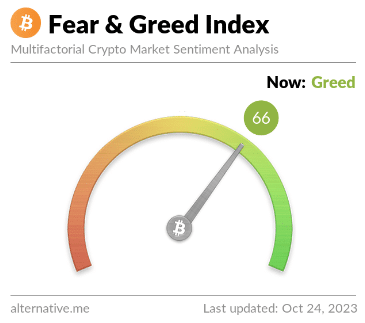

Human sentiment is an essential driver of prices in the crypto markets. The most significant emotions to take into account are fear and greed. The two gave rise to the Fear and Greed Index, used to measure how greedy or fearful investors currently are.

Read on to learn about the Crypto Fear and Greed Index and how it works.

What Is the Fear and Greed Index?

The Fear and Greed Index, first created by CNNMoney for stock markets, measures investors’ fear and greed. The two emotions are used to determine whether investors are bullish or bearish about the market.

The index depends on short and long-term data, varying from daily to annually. It relies on whether the market depresses, causing fear, or thrives, causing greed. Consequently, the index indicates that investors are bound to buy during a high season due to the Fear of Missing Out (FOMO). The opposite is true for low seasons.

Alternative.me took CNNMoney’s approach to create the index’s variant for Bitcoin, creating the Crypto Fear and Greed Index.

How Does the Crypto Fear and Greed Index Work?

The Fear and Greed Index selects a value between 1 and 100. 1 stands for extreme fear, while 100 for extreme greed. These are the ranges that determine what fear or greed scale the market is in:

- 0-24 is extreme fear

- 25-49 is fear

- 50-74 is greed

- 75-100 is extreme greed

Alternative.me leverages six signals, divided into percentages adding up to 100, to calculate the Fear and Greed Index. These are:

- Trends: This signal gets 10%, which depends on searches related to Bitcoin, monitored by Google Trends. There is a high probability of heightened greed if the searches are more than usual.

- Dominance (10%): Bitcoin remains the most dominant in the market. If its dominance rises, there is a fear sentiment in the larger market, resulting in people buying more BTC as a cushion. The opposite means that more people believe in other risky coins as potentially lucrative investments.

- Social Media (15%): One of the best places to know what people are thinking about every day is through Twitter hashtags. The index indicates rising greed if more hashtag and topic interactions exist on social media. If the interaction dwindles, there is increasing fear.

- Volatility (25%): More stable prices mean more greed than fear. Likewise, high volatility highlights fear brewing in the market. For this to work out, the index depends on an average volatility of BTC over 30-90 days.

- Market Volume (25%): More selling volumes indicate high fear levels while buying indicates investors’ bullish sentiment.

- Surveys (15%): Alternative.me used this signal but has it discontinued for now. However, it collects people’s responses on different polls to gauge their sentiment.

How to Interpret and Use the Fear and Greed Index

When the index shows that people are greedy, the Bitcoin market may be overheating, and a correlation could soon occur.

Conversely, when people are fearful, it may be a good time to buy (according to the index) as prices are suppressed and may experience upside volatility in the future.

A more objective way the Fear and Greed Index achieves more effectiveness is by comparing the BTC index score to its adjacent price over time. Investors can focus on this history to get a broader perspective on how these numbers correlate and how the correlation changes over time.

Why Is the Bitcoin Fear and Greed Index Important?

Bitcoin has a level of correlation with altcoins, making its price a valuable indicator of possible price movement for the wider crypto market. Therefore, the fear and greed index could improve an investor’s decision-making during dips and booms.

Having said that, the best way to leverage the index is arguably by combining it with other indicators to make investment decisions. Additionally, more research may help you gain more insights into the past and potential future price developments of different coins and tokens.