June 3, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Master Ventures launched a $30M fund focused on Polkadot projects

-

Guggenheim Investments registered a new fund that may seek crypto exposure

-

Crypto investment products saw a $74M inflow last week

-

Hxro, a crypto derivatives firm, raised $15M in a token sale

-

Fanatics is partnering with Mike Novogratz and Gary Vaynrerchuck to launch Candy Digital

-

The SEC has delayed its decision on the WisdomTree bitcoin ETF

-

Google will now allow qualified crypto advertisers to target the US

-

China gifted 200,000 residents 200 yuan worth of its CBDC

-

Goldman Sachs’ Head of Commodities called Bitcoin a substitute for “copper” rather than gold

-

Standard Chartered has plans to launch an institutional crypto brokerage for European clients

- Dogecoin jumped 20%+ yesterday after Coinbase announced its intent to list it

What Do You Meme?

At the time of writing, Bitcoin was up about 4%, and I can confirm… this video is an accurate representation of my Twitter feed:

What’s Poppin’?

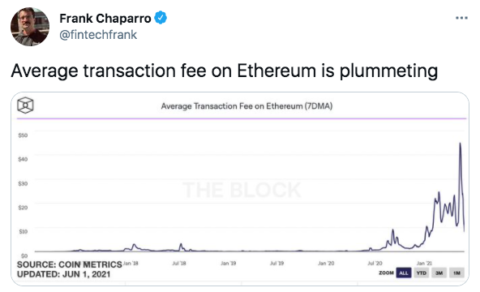

If you were waiting for cheaper gas fees to make a few DEX trades or yield farming transactions, then there is no time like the present. As pointed out by The Block’s Frank Chaparro, Ethereum gas fees have plummeted over the last few days.

According to data from Ycharts, the average Ethereum transaction fee was roughly $5 yesterday. Seeing a sub $10 transaction fee on Ethereum comes in stark contrast to the May monthly high of $71, which was most likely caused by a rush of memecoins clogging up the network.

Low transaction costs seem to be a theme to start the month, as Bitcoin transaction fees are also down to start June. After peaking at $64 per transaction in mid-April, BTC transaction fees have leveled off around $7.

Recommended Reads

- Arthur Hayes on the Treasury’s money printer, inflation, and why he is bullish on crypto (must read):

- Ben Simon on why he loves rollups:

- Metaplex is building the WordPress for NFTs on Solana:

On The Pod…

June 14th is the 5-year anniversary of Unchained. 🎉

On Tuesday, June 15th, we’ll publish a 5-year anniversary episode with questions or messages from you listeners to me.

- record a video or audio message of 60 seconds or less stating your name, where you’re from and your question or message.

- email it to hello@unchainedpodcast.com with “anniversary” in the subject line (or just respond to this email)!

The deadline to get your submissions in is Thursday, June 10 by 5 pm ET/2 pm PT.

Thanks so much for supporting Unchained all these years! 🙏

Check out the latest episode of Unchained:

Nick Tomaino on 1confirmation’s $125 Million Fund and What Future NFTs Will Look Like

Nick Tomaino, general partner of 1confirmation, discusses his firm’s recently announced third fund of $125 million and gives his perspective on many hot crypto topics, such as NFTs, Layer 2 solutions, Polkadot, DAOs, and more. Show highlights:

- why Nick became interested in crypto and his background

- what drives 1confirmation’s investment thesis

- why Nick believes NFTs have taken off in popularity this year

- why NFTs are currently in a bubble

- what we might do with NFTs in the future

- how competition between different NFT marketplaces will shake out

- how music NFTs could work

- the feasibility of charging royalties in the secondary sale of NFTs

- why environmental concerns over crypto mining to only be a short-term issue

- why Nick is not an Ethereum maxi and how he feels about the fragmentation of Layer 2 solutions on ETH

- why Polkadot is such an exciting project

- whether, as an early Coinbase employee, he would say the fat protocols thesis is true

- what new trend Nick is keeping an eye on for 2021 and beyond

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians