August 3, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Cash App users bought $2.72B in BTC in Q2 2021.

-

Weekly NFT volume surged to an ATH yesterday.

-

Crypto companies raised $9.9B over 588 rounds in H1 2021.

-

Marathon Digital bought $120M worth of bitcoin miners.

-

NCR, a Fortune 500 company, is purchasing Bitcoin ATM operator LibertyX.

-

Ethereum miner revenue surpassed Bitcoin’s for a record third month in a row.

-

Voyager Digital, a crypto trading platform, has acquired Coinify in an $85M deal.

-

FTX is creating an NFT-focused sports and entertainment marketplace.

-

Representative Tom Emmer named what he called “Janet Yellen’s Treasury” a potential driving force behind the surprise crypto provision found within the $550B infrastructure bill.

-

Matrixport, a crypto financial services platform, raised $100M at a valuation of $1B.

- Senator Toomey plans to “offer an amendment to fix” the “hastily-designed tax reporting regime for cryptocurrency” found within the bipartisan infrastructure bill.

What Do You Meme?

What’s Poppin’?

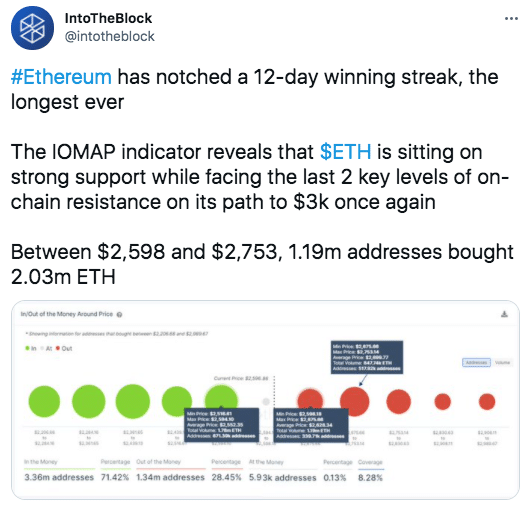

Ethereum’s highly anticipated London hard fork is expected to go live on Wednesday and ether appears to be on a hot streak in anticipation of the event.

In the past week, the price of ETH has jumped about 15%, bouncing up from ~$2,200 to ~$2,600. Into The Block, a blockchain analytics platform, reports that ether’s “winning streak” has lasted 12 days — its longest ever.

It is perhaps unsurprising that the price of ether has soared with the London hard fork looming. Notably, the blockchain upgrade contains Ethereum Improvement Proposal 1559, which will begin to burn ether with every transaction and could substantially decrease the supply of ETH over time. With a reduced (or even deflationary) supply, ether’s appeal as a store-of-value digital asset, a niche Bitcoin has overwhelmingly filled, could be rising in the industry.

For more information on London and EIP 1559, check out the recent Unchained pod with Ethereum Foundation’s Tim Beiko and MyCrypto’s Taylor Monahan.

Recommended Reads

- The Defiant on NFT avatars:

- CoinDesk on cryptography:

- Andrew Beal, who writes a crypto newsletter himself, on the creator economy:

On The Pod…

Can a DeFi Smart Contract Be Regulated? Two CFTC Commissioners Discuss

CFTC Commissioners Dan Berkovitz and Brian Quintenz discuss the difficulties of regulating crypto derivatives and DeFi. Show highlights:

- their backgrounds

- what the CFTC’s duties are regarding crypto

- how the CFTC’s jurisdiction has evolved over the years

- why Commissioner Quintenz believes SEC Commissioner Hester Peirce’s safe harbor proposal is “brilliant”

- what relationship the CFTC and SEC have when making decisions on crypto assets

- why the commissioners believe CFTC’s complaints regarding BitMEX are “well-founded”

- why formal regulation for crypto derivatives is unlikely to be produced by the CFTC

- why leveraged derivatives products are a “concern” to the CFTC

- what makes regulating DeFi platforms so difficult

- when it comes to DeFi, who is a natural entity for the CFTC to regulate, if any

- whether the CFTC would ever go after DeFi “market participants,” who the CFTC also regulates

- why smart contracts involving futures could be illegal

- how the possibility that smart contracts could be illegal squares with the view that software development is a form of free speech

- whether the CFTC could prosecute developers who write smart contracts

- whether the CFTC needs to re-write its laws in light of DeFi innovation

- why Commissioner Berkovitz thinks the DeFi “winners” will be protocols that focus on meeting regulatory requirements

- why the CFTC approved Bitcoin futures in 2017 while the SEC has not yet approved a Bitcoin ETF

- how a Bitcoin ETF could solve Bitcoin’s accounting issue, which currently gives companies no upside for adding BTC to its balance sheet

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians