the 8th consecutive week.

- MetaMask hit 10M+ monthly users in July, marking an 1800% increase compared to last year.

- Tether asked the New York Supreme Court to block the NYAG’s office from releasing documents to CoinDesk.

What Do You Meme?

What’s Poppin’?

FTX.US, the affiliate of Sam Bankman Fried’s crypto exchange FTX, announced its first acquisition yesterday. The company has bought LedgerX, a crypto derivatives exchange, for an undisclosed sum. The deal, if completed, could close as soon as October.

This is big news, as it signifies that FTX.US is planning to offer crypto derivatives in the US — something competitors like Coinbase, BinanceUS, or Kraken do not yet support.

Notably, LedgerX is a Commodity and Futures Trading Association (CFTC)-regulated crypto derivatives exchange. The newly acquired company has already done much of the regulatory legwork for FTX.US. Back in 2017, LegerX fell into the crosshairs of the CFTC after announcing the launch of its derivatives products without first obtaining the necessary licenses, which led to its two co-founders going on administrative leave.

Since then, LedgerX, led by a new management team, has checked all of its regulatory boxes. The company has already submitted and been approved for a derivatives clearing organization (DCO) license, a designated contract market (DCM) license, and a swap execution facility (SEF) license from the CFTC. Furthermore, the exchange is already functional, offering futures, options, and swaps on BTC and ETH, allowing FTX.US to enter the derivatives game quickly and efficiently.

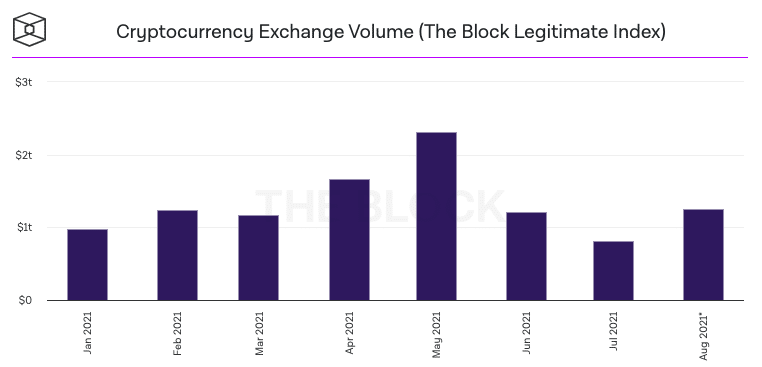

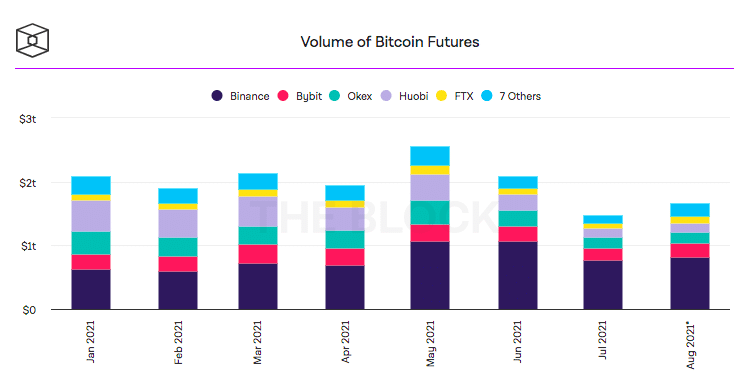

Brett Harrison, President of FTX.US, described the acquisition as a “significant milestone” for the company. Looking at the crypto market, it makes sense why Harrison would be thrilled about the purchase. Crypto derivatives, which are financial products based on the price of an asset rather than the actual asset itself, actually make up a larger market than crypto spot trading, as you can see from the charts below. For example, data from The Block shows that Bitcoin futures volume YTD sits at roughly $15.85T, while Bitcoin spot volume is at $10.66T.

Zach Dexter, LedgerX co-founder and CEO, also expressed optimism for the deal. “US crypto derivatives is an incredibly underserved market, and it took time and resources for us to become a regulated entity under the existing frameworks,” said Zach. “FTX.US has taken the view, which we share, that US regulators are ready and willing to partner on innovative products, and it’s the responsibility of the industry as a whole to step up and work with agencies like the CFTC.”

According to a Forbes report, Harrison plans to merge LedgerX and FTX.US product offerings into one platform.

Recommended Reads

- Sam Trabucco on adapting in the crypto world:

- HackerOne on DeFi bug bounties:

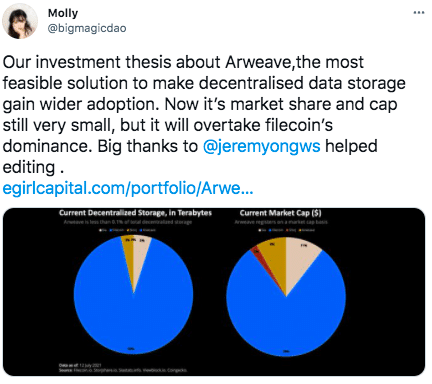

- eGirl on Arweave:

On The Pod…

How Pplpleasr Helped Fortune Magazine Sell More Than $1 Million in NFTsPplpleasr, the artist behind Fortune magazine’s recent crypto cover and Uniswap’s V3 announcement animation, talks about her crypto journey and how NFTs are changing the game for creators. Show highlights:

- how not getting a job at Apple changed her life forever

- how the Pplpleasr-Uniswap collaboration came about

- what goes into her creative process

- how Pplpleasr got hired for the Fortune magazine cover

- why she chose to represent anon-avatars on the Fortune cover

- why Pplpleasr was surprised by Fortune’s response to her artwork (and crypto in general)

- what sort of crypto personas are represented on the Fortune cover and why

- how NFTs are changing the paradigm of monetization for creators compared to the traditional art world

- what pplpleasr is looking forward to in future NFT smart contracts

- why NFTs are still limited right now

- why institutions, like Budweiser and Visa, are suddenly interested in NFTs

- what Fortune is doing to grow its NFT collection

- how DAOs are changing art curation and collecting

- why Pplpleasr was surprised that a DAO (bearing her name) purchased the Uniswap V3 animation

- where Pplpleasr thinks the NFT space will go in the next year or so

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians