July 29, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- Bankrupt crypto lender Celsius notified its customers that their email addresses had been leaked to a third party.

- Ethereum’s Goerli testnet will undergo its merge on August 4th.

- Nirvana, a Solana-based DeFi protocol, lost $3.5 million to a flash loan attack that drained its liquidity pools.

- Clearpool launched its uncollateralized lending protocol on Polygon.

- Bored Ape Gazette, a news site covering Yuga Labs and APE DAO, will be funded by APE thanks to an APE DAO governance proposal.

- Crypto exchange Zipmex filed for bankruptcy protection in Singapore.

- Sky Mavis denies any wrongdoing regarding a $3 million transfer of AXS in the hours before the Ronin hack occurred.

Today in Crypto Adoption…

- The much anticipated bipartisan stablecoin bill is being shelved over the August Congressional recess without draft text seeing the light of day.

The $$$ Corner…

- Variant announced that two venture funds worth $450 million will be investing in crypto projects.

- Aurigami, a DeFi project on Aurora, raised $12 million in token rounds.

- Space and Time, a DeFi data platform, raised $10 million in a seed funding round.

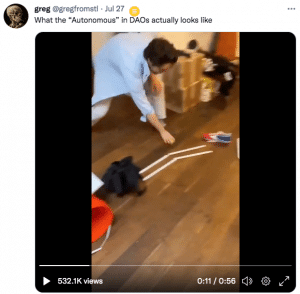

What Do You Meme?

What’s Poppin’?

Ethereum’s Testing Day Is Set

Ethereum’s final test before the merge is officially on the calendar.

The Protocol Support Team announced that Ethereum’s last testnet, Goerli, will begin The Merge process on August 4th, 2022. Based on how quickly Goerli reaches a Terminal total Difficulty number, the Protocol Support Team expects the process to be complete between August 6 and 12.

As Goerli is the last testnet to undergo The Merge before mainnet, it is the last time dApps get to check whether they work as expected through the proof of stake transition and post-merge environment. While smart contract impact should be minimal, Ethereum developers still caution that consumer-facing items may be affected. “Now is the time to ensure that your front-end code, tooling, deployment pipeline and other off-chain components work as intended,” the Ethereum blog warns.

Notably, the date for the mainnet merge has not been set, as it depends on how Goerli fares through the test merge. “Assuming no issues are found during the Goerli/Prater merge, once clients have feature-complete releases, a slot height will be chosen for the Bellatrix upgrade on the mainnet Beacon Chain and a total difficulty value will be set for the mainnet transition. Clients will then make releases that enable The Merge on mainnet,” wrote the Ethereum blog.

Recommended Reads

- Gabriel Shapiro on DeFi regulation

- LexDAO on community finance

- Synapse on Synapse v2

On The Pod…

Marisa Tashman, policy counsel at Blockchain Association, analyzes the US Securities and Exchange Commission’s (SEC) decision to name nine tokens as securities and investigate whether Coinbase lists securities. Show highlights:

- why the SEC named tokens as securities in an insider trading case where no exchanges or token teams are listed as defendants

- what happens if the Coinbase insider trading case is settled or goes to court

- why the SEC’s actions should be considered “regulation by enforcement”

- whether there is any process to force the SEC to reveal its reasoning for calling a token a security

- why Marisa thinks the SEC is actively harming US investors with its crypto policy

- how Coinbase is handling the SEC’s investigation

- what Marisa thinks of Coinbase’s listing process

- why the Cynthia Lummis-led crypto regulatory framework is a good start

- what Marisa believes will happen in the crypto regulatory landscape in the near future

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians