Enthusiasm about the SEC potentially approving a spot ether exchange-traded fund (ETF) has propelled the market cap of Ethena’s synthetic dollar cryptocurrency USDe above $2.5 billion, following a surge in Ethereum open interest among exchanges and increased perpetual funding rates across the market.

The market cap of USDe hovered around $2.45 billion on May 20, before Bloomberg ETF analysts Eric Balchunas and Jeff Seyffart increased their odds of the United States Securities and Exchange Commission approving a spot ether ETF to 75%. Since then, USDe’s market cap has grown by $100 million in dollar terms, a 4% increase in the past three days, to $2.55 billion at presstime, data from CoinGecko shows.

The jump in USDe’s market cap in part stems from Ethena’s USDe staking yield becoming more attractive. Per Ethena’s homepage, USDe’s staking yield currently stands at 37.2%, a sharp rise from 27.55% on May 14.

Ethena’s staking yield comes from the rewards from staking ETH and the funding rate earned by Ethena for opening short derivative positions. Traders who have gone long in futures derivatives markets on exchanges pay funding fees to those holding short positions like Ethena.

As a result, Ethena’s USDe staking yield earned by depositors increases when open interest and perpetual funding rates increase. When Bloomberg analysts increased odds of a spot ETH ETF approval, Ethereum open interest and perpetual funding rates grew.

“The increase in both open interest and funding is and will continue to be a large tailwind for Ethena – average perpetual funding rates across the market moved from <7% [on May 20] to over 35% in less than eight hours,” wrote Ethena Labs founder Guy Young to Unchained over Telegram.

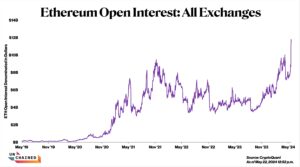

Ethereum open interest on exchanges stood at 2.8 million on May 20 and has since risen 10% to 3.1 million ETH, about $11.58 billion, an all-time record high in open interest, data from CryptoQuant shows. Open interest refers to the total number of long and short positions currently held by investors on derivative exchanges.

Read More: Ethena Partners With Bybit. Will It Catalyze USDe’s Growth?

“Traders in the perpetual futures market aggressively opened long positions in Ethereum, expecting higher prices after rumors that the spot Ethereum ETF in the USA could be approved in May,” wrote analysts from blockchain analytics firm CryptoQuant in a report published Wednesday.

Ethena’s native governance token ENA has dropped 5% in the past 24 hours but increased 13% in the past seven days to trade at 83 cents, per CoinGecko.