This year could have been a standout for Ethereum. In March, the Ethereum Dencun upgrade was implemented flawlessly. In May, Spot ETFs in the U.S. were approved, a development few expected. Plus, A monumental shift in crypto policy that led to the approval of FIT21, the repeal of SAB 121, and Trump’s promises, is set to benefit the sector overall. And in June, the SEC closed its investigation into Ethereum 2.0.

Meanwhile, activity on Layer 2 solutions has quadrupled since the beginning of the year, as per L2Beat. Additionally, BlackRock, the world’s largest asset manager, launched a fund on Ethereum.

Despite all these positive developments, ether’s performance has been disappointing, with the asset being up just 11% in 2024, while BTC is up 36% and SOL is up 40%.

What’s even more surprising is that, despite being one of the assets that performed the worst during this weekend’s market sell-off, it has been also the one that has rebounded the least from the bottom, according to researcher Ceteris.

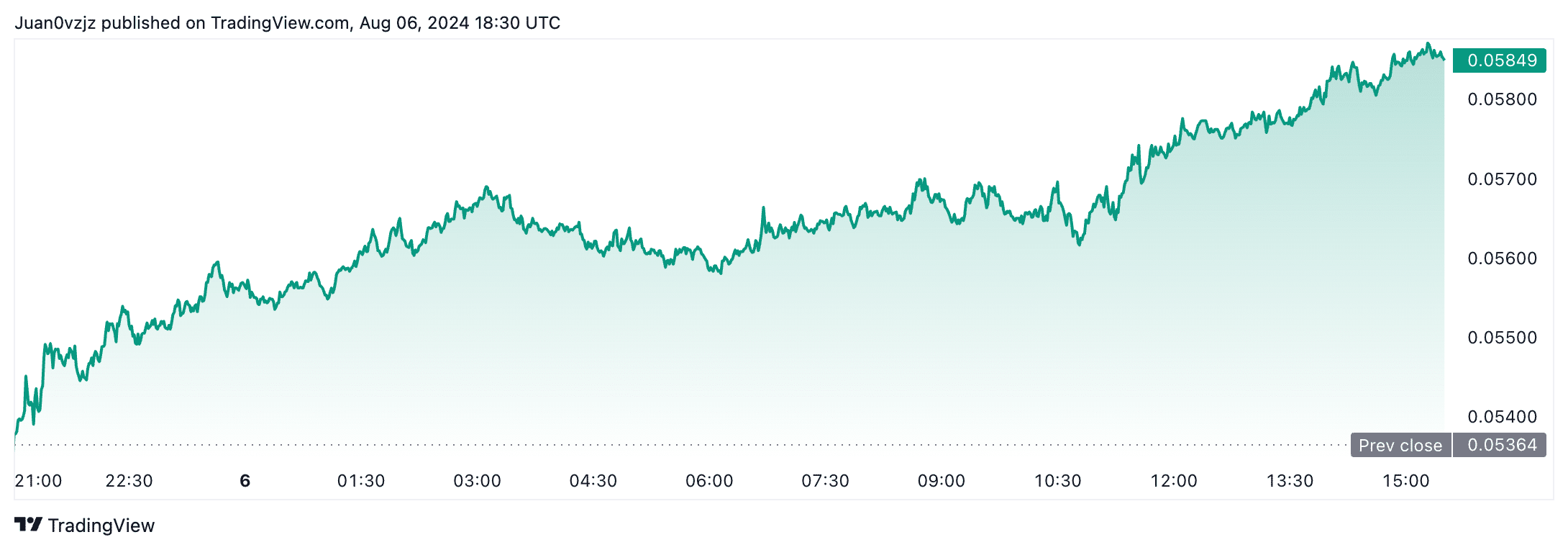

Ethereum’s lagging performance can also be seen in the ETH/BTC ratio, which has dropped to its lowest point since April 2021, currently standing at 0.045. Meanwhile, SOL has been gaining ground, with the SOL/ETH ratio up 13% in the last day and trading at all-time highs.

On the latest episode of Unchained, Arca’s CIO Jeff Dorman said it is “incredibly shocking” that Ethereum isn’t living up to expectations in 2024, highlighting how the approval of Ethereum spot ETFs and a favorable shift in US crypto policy were expected to boost Ethereum’s performance. He remarked that Ethereum is underperforming not just against Bitcoin, but also against assets like SOL, BNB, and even equities.

“You certainly would have expected that one of the benchmark assets that has nothing but positive news coming out to be performing better than it has,” Dorman said.

Dorman elaborated on the factors that were expected to drive Ethereum’s performance this year. He pointed out that May marked a significant shift in U.S. crypto policy, arguably the most “influential month in crypto history.” It began with Trump declaring his support for crypto, continued with the Senate repealing SAB 121, an accounting rule unfavorable to digital assets, and culminated with Ethereum ETF approvals. These developments were seen as a complete reversal of previous U.S. regulatory stances on digital assets. “To me, that was the most important couple of weeks in crypto’s history, certainly from a regulatory standpoint, combined with the new inflows from the ETF,” Dorman added. Despite these positive changes, Ethereum has not only lagged behind its peers but has also struggled to show significant gains, which Dorman finds “incredibly surprising.”

Market Sell-Off and Contributing Factors

The recent broader market sell-off has also played a significant role in Ethereum’s struggles. The unwinding of the Japanese Yen carry trade and a significant $600 million in ETH selloff by Jump Trading triggered a cascade of negative sentiment.

According to a new CryptoQuant report seen by Unchained, market sentiment shifted dramatically as traders in crypto futures markets began aggressively closing long positions. This led to a decline in open interest in Bitcoin and Ethereum futures markets by about $6 billion each, representing decreases of 30% and 46%, respectively. Additionally, the funding rate turned negative, indicating a preference for short positions over long ones.