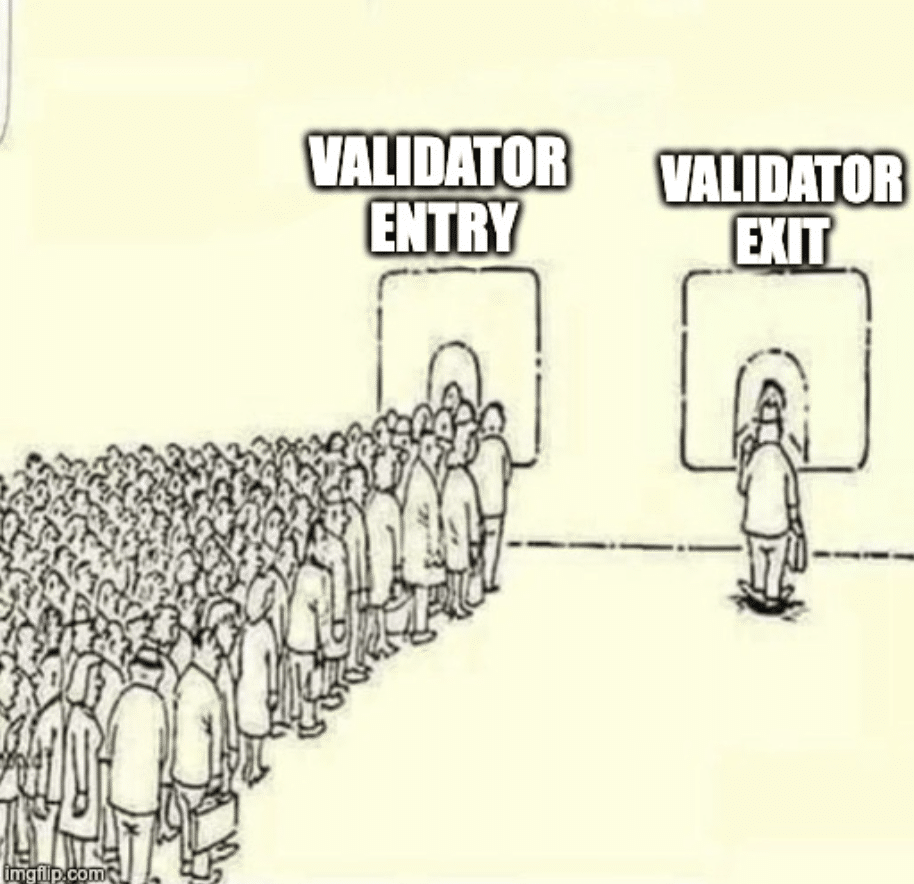

The queue for validators to start securing the Ethereum network is significantly longer than the line for validators to relinquish their responsibilities of confirming blocks, a sign of interest in restaking, the practice of re-using ether (ETH) already securing the base layer of Ethereum in additional ways. The more validators that are securing the Ethereum blockchain, the more ETH is available to be restaked.

The enter queue is 51 times bigger than the exit queue at press time, according to data provided by blockchain explorer beaconcha.in. Nearly 8,300 validators each with 32 ETH are currently waiting in line to begin staking, while 161 validators are trying to exit.

The validator queue is a mechanism aimed at stabilizing Ethereum’s proof-of-stake consensus. If validators didn’t have to wait, a huge and sudden influx of ETH could either enter or exit, causing an abrupt change in the security system for the second-largest blockchain by market capitalization.

The number of validators waiting to enter the network is at its highest mark since the start of October. At press time, the number of active validators – those currently securing the Ethereum blockchain and not waiting in the queue – exceeds 943,000.

“The validator queue started to increase in the beginning of Feb, while the ETH staking yield is still below 4%. This [increase] coincides with EigenLayer’s staking cap raise on 2/5,” wrote Kelly Ye, portfolio manager at Decentral Park Capital, in a Telegram message to Unchained.

More ETH Available to Be Restaked

With 32 ETH each, the roughly 8,300 validators will bring in about $746.3 million in total to secure Ethereum. Consequently, this also means that more ETH is available to be restaked.

Eigen Layer, the protocol widely known for its restaking technique that extends Ethereum’s security to additional applications and networks, has been a popular destination for crypto denizens’ liquid staking tokens (LST).

People have been able to deposit their LSTs into EigenLayer, but the team placed caps on each LST pool. The team has temporarily lifted caps on the number of LSTs people can deposit into the protocol several times. The latest cap raise occurred on Feb. 5, which saw the value locked in EigenLayer’s smart contracts more than triple from $2.156 billion to nearly $7.034 billion in 10 days, data from DefiLlama shows.

As the number of validators entering the population outpaces those leaving, the rewards per validator will continue to shrink. Ethereum staking APR started at above 5% in June 2023 and has since decreased 129 basis points to nearly 3.8% at press time, according to data provided by beaconcha.in.

However, Decentral’s Ye noted that “we expect ETH staking interest to continue to grow as the staking theme continues to grow. ETH currently has about 32.5% staked, which is still lower than other big [proof-of-stake] chains.”

The price of ETH, the native cryptocurrency for Ethereum, has increased 3.2% in the past 24 hours and 17.5% over the past seven days to trade at $2,851, data from CoinGecko shows.